By The AllGen Team

Fluctuating income can make tax planning complicated. Compared to other people who earn consistent salaries, self-employed people, freelancers, and commission-based workers frequently deal with varying revenue throughout the year. Because of this unpredictability, estimating tax liabilities and meeting deadlines for tax payments can make consistent financial planning a challenge.

But this challenge is solvable! You can optimize your financial situation and efficiently handle your tax responsibilities by understanding the unique difficulties associated with fluctuating income.

We wrote this article to share the essential steps you should be aware of.

1. Be Aware of Your Quarterly Payment Due Date

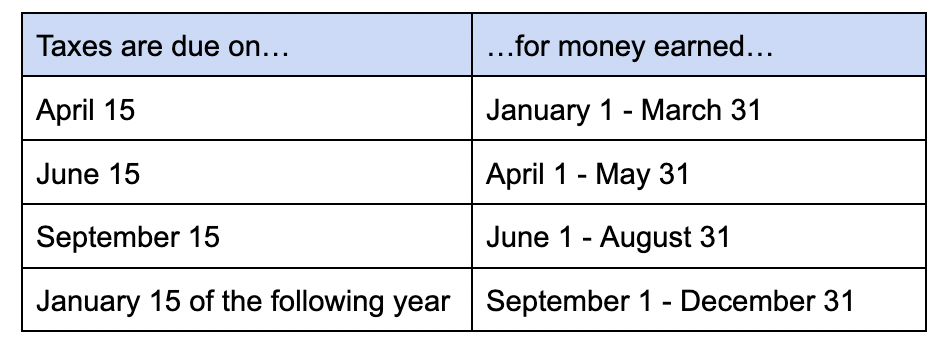

If you’re currently self-employed, a freelancer, or a commission-based worker, instead of paying taxes annually, you’re responsible for paying taxes to the IRS in quarterly estimated payments.

Being your own boss comes with many perks. But it also means you have to calculate and remit tax payments for what you owe; unlike W-2 employees, your taxes aren’t automatically withheld from your paycheck. This can be an administrative burden if you don’t keep a running schedule and budget.

The first step is to be aware of exactly when your quarterly estimated tax payments are due.

2. Estimate How Much You Owe

Now that you’re aware of quarterly estimated tax due dates, it’s time to estimate how much you owe.

If your income varies, it’s a challenge to understand what you actually owe. You risk being penalized by the IRS if you underpay, and if you overpay, you risk giving them an interest-free loan. The smartest approach is to avoid the underpayment penalty by paying the lesser of the following:

- 90% of your tax liability for the current year or

- 100% of your tax liability for the previous year (you must pay 110% of your prior tax liability if your adjusted gross income for the previous year exceeded $150,000).

Keep in mind that by annualizing your income and making uneven payments throughout the year, you might be able to lower or even eliminate penalties.

3. Save the Appropriate Amount

After figuring out how much tax you should pay, the next step is to create a saving strategy that allows you to save the necessary amount. Self-employed individuals are generally advised to set aside 25-30% of their revenue for taxes; however, the precise amount required varies depending on a number of factors, including your state of residence, tax rate, and business structure.

It’s important to make adjustments to your savings as your income fluctuates. When you have a particularly prosperous month, set aside 50–60% of your salary to compensate for months when your income is lower. Work with a wealth manager or use a budgeting app to stay on top of your income and expenses as they apply to your tax payment responsibilities.

4. Log Every Deduction

It’s hard to remember everything you paid for throughout the year. Especially when you’re focused on managing an irregular income.

But it’s crucial to document as much as possible so you can leverage every appropriate deduction. After all, the point of deductions is to decrease your taxable income. When your taxable income is lower, your estimated tax payments are lower. And so is your stress level!

Partner With a Professional

Are you feeling overwhelmed as you try to sort through important tax-planning issues? Instead of trying to do it alone, we want you to feel the clarity and comfort that a financial professional can provide.

When you work with AllGen, you’re getting a mentor, a coach, an accountability partner, and a guide for your full journey to financial wellness.

To schedule a complimentary meeting, call (407) 210-3888 or email advisors@allgenfinancial.com.

About AllGen

Based in Orlando, Florida, AllGen Financial Advisors, Inc. is an independent, fee-based Registered Investment Advisor (RIA) firm dedicated to helping individuals and businesses maximize their financial resources. The AllGen team comprises trusted advisors, each with specialized skills, providing comprehensive guidance and tools to clients at any stage of life or socio-economic position to experience and maintain financial freedom. AllGen offers highly tailored financial planning and investment management, helping clients understand their current financial situation and define their future goals. The team develops and executes customized plans to pursue these goals, managing and tracking investments and financial progress along the way. Known for being relatable and approachable, AllGen’s advisors leverage their vast experiences, education, and interests to make complex financial concepts understandable and personal. At AllGen, clients are treated as individuals, not just numbers.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.