Read through this post on stocks or skip to the AllGen Academy stocks video below.

When people think of investing, most of them think about the stock market. But what is a stock?

A share of stock represents a fractional ownership of a company. For example, if a company has 100 shares of stock, owning 5 of those shares means you own 5% of the company.

How Stock Ownership Benefits Investors

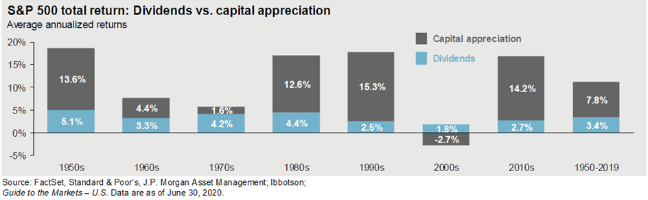

There are two main components of stock ownership that provide growth to investors:

- Capital Appreciation – the value of the company increases as the company grows and earns more revenue. Your stock also grows as a fractional owner (shareholder) of the company.

- Dividend – a dividend is a sum of money that comes from the company’s profit or surplus paid to shareholders, usually quarterly.

Dividend Yield

A common metric used to compare stocks is the dividend yield, the number of annual dividends paid to shareholders relative to the current stock price.

Dividend Yield = Annual Dividend Per Share / Current Stock Price

Example: XYZ Stock pays a dividend of $1 per share and the stock price is $50. The Dividend Yield is 2% ($1 / $50 = 2%).

Total Return

The Total Return of a stock investment includes both capital appreciation and dividends (if any).

Total Return = Capital Appreciation + Dividends

Drivers of Stock Prices

Many variables drive the price of different stocks:

- Profits – how profitable is the company? Profit = Revenues – Expenses

- Sector influences and trends

- Overall stock market trends

- Economy

Types of Stocks

Stocks are differentiated by various characteristics.

- Size (also called market capitalization)

- Large Cap – company is valued at over $10 billion

- Mid Cap – company valued between $10 billion and $2 billion

- Small Cap – company valued less than $2 billion

- Geographic Region

- US stocks

- International stocks – companies based in developed international countries such as Germany, Japan, England, France, etc.

- Emerging Markets – companies based in developing international countries such as Brazil, Russia, India, China, etc.

- Sector or Industry

- Valuation and Growth Metrics

- Value stocks – companies whose valuation is historically low compared to their revenues, earnings, cash flow, or book value

- Growth stock – companies that are growing revenues and sometimes earnings at a fast rate. They typically have more expensive valuations but are growing fast.

For more information on stocks, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.