Read through this post on net worth statements or skip to the AllGen Academy spending plans video below.

What Is a Spending Plan?

A spending plan (or budget) is a framework that tracks all income and expenses coming in and out for a household. It is a guide for the ongoing management of your finances on a monthly basis. A spending plan provides both forecasting and reporting on how your income is spent each month so you can make the necessary adjustments to better reach your financial goals.

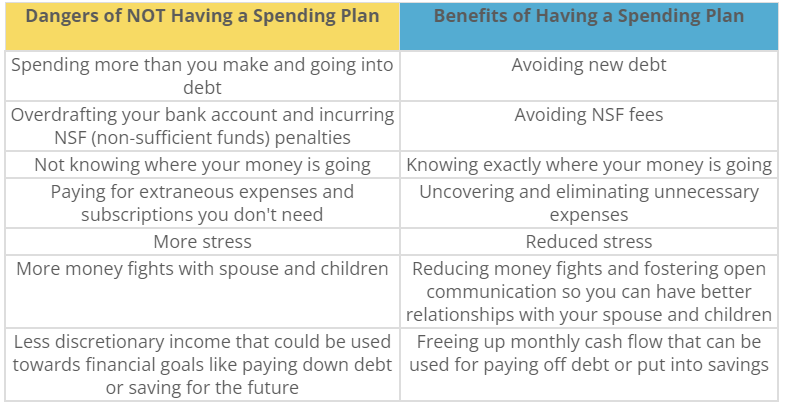

Why Is a Spending Plan Important?

Many people allow money to run their lives but a financially successful person takes control and manages their finances purposefully. This begins by knowing where your money is going.

Without a clear understanding of how your money is being spent, it’s impossible to define a clear path toward financial freedom. You need to know where there’s a shortfall or surplus in order to determine how much you can allocate toward your financial goals (paying off debt, saving for retirement, etc.). Then you need to monitor your spending plan each month to ensure your money is actually being spent the way you intended. If not, you’ll need to make the changes necessary to get back on track.

By creating a spending plan, you take a proactive stance and get a better grasp of your money coming in and going out—also called cash flow. It’s easier to make better financial decisions when you know exactly what you have to work with.

How to Create a Spending Plan

To create a spending plan, it’s important to track all income and expenses on a monthly basis.

1. Determine your household’s net take-home pay each month across all income sources

Here are a few guidelines for figuring out your monthly income:

- If you earn a paycheck bi-weekly, take the net amount per paycheck and multiply it by 26 pay periods in a year. Then divide that number by 12 to arrive at your monthly income.

- If you expect to receive bonuses or other irregular income, use an average of your historical earnings or a conservative estimate.

- If you have 1099 income (independent contractor), estimate your net earnings by subtracting 25% out of your gross earnings for taxes.

2. Capture your monthly expenses across different categories

After you have a solid number for your monthly income, it’s time to delve into expenses. You want to get a good breakdown of your current monthly expenses across various categories.

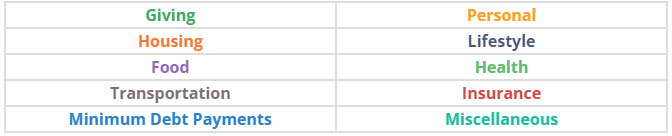

You can start with the following categories and then break out each one into more specific line items as needed:

Total up your expenses for each category and compare them to previous spending patterns. Use this data to allocate expected income for the upcoming month across different categories.

3. Subtract expenses from income to get net income

A positive number means you have a surplus in your monthly cash flow. You’re living within your means–well done!

Direct your surplus income towards financial goals (i.e. paying off debt, emergency reserves, long-term savings, etc.).

If you have negative monthly cash flow, you need to make adjustments to your spending plan in order to avoid taking on new debt. Consistently negative cash flow is unsustainable and can quickly spiral into financial ruin.

Consider cutting back your spending in certain areas to make up the deficit or finding ways to increase your monthly household income. It’s easier to reduce discretionary spending (i.e. dining out, shopping, entertainment, etc.) but in extreme circumstances, you may need to downsize fixed expenses and overall lifestyle.

Tips for Creating and Managing a Spending Plan

- Track your spending over the last 3 months to get a more accurate picture of how much you generally spend on certain things.

- Find a method or tool that works best for you.

- Pencil and paper: Track your spending the old-fashioned way by printing out your bank and/or credit card statements and categorizing expenses by hand.

- Spreadsheet: download your transactions into a spreadsheet and categorize them digitally.

- App: there are many apps that can aggregate your transactions directly from your accounts. You can create custom categories and reports to track spending patterns over time.

- Capture all transactions for each month on one paper or spreadsheet even if you have multiple checking accounts or credit cards. This will reflect your true spending for a given month.

- Account for expenses that occur less frequently (i.e. quarterly or once a year). For example, while you may only pay property taxes once a year, the annual amount should be divided by 12 and included in your monthly expenses. Each month as you earn income, you’ll set aside the monthly amount. This way when the bill comes, you’ve already saved up for it and it doesn’t catch you by surprise. The same approach works for large expenses such as future vacations, car purchases, and other expenses that do not occur frequently.

- Consider using the envelope system for food and entertainment:

- Once you determine the appropriate amount needed for food and entertainment, withdraw that amount in cash at the beginning of the month. Put the cash in separate envelopes and use that money to pay for food and entertainment throughout the month. Once you run out of money in the envelope, you can’t spend any more in that category for the month. This is a great strategy for enforcing discipline.

- You can split the month in half or do one week of cash at a time. Some months have 5 weeks so plan accordingly. Choose the time frame that works best for you depending on when you get paid.

- Do a new spending plan every month. Some monthly expenses stay the same but some fluctuate or are seasonal (i.e. back to school supplies, holidays, vacation). It’s important to anticipate upcoming expenses and budget for them instead of keeping a static budget from month to month and overspending.

- If you’re married, work on your spending plan with your spouse. One person may be responsible for creating the budget but both spouses have a vote for each line item. This creates open communication and buy-in from both parties.

Lastly, it’s important to give yourself space to mess up when first attempting to follow a spending plan. Like exercising, it’s not easy when you first start out. Understand that you’re going to make mistakes over the first few months but you’ll eventually get the hang of it.

When you mess up, don’t give up!

Learn from your mistakes and make adjustments going forward. For example, if you budgeted $500 for food but realize you’re spending closer to $800 a month, increase your budget for the food category going forward. Just make sure to reduce the same amount ($300) from another category so you don’t overspend.

Conclusion

Spending plans can help you to properly manage your spending by showing you exactly what your existing expenses are. Making a spending plan will show you where you can cut back and eliminate unnecessary expenditures so that you can more easily meet your financial goals. Contact us with any questions on net worth statements and how to create a spending plan.

For more information on spending plans, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.