Personal Investment Managers in Orlando

Navigating the investment journey for you.

Meet Your Investment Team

Jason Martin, CFP®, CMT

CIO & Co-Founder

Jason Martin, CFP®, CMT is the CIO & Co-Founder of AllGen Financial. He draws on his 20+ years of experience in wealth management to lead AllGen’s Investment Management team and help clients achieve Financial Freedom.

Christina Shaffer, CFA®

Director of Fixed Income

Christina Shaffer, CFA is the Director of Fixed Income at AllGen Financial. Prior to AllGen, she was the Senior Fixed Income Analyst for Charles Schwab, which she utilizes to help clients build wealth and manage investment risk so they can enjoy Financial Freedom.

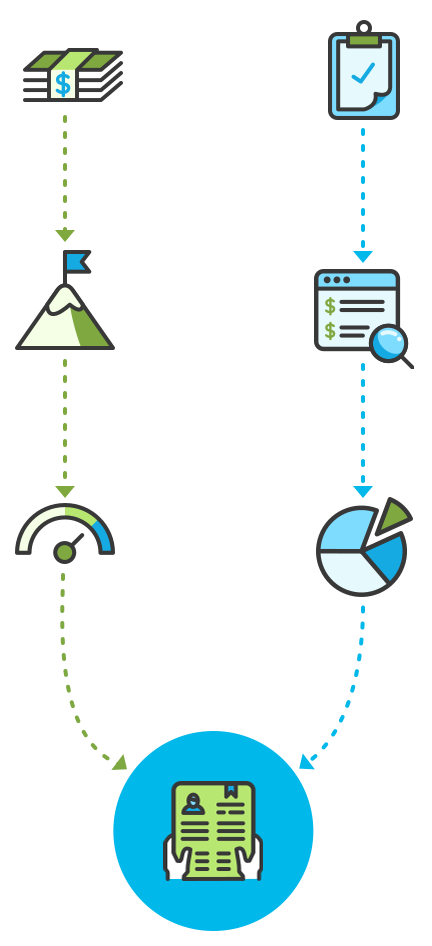

How It Works

Finding the Right Portfolio For You

Financial Situation

Evaluate your emergency reserves, tax situation, and debt to tailor the appropriate investment strategy for you.

Investment Objectives

Define what Financial Freedom looks like for you and analyze how your investments can help you get there (and stay there).

Risk Profile

Determine your risk tolerance by measuring your ability to stay disciplined during market movements.

Your Custom Portfolio

A living cycle of carefully-curated assets that is aligned with your unique #FinancialFreedomVision.

AllGen’s Management of Portfolios

Big Picture Thinking

Assess overall market strength using top-down, macroeconomic analysis to try to anticipate future major market trends.

Screening Investments

Screen thousands of investment options, striving to optimize risk/reward characteristics.

Asset Optimization

Calculate an optimal asset allocation, aiming for true diversification with securities of noncorrelated asset classes and sectors.

YOUR CUSTOM PORTFOLIO

A living cycle of carefully-curated assets that is aligned with your unique #FinancialFreedomVision.

Ongoing Money Management

Proactive monitoring and management of Your Portfolio through repetition of investment management processes and strategic rebalancing.

From the Trade Desk

Frequently Asked Questions

Learn more about AllGen’s Investment Management Services.

What is Investment Management?

Investment Management is the management of financial assets in a portfolio. A person can hire AllGen to manage investments on their behalf, which includes researching market trends, making investment decisions, and implementing strategies.

What types of investment accounts does AllGen manage?

AllGen can manage a variety of investment accounts ranging from non-retirement individual and joint accounts, custodial accounts for minors, rollover and Roth IRAs, SIMPLE and SEP IRAs, and even self-directed brokerage retirement accounts.

What is a custodian and who is AllGen’s custodian?

A custodian is a financial institution such as a broker dealer or bank, that holds customers securities for safekeeping. Examples of custodians are Charles Schwab, JP Morgan, Fidelity, Robin Hood, etc. AllGen currently chooses Charles Schwab as the custodian to house client assets. They have been providing services since 1975 and are highly respected in the industry. Charles Schwab is the largest provider of investment services for registered investment advisors (RIA firms). They provide our clients with access to more than 15,000 mutual funds and nearly all ETFs, stocks, bonds, and fixed income investments. Schwab charges no account management or custodian fees to our clients.

Are you a fiduciary?

Yes, AllGen serves clients in a fiduciary capacity. A fiduciary will act on behalf of another, placing client interests above their own with a duty to preserve good faith and trust. For more information, visit our fiduciary advisors page.

Is AllGen an active money manager?

Yes, AllGen is an active money manager and will make strategic decisions in the handling of financial assets based on research and analysis. While most people (including fund managers) do not beat their respective index, we aspire to be like the 20% of those professionals that consistently outpace their respective portfolio indexes’ net of fees. We strive for this goal through extensive research and active money management strategies. Since this requires a high commitment of time and resources, most individuals should do index or passive investing if they are managing investments by themselves.

If I sign up for investment management with AllGen, is there anything I need to do or monitor?

After your accounts are set up, AllGen will fully manage your investments on your behalf. This includes market research and implementation of investment strategies, as well as the ongoing trading in client accounts.

How do I deposit directly from my paycheck to my investments?

Clients looking to set up direct deposit to their managed AllGen accounts can connect them using their Charles Schwab routing number and account number. Providing this information to your HR or payroll department can start the process.

What do your investment management services cost?

AllGen is a fiduciary and charges a tiered rate for investment management which is billed directly from your accounts on a quarterly basis. The tiered rate is a percentage based on the value of your account and is structured so that when you do better, we do better. To learn more about fiduciaries, click here.

Does AllGen collect commissions?

AllGen does not collect commissions on the sales of investment products. While some of AllGen’s advisors are licensed for insurance products, our investments are managed on a fee basis and we typically outsource any insurance needs clients may have. Those needs may be discovered during the financial planning process. To learn more, visit our financial planning page.

Does AllGen use ETFs?

AllGen uses exchange traded funds (ETF), mutual funds, and individual stocks in our portfolios. ETFs and stocks are traded throughout market hours and executed immediately, whereas mutual funds will calculate net asset value (NAV) at the end of the trading day when orders are then completed. When we research the funds to invest in, we are looking for the best net return (the net return is calculated after fees). Sometimes we might strategically pay a little more in fees if the investment has historically had returns significantly higher than low-fee options.

What do you do with the dividend income?

Dividend income is typically reinvested into the position on the date it is received.

What returns should I expect?

Average annualized returns will depend on the client’s individual financial situation and tolerance for risk. Clients who are more risk-averse can expect lower returns on average than clients who are more risk-accepting.

Can I pick my own stocks if I find one I like?

No. Our clients pay us to use our extensive research and industry knowledge to select stocks for them. If you would like to pick stocks yourself, we recommend you open a separate account where you won’t be charged for management.

How do I set up an investment account for my child or dependent?

AllGen can help you open a custodial account if the child is under the age of 18 years of age. If the child is over 18 years old, they will be able to open their own accounts.

How does an investment account work with my spouse, partner, or scenarios with joint accounts?

AllGen can manage joint accounts for you, as well as help you designate beneficiaries.

I'm self-employed. Can my business have its own investment accounts?

AllGen can manage corporate accounts as well.

Do you offer donor advised funds?

AllGen can open a donor advised account that allows for a select list of investment options provided by Schwab Charitable. We can help you decide which funds to choose based on your investment goals.

Do you offer health savings accounts?

Currently AllGen does not directly manage client HSA accounts through Investment Management but can provide investment guidance based on your plan or individual situation.

Is it too late for me to start investing?

It’s never too late to start investing, however there are important things to consider first. A good foundation like adequate emergency reserves and little to no consumer debt, as well as having basic insurance can have a greater impact on achieving your investment goals. An AllGen Financial Advisor will help you address these points and make sure you have the basics covered before investing.

Is it too early for me to start investing?

No. Although you need to be 18 to open an investment account, there are ways to begin investing sooner. An AllGen Financial Advisor can explore options whether it be opening up a custodial account, or a Trust, we will determine what works best to achieve your goals.

How many clients do you have?

AllGen currently serves over 1,000 clients and counting!

What types of clients do you work with?

AllGen works with small business owners and individuals of all generations, hence the name: “All-Gen.” Our clients are from all walks of life and we believe everyone has the right to good financial advice, no matter age, race, or income.

Do you have a minimum?

AllGen has no account minimums and welcomes all people seeking prudent, objective financial advice.

What is an IRA Rollover?

An IRA Rollover is an individual retirement account that holds tax-deferred dollars. Clients may “roll-over” previous employer sponsored retirement plans (like a 401k) into these accounts. They can often do this without a tax penalty and the assets may still grow tax-deferred. For more information, visit our IRA and 401k Rollovers page. You can also find information about a basic rollover here.

How do you protect investments?

AllGen develops diversified portfolios for clients by incorporating investments of multiple asset classes and sectors. We strive to optimize risk and reward through proper asset allocation, diversification, and strategic rebalancing. These strategies have historically reduced risk in portfolios over time. For more information, you can review our blog and video about rebalancing.

How do I know how much I need to save up for a retirement plan?

Everyone has different investment goals. We want to hear yours so we can develop a plan that can put dreams into reality. Our team of advisors, planners, and analysts will work together to determine specific action steps for you, so you can be financially free one day.

How is investment management different from financial planning?

Investment Management focuses on wealth accumulation and is predominantly in the Formation Stage of the Path to Financial Freedom. Financial Planning focuses on big-picture aspects of your journey to financial freedom and can range from budget planning and debt elimination (debt snowball), to determining best life insurance options, tax minimization, education funding or retirement planning. Our planners can sometimes serve as therapists, life coaches, accountability partners and much more than just financial related stereotypes.

What is Financial Freedom?

Financial Freedom is the intersection between the life you want to live and your ability to live it! AllGen prioritizes the concept of Financial Freedom and often uses this language instead of just “retirement” as a way of acknowledging the many different goals people may have throughout their lifetime.

How do I get started?

Contact a financial advisor today to take charge of your financial goals and make your Financial Freedom a reality!

Allow us to guide you toward Financial Freedom. Let’s start your journey!

![]()