Read through the blog here, or skip to our Retirement Planning: Are You Ready To Retire? video below.

How do you know when you are ready to retire? While it can be different for each person, everyone has to take into account both how much you’ll be spending to maintain your desired standard of living and where that money will be coming from once you retire. Likewise, if you are funding your retirement from an investment portfolio, then you will need to make sure that your withdrawal rate from your accounts is sustainable.

Determining if You Have Enough Income To Cover Your Expenses in Retirement

To determine if you are ready to retire, you will first need to create a retirement budget, identify your known income sources, and determine the amount needed from your investment portfolio, if any. By known income sources, we mean pensions, salary, rental property income, social security, etc. Known income sources are different from distributions from your retirement or other investment accounts – those come up in step 3. The goal is to have enough total income to cover your retirement expenses. It’s best to calculate this on a monthly and/or yearly basis to obtain a clear picture of your financial situation. To figure this out, you can take the following simple steps:

Step #1: Create a Budget

Budgeting may not be the most exciting task, but it’s essential. To start, list out all your monthly expenses and multiply them by 12 to determine your annual living expenses. If you are unsure about an expense, keep in mind it’s better to overestimate than underestimate. Your monthly expenses may include items such as:

- Housing (mortgage and/or HOA fees)

- Transportation

- Gym memberships

- Groceries

- And more…

Step #2: Identify Your Income Sources

Once you have determined your income needs, you need to take a look at how you are going to pay for them. Known income sources can include but are not limited to:

- Salary

- Rental Property Income

- Social Security

- Pension

Step #3: Fill Any Remaining Income Needs With Your Investment Portfolio

Once you have the sum total of your known income sources, the next step is to compare that figure with your income needs. In order to retire, your income sources should ideally match or exceed your budgetary requirements. If your income needs are greater than your known income sources, you’ll need to fill the gap with distributions from your investment portfolio. These can include retirement accounts, trusts, or other taxable accounts. As pensions become less common, more individuals are relying on their investment portfolios to fund their retirement. The question then becomes, “What is a safe withdrawal rate from my portfolio?”

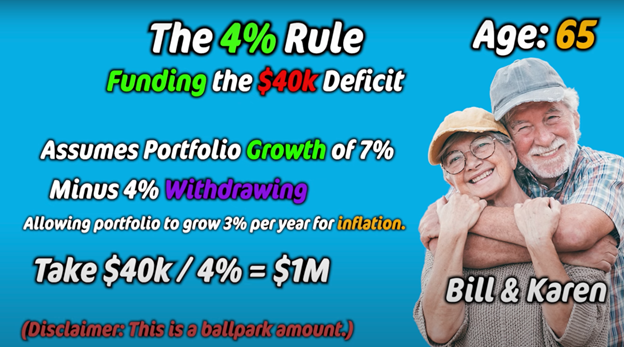

The 4% Rule

The 4% rule is a general rule of thumb that tells you, hypothetically, a sustainable withdrawal rate from your investment portfolio. It assumes that with an annual return of 7% and an annual inflation rate of 3%, you can then sustainably withdraw 4% of your portfolio balance every year without dipping into principal.

Applying the 4% Rule

To determine the amount of money you need to have in investments for the 4% rule to apply to you, do the following simple math:

Budget’s Deficit ÷ 4% = Money Needed in Your Investment Portfolio

The budget deficit is how much additional dollars you need each year above and beyond your known income sources to cover your expenses each year in retirement. Keep in mind that market performance is variable and that actual returns can vary significantly from year to year.

Example

To illustrate this concept, let’s consider Bill and Karen, both of whom are 65 and ready to retire. Their expenses are $100,000 a year, while their income sources break down into the following:

This leaves them with a $40,000 deficit that needs to be addressed.

In this example, Bill and Karen have an investment portfolio of $1 million, growing at a rate of 7%, with an inflation rate of 3%. Utilizing the 4% rule, they can withdraw $40,000 annually from their investment portfolio, meeting their financial needs without depleting their investments (or dipping into principal).

What To Do if You Cannot Make Up Your Budget Deficit

If you find that you do not have enough total income (between known income and your portfolio) to cover your annual retirement expenses, then there are several options to explore:

- Spend less in retirement – paying off your mortgage and any car loan is a great way to lower expenses.

- Delay your retirement date.

- Change your investment allocation – be mindful to not end up taking on more risk than you are comfortable with in your desire to have higher returns.

- Continue working part-time in retirement.

When deciding which approach, if any, is appropriate for your circumstance, it’s essential to consider all the factors. Each alternative comes with its own set of considerations and is important for you to think through. If you are stuck, we encourage you to talk to a financial advisor before making any decisions.

How Financial Advisors Assist in Retirement Planning

To determine if you are ready for retirement, we highly recommend consulting with a financial advisor. They’ll help you create a comprehensive plan tailored to your unique circumstances that considers your income sources, expenses, taxes, inflation, legacy planning, and investment portfolio.

Monte Carlo Analysis

One of the tools financial advisors use in helping decide if you are ready for retirement is a Monte Carlo Analysis. This statistical analysis evaluates your entire financial situation across a thousand-plus different market scenarios (including high inflation, economic downturns, and more…) to provide you with a range of outcomes and a probability of success. This can help to provide you with confidence when determining if you are ready to retire.

In Conclusion

In conclusion, determining your readiness for retirement requires a thorough evaluation of your financial circumstances. By creating a budget, evaluating your income streams, and considering strategies like the 4% rule, you can gain a clearer understanding of your financial preparedness for retirement. For personalized guidance and further insights, we encourage you to contact your financial advisor.

For more information, watch the Retirement Planning: Are You Ready to Retire? video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.