Read through this post on how inflation impacts retirement planning and Financial Freedom or skip to the AllGen Academy inflation video below.

Inflation

Inflation is a critical part of planning for Financial Freedom. As we discussed in the previous lesson, anticipated costs of living directly impact how much you will need to accumulate for the Freedom stage. A primary factor to consider when estimating costs of living and the total amount of funding needed is the rate of inflation.

Inflation is defined as the rate at which costs of living are increasing every year. A positive inflation rate means that things will be more expensive in the future than they are today. Historically, inflation has averaged between 2% and 4% a year. Though this doesn’t seem like much, a small change in the inflation rate can have a big effect on the amount you’ll need to live off of long term.

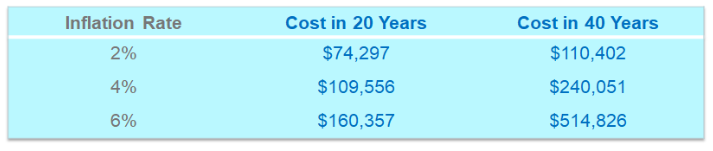

For example, a lifestyle that costs $50,000 today will cost much more in the future depending on the annual inflation rate and length of time. This table illustrates how a difference of just a couple of percentages makes a big difference in the future cost.

Consumer Price Index (CPI)

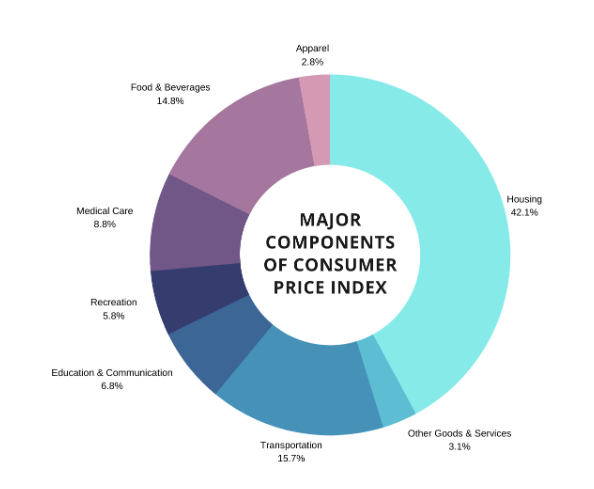

Inflation is driven by something called the Consumer Price Index (CPI) which measures the average change in prices over time that consumers pay for a basket of goods and services. This chart shows the different types of goods and services included in this measurement.

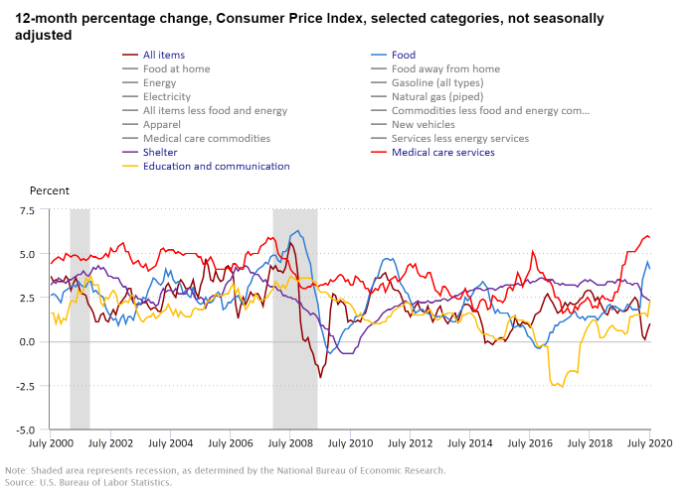

Some of these categories experience higher inflation rates than others, such as Housing, Medical Care, Education, and Food. Although overall inflation has remained around 2.5% in the past 5 years, these categories have risen faster at 3% – 6% annually, as shown in this graph.

In addition to the inflation rate, the CPI influences the cost of living adjustments (COLA) used to increase periodic income benefits such as Social Security each year. Without cost of living adjustments, constant income streams will start to lose purchasing power over time.

Purchasing Power

Purchasing power is the amount of goods and services that one unit of money can buy. For example, $10 can buy fewer goods and services today than it could 10 or 20 years ago. Purchasing power is inversely related to the inflation rate, which means that as inflation goes up, purchasing power decreases. This is also referred to as the erosion or weakening of purchasing power.

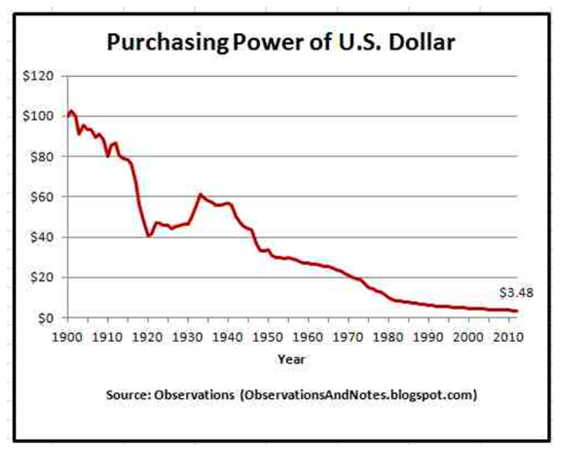

As you can see in this graph, the purchasing power of $100 back in 1900 has eroded to the equivalent of only $3.48 in 2010.

Inflation and the loss of purchasing power are why it is important to invest your savings in order to ‘keep up with inflation’ instead of just keeping it in cash or savings accounts that don’t appreciate. We’ll look at investing in more detail later in the course but for now, the key takeaway is to account for inflation in your Financial Freedom plan so you’re not surprised by how much things cost when you get to the Freedom stage. Planning accordingly will enable you to live your desired lifestyle.

For more information on how inflation impacts how much you’ll need to save for retirement, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.