Read through this post on net worth statements or skip to the AllGen Academy net worth statements video below.

Be sure to download the net worth statement template as well!

What Is a Net Worth Statement?

The Net Worth Statement tells us how healthy you are financially by “netting” out everything that is truly yours. It not only takes what you own into account but also what you owe.

By tallying up everything you have on the Net Worth Statement, you can get a definitive picture of where you currently stand financially.

Why Is a Net Worth Statement Important?

Society focuses heavily on obtaining a good Credit or FICO Score but all it really tells you is how well you borrow money. Instead of focusing on the use of someone else’s money, it’s better to focus on growing your money.

Your Net Worth Statement shows how much money you currently have and provides a way for you to track how your money is growing over time. It is a better measure of your financial state than just your borrowing history.

Knowing your net worth is a key part of the Path to Financial Freedom because you can start making smarter financial decisions by determining how each decision will impact your net worth in the long run. As you continue down the Path, it’s important to update your Net Worth Statement periodically as it is the best gauge for financial progress.

Creating a Net Worth Statement

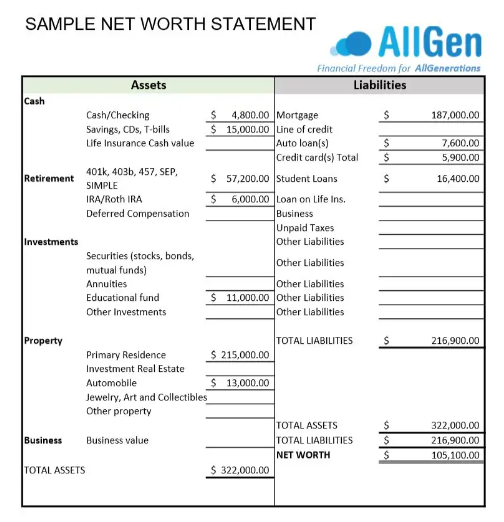

If you’ve worked with an AllGen financial advisor before, then you may already have a net worth statement. If not, you can create your own using this net worth statement template. You can see a sample of the template below.

How to Determine Net Worth

Your Net Worth is calculated by adding up all of your assets and subtracting all of your liabilities.

Net Worth = Assets – Liabilities

To start, take an inventory of all your assets including:

Cash and Investment Accounts

- Bank accounts (checking and savings)

- Retirement accounts (401k, 403b, IRA, Roth IRA, etc.)

- Taxable investment accounts (stocks, bonds, mutual fund shares, ETFs, etc.)

- Employer stock options

- Education savings accounts

- Notes receivables

Real Estate

- Primary residence

- Rental property

- Land

Personal Property

- Cars and other vehicles

- Jewelry

- Collectibles

Other Assets

- Life insurance cash value

- Value of business ownership

We recommend using the fair market value for each asset: how much you would get if you were to sell it today.

Next, list all your liabilities, which are the outstanding balances you owe on the following:

- Student loans

- Car loans

- Mortgage(s)

- Personal loans

- Credit cards

- Lines of credit

- 401(k) loans

- Any other debt

Add up the total of all your liabilities and subtract it from the total of all your assets. The difference is your net worth.

A positive number means you have more assets than liabilities. A negative number means your debt exceeds your assets. Your wealth is based on positive net worth, also referred to as equity. This is what you truly own.

How to Increase Your Net Worth

The goal of establishing and monitoring your Net Worth Statement is to increase your overall net worth over time. Now that you’ve determined your net worth, what can you do to positively impact it?

You can improve your net worth by:

- Eliminating liabilities

- Increasing assets

- A combination of both

A logical place to start is by eliminating liabilities, specifically consumer debt. We’ll discuss how to get out of debt in more detail later on. For now, it’s important to understand that paying off your liabilities has a direct and powerful impact on increasing your net worth in the long run.

Another way to accumulate net worth is to increase the number of assets you own. Sometimes assets are gifted to you but most often, you acquire assets by purchasing them. This requires understanding the kinds of things you buy and investing your earnings in assets that appreciate over time as opposed to consumption items that may not add to your net worth.

Conclusion

A net worth statement can help you to see exactly where you’re at now, from what you currently own to what you currently owe. Knowing where you are is an essential component of getting where you want to go. Contact us with any questions on net worth statements and how to create them.

For more information on net worth statements, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.