Allgen Update – July 2016

Greetings from Allgen. We hope you are enjoying your summer so far. We say this in light of the events that have transpired (the Pulse shooting in Orlando, the “Brexit”, etc.). Yet, history has taught us that challenging circumstances have brought human resilience to the forefront. Once again we see this to be true in Orlando. The community has come together to support those affected by the tragedy, the financial markets have rebounded from the initial drop after the Brexit announcement, and we, at Allgen, have increased our efforts to educate the community regarding financial issues.

These efforts include our teenage “Money Cent$ Camp” where we spent a week teaching young minds real financial issues including the importance of budgeting, saving, investing, and giving back to the community. We also launched Allgen’s “Money Minute” whereby the two partners of the firm, Paul and Jason, speak on various financial topics of interest in short video clips. We have made them available via our website, Facebook, Twitter, LinkedIn and YouTube channel. As such, our goal is to connect with each of you to do a review via in-person visits, virtual reviews in front of a computer, or a client investment forum (stay tuned for more details).

More than ever, we see a critical need for folks to take a look at not only their portfolio but their overall financial picture to see what changes or adjustments (if any) are necessary to meet financial goals in a prudent manner. A key component of your financial well-being is the tracking and progressive monitoring of your personal balance sheet a.k.a. the net worth statement.

Financial Planning – Net Worth

Your Journey Starts Here

We believe the ultimate measure of Financial Freedom as outlined in Allgen’s Path to Financial Freedom is building your wealth up to a point that you are no longer focused on a paycheck, but rather free to pursue your purpose in life, whatever that may be. This is accomplished via either: 1) income from one or various sources (pensions, social security, etc.), 2) liquid assets (401K plan), 3) income from a business or real estate, or a combination thereof.

While many companies have just about eliminated traditional pension plans, and social security seems to be struggling to remain a viable option for retirement income, Americans are having to assume the responsibility of accumulating assets for their retirement. And here enters the importance of net worth.

What Am I Worth (…from a financial point-of-view)?

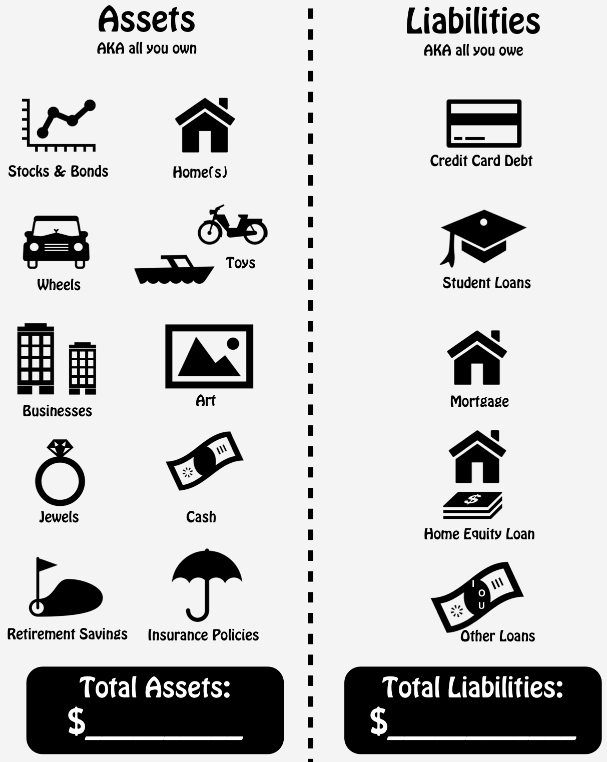

A person or family’s net worth is calculated by adding the value of everything owned (house, bank account, 401K, etc.), otherwise known as assets, and subtracting all debt or liabilities (mortgage balance, credit cards, school loans, car loans, etc.). The result of this calculation is the net worth.

ASSETS – LIABILITIES = NET WORTH

WHAT I OWN – WHAT I OWE = NET WORTH

The higher the net worth, the more a person or family actually owns. The goal is to increase the net worth so as to facilitate financial freedom or independence. Of course, being financially independent looks different for every person; there is no one measure of net worth that is right or adequate per any given family or individual. The appropriate net worth for you depends on several factors including your age, your time horizon to reach financial independence, potential income streams, and standard of living. This is why the net worth calculation should be used as a measure in the context of an overall financial plan specific to your situation or circumstances.

Optimize

The net worth gives great insight as to how to optimize your finances. It reveals where you are today. There are 2 fundamental ways to increase your net worth; 1) increase your assets or 2) decrease your liabilities. Both factors, however, are not mathematical equals. For example, let’s say you have $15,000 in your savings (most savings accounts earn less than 1% these days) and $10,000 in credit card debt earning 12.9% interest. If you took $10,000 from your savings to pay off your credit card debt, you could save $1,290 per year in interest payments and no longer have to make a credit card payment each month (assuming you stopped using the credit card). This is just one example of how to optimize your financial picture through your net worth.

While accumulating assets logically makes sense and is much more appealing to most, eliminating liabilities can have a stronger impact on the equation, especially if you have consumer debt. The reason is that liabilities come with an added negative interest. Interest on debt compounds against you, making it that much more difficult to get to a point where your net worth calculation actually starts to increase. This is one reason why some people seem to never make a big dent on this number while they try to overcome all of the detrimental compounding debt (student loans, car loans, house debt, credit card debt, etc.). In fact, this task becomes so arduous that most give up on the idea of living debt-free and just tailor their lives around this ball-and-chain as a life-long presence in their finances.

You can also use your net worth statement to gauge how diversified you are from a high level. For example, many business owners have the majority of their net worth tied up in their company. If the bulk of one’s net worth is in illiquid assets (business or real estate) and something happens (disability, sickness, failed business, lawsuit, etc.) where that person needs money quickly, they may be forced to sell their business or real estate at a very low price. Or, if not, they could be in danger of defaulting on their monthly payments. Ideally one’s net worth should be composed of some liquid funds (checking, savings, liquid investments, etc.), even if most of their net worth comes from a business or real estate.

Tracking

As we mentioned above, an essential part of financial health is always having a clear understanding of where you are. Tracking your net worth, at least annually, is a way to stay on track and make sure you are progressing in the right direction. It will also help you spot the strong and weak areas of your financial portfolio which can help you grow your net worth faster and/or reduce your risk.

There are several tools available to track your net worth including:

- Excel spreadsheet

- Allgen’s Wealth Tracker

- Mint.com

- Microsoft Money

- Quicken

Just to name a few. As always, we would welcome the opportunity to go through your personal net worth and help you make wise decisions based off what we see from an objective point-of-view. In our next planning update, we will discuss tracking monthly cash flow, which when combined with the tracking of your net worth, empowers you with your money, keeps you on track to reach your goals, and gives you a full view of your financial picture!

Additionally, we invite you to stay connected with Allgen’s market viewpoints and financial education. You can find us via allgenfinancial.com, Facebook, LinkedIn, Twitter and YouTube.

Written by Paul Roldan, Chief Executive Officer and Jason Martin, Chief Financial Officer, with Allgen Financial Services, Inc.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Services, Inc. (Allgen) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details the business practices, services offered, and related fees of Allgen, is available upon request.