Read through our market commentary here, or skip to Jason’s June 2022 Market Update video below.

While stock prices have historically gone up, markets are no stranger to volatility, bear markets, and recessions along the way; 2022 has been a sobering reminder of that. To understand what’s happening, we have to get nerdy in these paragraphs, so buckle up!

Elevated Inflation Rates

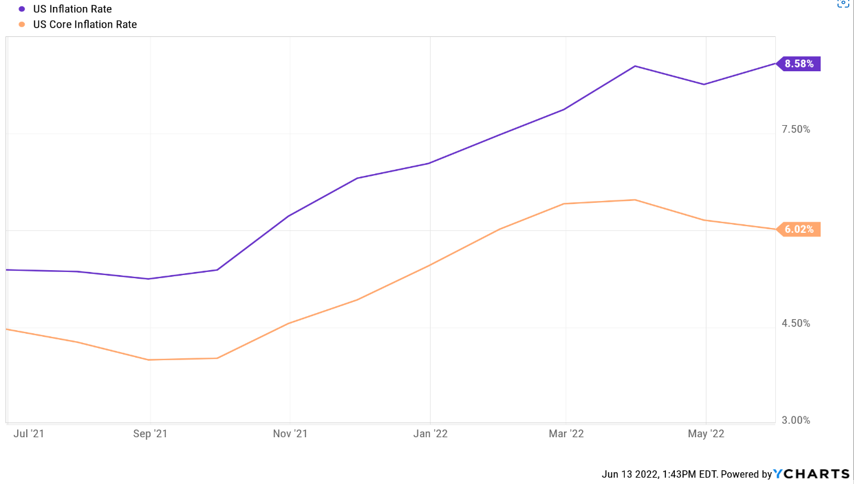

Inflation remains elevated at over 40-year highs and over the last 12 months, as of May 2022, the US Inflation rate reads 8.5%. Core inflation, which measures price changes excluding food and energy is at 6.02% and moving downward, as evident in the below chart.

The Federal Reserve’s main tool to combat inflation is raising interest rates aggressively which has already begun. This increases the cost to borrow and spend money in the economy for companies and individuals, which is de stimulative and typically slows the economy. It can be effective at reducing inflation however, historically, when the Fed has been this aggressive in the past, the economy has struggled.

Bond Prices Inverse to Yields

Historically, bond prices move inversely to yields, meaning that when yields go up, bond prices go down. The chart below plots the yield of the 10-year treasury looking back to 1962. From 1962 to 1981, also a period of high inflation, yields rose to nearly 16%. From 1981 until recently, yields have been coming down on average, which has been good for bond prices. Now, with inflation high and yields rising, bond prices have been performing poorly. Just as the stock market can anticipate the future, the bond market has anticipated the rise in interest rates and has already fallen significantly even though the Fed has only recently begun to raise rates. AllGen had underweight bonds during this time and for the bonds that we did hold, we held less interest rate-sensitive bonds, which typically have shorter maturities.

On the right side of the chart above, we’ve highlighted different years where the bond market dropped by -5% or more. Since yields have already gone up significantly, and bond prices have already gone down significantly (about 12% so far in 2022), it can be a sign of opportunity. Given the bond market has historically performed well after sharp drawdowns listed in the table on the right-hand side, going into the summer months we will be looking for opportunities in our bond portfolio. Learn more about our thoughts on bond prices and the timing of Fed rate hikes here February 2022 Market Update: Russia-Ukraine, Inflation, Interest Rate Hikes & More – AllGen Financial Advisors, Inc.

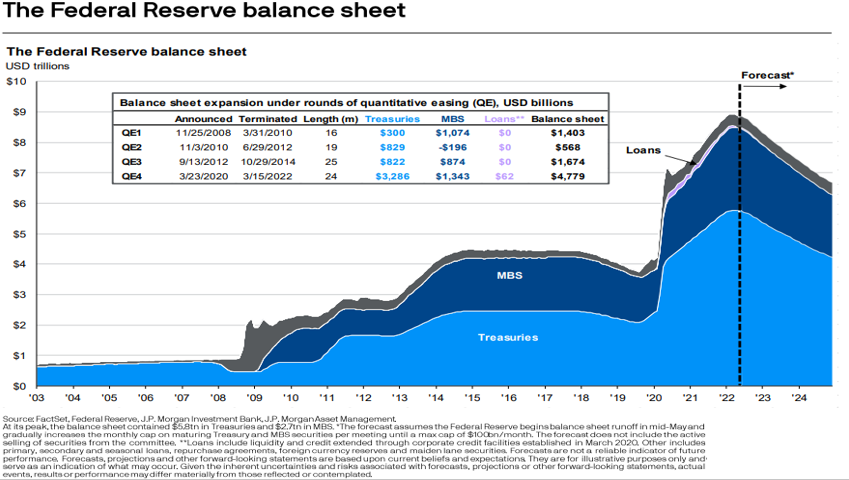

Federal Reserve Quantitative Tightening

Raising interest rates is not the only tool the Fed has in controlling and reversing inflation. It can also reduce its balance sheet by letting bonds mature and making the money “disappear”. The chart below illustrates the Fed balance sheet over time and the types of assets it held. During the pandemic shutdowns of 2020, the fed increased its balance sheet by printing money and buying bonds in an effort to stimulate the economy. Fast forward to today, the vertical dotted line, the Fed has begun to wind down its balance sheet which will do the opposite of money printing (quantitative easing) and reduce the money supply (quantitative tightening). This is also de stimulative and in line with rising interest rates.

How Has All the Anti-Stimulus Affected the Economy?

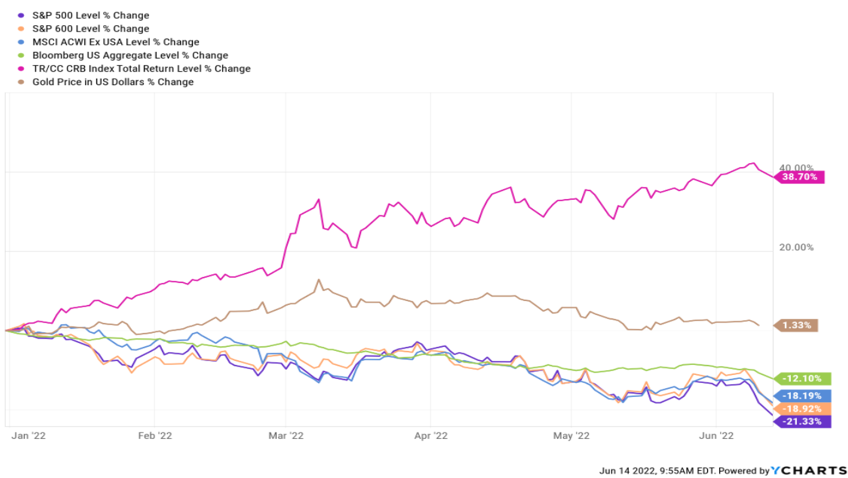

As seen in the chart below, nearly all major stock indexes are down over -18% in 2022, with bonds down over -12%. We mentioned that raising interest rates and reducing the Fed balance sheet can cause weakness in the economy however, not all asset classes have performed poorly. Commodities are up 38.7% for 2022 as of June 14 and are generally seen as a hedge against inflation and can be a good way to diversify in inflationary times. Over the long run, keeping a good mix of assets not correlated with one another can help cushion market downturns. Traditional investment portfolios tend to stick to only stocks and bonds which are typically noncorrelated. This year has been unique in that stocks and bonds are declining together as the fed is attempting to reverse much of the stimulus of 2020 to combat elevated inflation. Incorporating commodities in the picture can offer a portfolio additional levels of diversification.

Emerging Markets

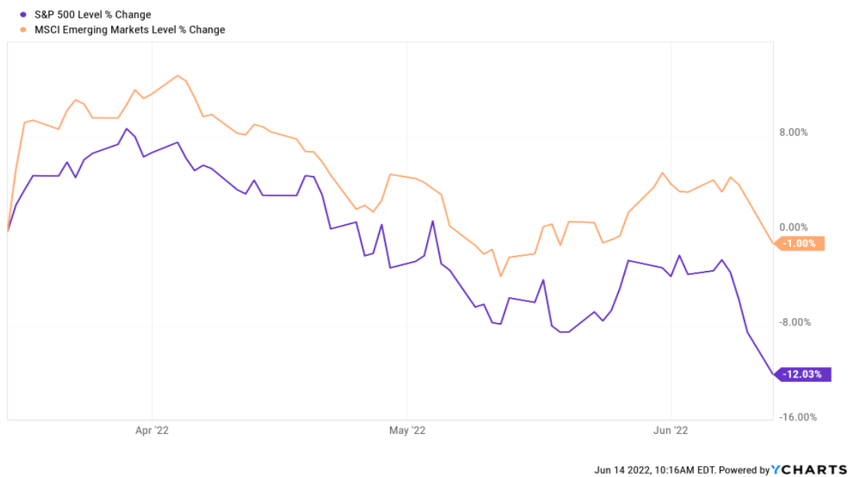

Over 2021 we have been adding to emerging markets, which were showing signs of undervalue, indicating opportunity; see our Market Update from March 2022 where we examine these signs. March 2022 Market Update: International and Emerging Markets, Russia-Ukraine, & More – AllGen Financial Advisors, Inc. At the beginning of 2022 emerging markets finally began outperforming the S&P 500 but then the Russia/Ukraine war shocked the emerging markets space. Since early March of 2022, emerging markets have recovered and are now outperforming again seen in the chart below with emerging markets down only -1% while the S&P 500 is down -12%.

Growth vs. Value

We’ve covered the case for overweighting value stocks over growth stocks in previous market updates. In the chart below a rising line indicates value stocks are outperforming and vice versa. The green arrow on the right suggests that after nearly 13 years of growth stocks outperforming value, value stocks could finally take the baton (see chart below). Value-oriented companies typically have strong balance sheets, earnings, and high dividends that can provide advantages when economies struggle. Growth stocks are typically more sensitive to quantitative tightening as they rely more on cheap borrowing costs to fund their operations. So far in 2022 as of June 13, growth stocks are down -30.4% whereas value stocks are down only -10.39% according to Stockcharts.com.

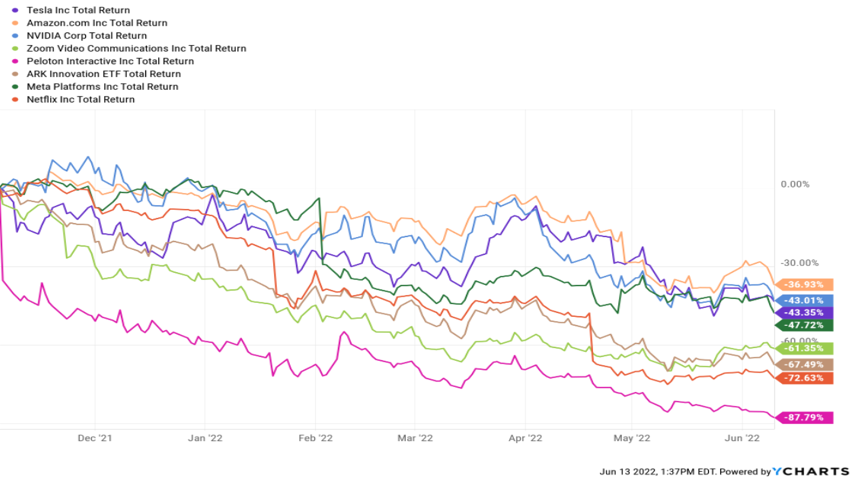

Speculation Is Not an Investment Strategy

Speculating can be exciting, but also devastating if overdone. The popular growth stocks throughout the Covid-19 pandemic including Netflix, Peloton, Zoom, Amazon, etc. saw incredible gains, several of which were over 100%. Towards the end of 2021, and as of 6/13/2022, these stocks have been crushed from their highs. Zoom, Netflix and Peloton are down -61%, -72% and -87% respectively (see below). Bitcoin and Ethereum, also extremely popular during the pandemic, are down -60% and -69% respectively over the same time period. Over 2021 AllGen was reducing the growth side of the stock portfolio as we began to see signs that growth stocks were becoming overbought.

We try to manage risk effectively by overweighting and underweighting asset classes in a diversified portfolio. We have been underweighting growth stocks and overweighting value stocks as we see the pendulum begin to swing towards favoring value. While we entered the year underweight bonds, we are beginning to add to the position gradually. Additionally, we feel it’s important to diversify outside US stocks and bonds, incorporating gold commodities and emerging markets. Strategically rebalancing accounts back to these target allocations can also protect portfolios from becoming too overweight in any particular asset class.

Get in touch with our team to discuss strategy when planning your investment goals.

For more information, watch the full June 2022 Market Update video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.