What Is an Emergency Fund?

An emergency fund is a predetermined amount of cash set aside to cover expenses in case of unforeseen events such as unemployment, disability, illness, automobile repairs, medical deductibles, etc. An emergency fund is not an investment but rather secure funds that are readily available when needed.

Keep reading this blog or skip to our emergency funds video below from AllGen Academy.

Why Emergency Funds Are Important

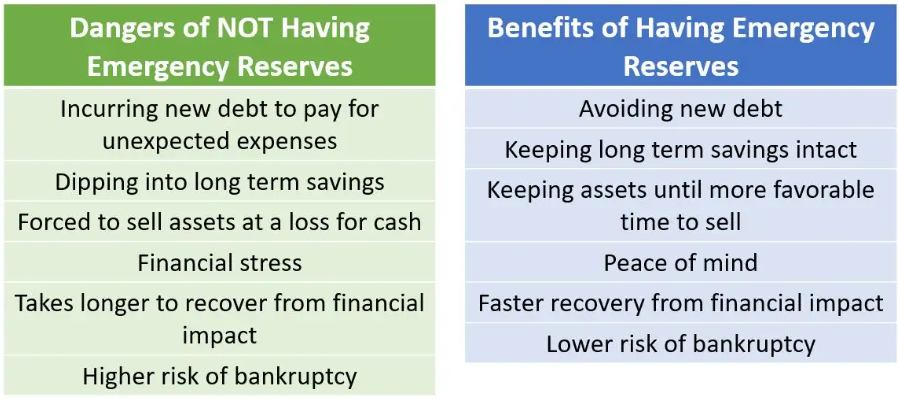

Most Americans live paycheck to paycheck and could not cover a $700 emergency. Yet, the foundation of any financial plan requires that we protect ourselves from unforeseen life events. The best financial plan can be derailed if you are not prepared for emergencies.

Having an emergency fund provides you peace of mind that should any unexpected expenses occur, you have a financial cushion to absorb it. Without this cushion, you’ll be forced to take on more costly debt or dip into long-term savings to cover the expense. Being unprepared can cause setbacks in your financial progress and delay your ability to reach Financial Freedom.

How to Establish an Emergency Fund, Step-by-Step

There are two phases to establishing an emergency fund:

Phase 1: $1,000 Initial Emergency Fund

If you have consumer debt (i.e. credit cards, auto loans, etc.), your first goal is to set aside $1,000 for emergencies. At that point, all surplus should be directed towards eliminating consumer debt as quickly as possible.

Phase 2: Full Emergency Fund

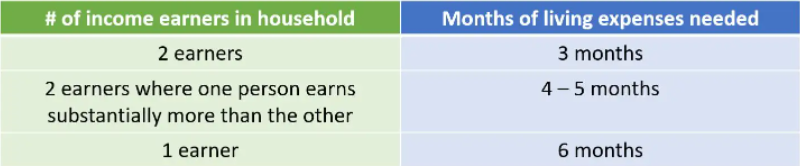

After you’ve paid off all consumer debt, your next goal is to accumulate 3-6 months of living expenses in a money market account. Here are some guidelines for how much you need to set aside:

- If you are a single income generator in your household, you should aim for 6 months of living expenses.

- If you are in a double income home where both parties contribute similar amounts to the household, you can aim for 3 months of living expenses in savings.

- If there is a disparity between the two incomes, you should aim for 4-5 months of living expenses depending on how large the disparity is.

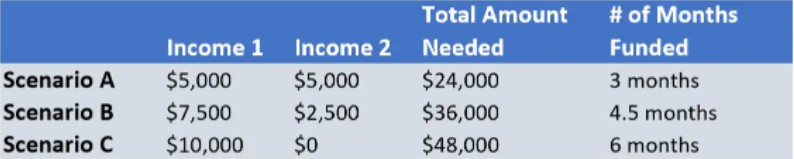

Examples for a household with $8,000 in monthly expenses:

Emergency Funds Goal

The goal of establishing an emergency fund is to have money set aside for unanticipated emergency expenses. These don’t include routinely occurring expenses or planned upcoming purchases. As we discussed under the Spending Plan section in the previous chapter, known future expenses should be built into the Spending Plan. Only unforeseen events constitute the use of emergency funds.

Some people may be uncomfortable with the idea of having a large amount of money not earning much interest. Keep in mind that the purpose of this money is not to grow but rather be readily accessible in case of emergencies. As such, these funds should not be invested or expected to earn much. A typical vehicle for emergency funds is a money market fund at a brokerage firm.

For more information on emergency funds, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.