A message from our investment team, in regards to the global markets undergoing their worst 5-day span this year.

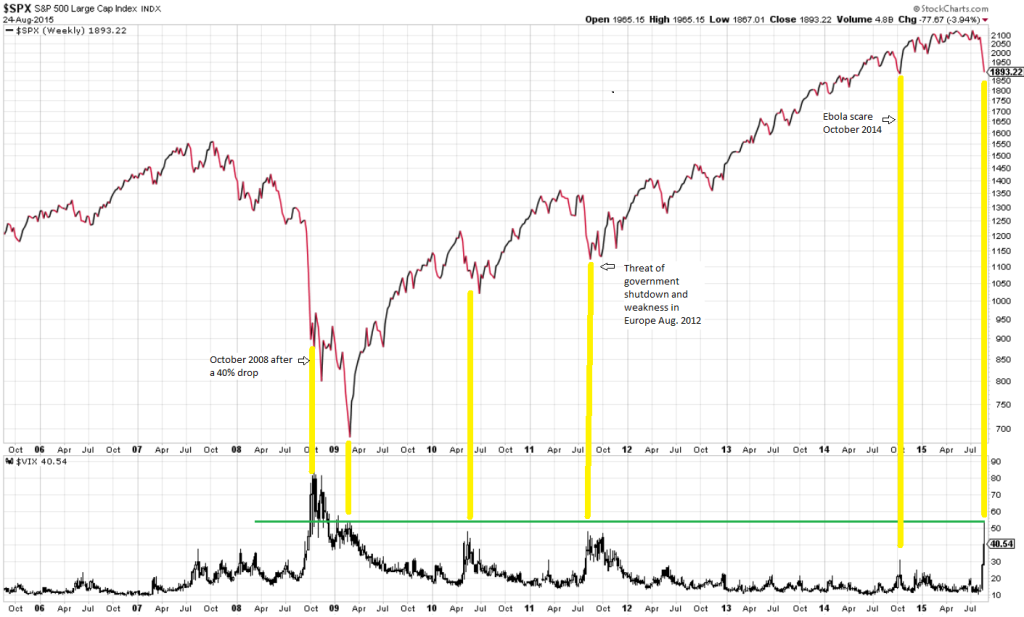

Global markets underwent their worst 5-day span this year. While concerns may arise from this heightened volatility it’s important that you stick with a long-term plan rather than focus on short-term market fluctuations. The markets registered more fear today according to the VIX (Volatility Indicator) than any time in the last 5 years, nearly as much fear as when the market hit its low point in October of 2008 (See chart). The difference is the market is only down 10% from its highs and in October of 2008 it was down nearly 40%. When you see this much fear it has historically been a sign of the market bottoming not topping.

While times as these can serve as a financial distraction, historically the most successful investors 1) follow a well established plan, 2) stay diversified, and 3) make sure their portfolio composition is lined up with their tolerance for risk and the timetable for when they’ll need to start drawing down their portfolio. We encourage our clients to go down “Allgen’s Path to Financial Freedom”. This path starts off by focusing on building a strong foundation including having strong emergency reserves (rainy day account), no consumer debt (less monthly payments and less risk) and proper risk management in place before you invest. Someone with a strong foundation is better prepared to weather the market storms as they can focus on the long term and stick with their plan.