Key Takeaways:

401(k) accounts, which are linked to employers, are one of the two most commonly used types of retirement accounts. The matching contributions that many employers offer make 401(k)s an attractive option. But what happens to a 401(k) when an employee leaves for a different job? In many cases, old 401(k) accounts are just forgotten.

How Common Is It To Forget a 401(k)?

Capitalize, a New York-based financial technology company, issued a white paper estimating that as many as 24.3 million people across the United States had forgotten 401(k) retirement accounts. In those accounts was an estimated $1.35 trillion. The white paper also estimated that each year, another 2.8 million 401(k) retirement accounts are left behind.

On average, individual retirees with forgotten 401(k) accounts lose an estimated $700,000 in savings for retirement. This also means those funds lose out on growth potential of up to $116 billion because the accounts aren’t properly managed and monitored.

How Does Forgetting an Old 401(k) Cost Money?

Retirement accounts aren’t like savings accounts. All of the funds in a 401(k) are invested so that they make more money in the long run. However, if you’ve forgotten about a 401(k) account, you might be missing out on better investment opportunities. Markets change over time and if that old 401(k) account hasn’t been properly rebalanced or diversified because you’ve forgotten about it, you might not be making the money that you could be.

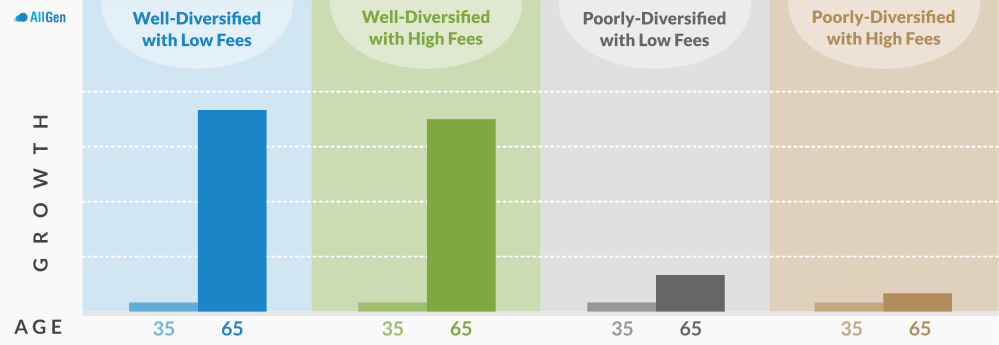

Two things impact your 401(k) account’s performance: fees and investment allocation.

How Do Fees Affect 401(k) Account Performance?

Some retirement accounts have higher fees than others. The higher the fees, the more money you’ll have to pay just to have the account and therefore the less you’ll have to invest. Fees may determine which type of account you want to have, for example, if you’re deciding between rolling over a 401(k) into a new 401(k) or an IRA. However, they don’t have nearly as large an impact on your retirement account’s growth as investment allocation.

How Does Investment Allocation Affect 401(k) Account Performance?

The primary way that 401(k) accounts do not perform well is via less-than-optimal investment allocations. Many 401(k) accounts default to Money Market accounts and aren’t set up properly to make the most of investment opportunities. If an old 401(k) isn’t well-diversified and the funds are instead in low-return investments, then there could be minimal growth.

Poorly allocated funds have the biggest negative effect on a 401(k)’s growth potential. It’s the investment allocation that determines whether the account still makes enough money to grow or whether it stagnates.

How Should I Allocate My Investments?

Since investment allocation is one of the most critical components of making sure your 401(k) is growing, you should ensure that all of your accounts are well diversified in high-yield investments. It’s a good idea to speak with a financial advisor to understand how best to allocate your funds. Up to 13% of Americans leave their accounts at the default settings, which could negatively impact future returns.

What Can I Do With a 401(k) When You Change Jobs?

People who change jobs have four options for what to do with a 401(k) account:

1. Rollover the 401(k) to an IRA

One option is to roll over the funds from the 401(k) into an IRA.

2. Merge the Two 401(k) Accounts

Many people choose to move the funds in their old 401(k) account into a new 401(k) retirement account.

3. Cash Out the 401(k)

Unless you’re of retirement age, cashing out a 401(k) is usually not recommended due to the fees and taxes you would have to pay.

4. Keep the 401(k)

If you have more than $5,000 in your 401(k), your old employer may let you keep the account. However, not all employers allow former employees to exercise this option and some may just cash out the old 401(k) and send you a check for the amount in the account.

What Should I Do With Old 401(k) Accounts?

If you have changed jobs throughout your career, you should check to make sure that you haven’t forgotten 401(k) accounts from previous jobs that are still active. You may consider keeping the accounts if they’re already well-allocated and you’re actively monitoring them, but for most people, it’s a better idea to roll over the funds to a new retirement account.

Should I Roll Over My Old 401(k) to a New 401(k) or an IRA?

Whether you choose to move the funds from your old 401(k) to a new 401(k) or an IRA depends on the fees associated with the account and the investment opportunities available.

Should I Consult a Financial Advisor?

A financial advisor can help you to maximize the returns on your investments. Millions of Americans don’t have as much money in their retirement accounts as they could, not just because they have forgotten 401(k) accounts. Proper allocation of investments is essential to earning as much money as possible for retirement.

A financial advisor can be the expert you need to ensure those investments are allocated to maximize your potential earnings from the 401(k) account. They can also advise you on your options for old 401(k) accounts and help you decide what options will work best for your financial needs and retirement goals.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.