Missing a financial deadline can have negative consequences on your finances that go beyond just paying penalties. For example, if you don’t set up a solo 401(k) by the tax filing deadline, then you could miss out on an entire year of retirement savings and the compounded growth those dollars could see over time. For this reason, we’ve outlined below the most important 2023 year-end financial deadlines you should be aware of. As always, please consult with your tax attorney or accountant on any tax strategies and the details specific to your circumstances.

Solo 401(k) Deadlines

A solo 401(k) is a retirement account available for businesses that have one owner (or two owners, if they’re married) and no employees. This type of 401(k), which follows all of the same rules as a traditional 401(k), is advantageous because you can contribute to it as both employer and employee, allowing you to contribute more throughout a year than you’d be able to with an IRA. You can contribute up to $66,000/year, or $73,500/year if you’re making a catch-up contribution after the age of 50.

Solo 401(k) Opening Deadline: Tax Filing Deadline

The deadline to set up a new solo 401(k) used to be December 31, 2023, but with the SECURE Act 2.0 the deadline is now the tax filing deadline. Keep in mind that all employee contributions (from payroll) into the solo 401(k) still have to generally be done by the first week of January (excluding sole proprietors that do not take payroll). So, many times it is still best to establish the solo 401(k) by the old December 31st deadline.

Solo 401(k) Employee Contribution Deadline: 1st Week of January

With a solo 401(k), you’re playing the role of both employer and employee. As an employee, you have until the first week of January to make the first contribution (from payroll) to a solo 401(k).

Solo 401(k) Employer Contribution Deadline: Tax Filing Deadline

The date that you must make the employer contributions to your solo 401(k) varies depending on how your business is incorporated. The SECURE Act 2.0 included a provision that allows sole proprietors and single-member LLCs to open solo 401(k) accounts. This deadline therefore may be March 15 (LLCs) or April 15 (individuals or sole proprietors), or, if you’ve filed for an extension, September 15 (LLCs) or October 15 (individuals or sole proprietors. Note that if the 15th falls on a weekend, the tax deadline would be the next business day.

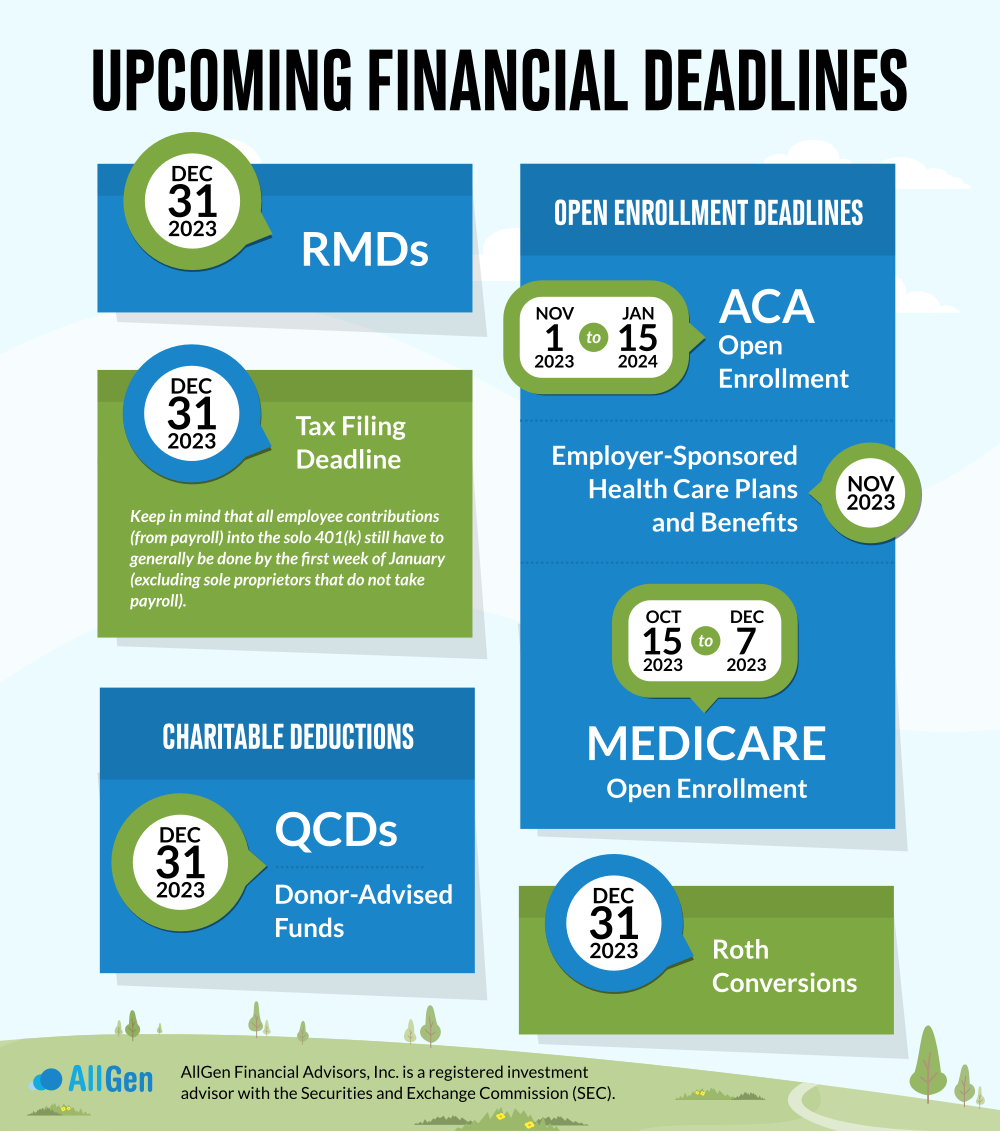

Roth Conversion Deadline: December 31, 2023

A Roth conversion involves converting eligible traditional IRA assets into a Roth IRA account. This can be a good strategy for those who want to lower their tax bracket in retirement and expect to have high RMDs, or required minimum distributions, that would bump them into a higher tax bracket. Keep in mind that the whole balance of the traditional IRA doesn’t have to be converted all at one time – it can often be more tax efficient to only convert portions of the traditional IRA to a Roth IRA to manage your tax bracket. The date for converting these assets is December 31, 2023.

Required Minimum Distributions (RMDs) Deadline: December 31, 2023

Required minimum distribution (RMD) is the term used for the money that you are required by law to take out of your traditional IRA, traditional 401k, or inherited traditional IRA after you reach full retirement age. You must withdraw the required funds, which are calculated based on the account balance on 12/31 of the prior year, by December 31, 2023. If you do not take your RMD by this deadline, then the penalties can be steep.

Charitable Contribution Deadlines

Making charitable contributions has multiple benefits. Not only are you giving back and contributing to important causes that you feel passionate about but you are also benefiting when it comes to taxes. The following are important deadlines to keep in mind for charitable giving for the 2023 tax year.

Qualified Charitable Distributions (QCDs) Deadline: December 31, 2023

Qualified charitable distributions are distributions done in replace of RMDs from traditional IRAs, traditional company retirement plans, or inherited IRAs that go directly to a qualified charity. This may be beneficial for those wanting to donate to charity but don’t necessarily need their RMD for their living expenses. The added bonus: in many cases, the distribution doesn’t count towards your taxable income in the given tax year. The deadline to make qualified charitable distributions is December 31, 2023.

Donor-Advised Fund (DAF) Contribution Deadline: December 31, 2023

A donor-advised fund can be an excellent way to manage your charitable donations in an efficient way. For those in a high tax bracket, that have a large taxable event, and/or are itemizing, DAFs allow you to recognize a donation in the year you donate to the DAF – even if you don’t spend from the DAF in that given year. You can contribute stocks, real estate, cash, and other assets into a DAF as well as invest cash that is in a DAF that you don’t plan to deploy for a period of time. The deadline for contributing to the DAF account for the 2023 tax year is December 31, 2023. Once the funds are contributed, you can then deploy the funds to charities at your own pace without deadlines.

Open Enrollment Deadlines

The open enrollment period is another financial deadline that you won’t want to miss. If you don’t sign up for the benefits you want, you will have to wait another year to change plans or sign up for health care benefits in the first place, unless you have a qualifying event that would make you eligible for a special enrollment period (such as starting a new job, getting married, or having a baby). If you’re already enrolled for benefits, then your current plan should automatically renew; you would just have missed your opportunity to make any changes to it.

Employer-Sponsored Health Plans & Benefits Open Enrollment: Usually November

If you get your health benefits through your employer, then the deadline will vary depending on your location and your employer. Typically, the employer-sponsored open enrollment period is in November.

Affordable Care Act (ACA) Open Enrollment Period: November 1, 2023 – January 15, 2024

The ACA open enrollment period varies by state, but in Florida, it runs from November 1, 2023, to January 15, 2024, for this year. The ACA can be a great option for those who have retired early, don’t have access to employer-sponsored healthcare plans, and aren’t yet eligible for Medicare.

Lowering Your Taxable Income in Early Retirement

For those who are on or plan to use an ACA healthcare plan while waiting for medicare eligibility, there are some ways you can lower your taxable income during retirement to potentially qualify for a subsidy:

- Tax loss harvesting on taxable investment accounts

- Build up savings outside of a traditional IRA or 401(k) to live off of

- Take distributions from a Roth IRA and avoid taking distributions from a traditional IRA or 401(k)

Medicare Open Enrollment: October 15, 2023 – December 7, 2023

If you aren’t working, no longer have access to employer-provided health insurance, and are eligible for Medicare, then you’ll need to enroll by December 7, 2023, or within 8 months of losing coverage. If you’re new to Medicare and don’t enroll by the deadline, you may face steep penalties. For those already enrolled in Medicare, you’ll automatically be re-enrolled, but you’ll need to make any changes by December 7th.

Contact Your Financial Advisor

If you have any questions about any financial deadlines, retirement planning, or charitable giving, don’t hesitate to ask your financial advisor. The sooner you discuss your options with your advisor, the easier it will be to plan ahead so you don’t miss out on an important deadline and potentially face penalties.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.