Financial Markets: 1st Quarter 2016

Allgen’s Market Commentary

4th Quarter Review

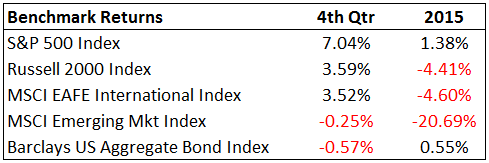

2015 was a year with increased volatility which caused a lot of fear in the minds of investors.

The S&P 500 had it’s the lowest return since 2008 and a diversified portfolio had its

first loss since 2011. U.S. small caps and international stocks were down. Most emerging markets are in bear market territory (down over 20%) with the hardest hit being nations that depend on commodity exports. Bond returns eked out a small gain despite the Fed’s first interest rate hike in 9 years. In this issue of Allgen’s quarterly market commentary, we will discuss our investment philosophy, increased volatility in 2016 and value vs. growth stocks.

Allgen’s Investment Philosophy

Understanding Allgen’s investment philosophy will allow you to sleep better at night when markets get turbulent. We are active money managers and our investment philosophy is to “Seek long-term capital appreciation and asset protection in down markets”. We manage risk first in order to avoid any major loss. The primary enemy of a portfolio’s success is excessive losses. Heavy portfolio downswings will wipe out the strongest of positive returns. For example, if you have $100,000 and lose 50% your account is now worth $50,000. You now have to gain 100% to get back to where you started. If you lose 90% you have to gain 1,000% to get back to where you started. The point is the more you lose the harder it is to comeback, which is why we strive to protect investor’s capital. We seek to outperform a client’s respective risk profile benchmark over an entire market cycle (Bull and Bear Market) net of fees. Our success at building portfolios that take on less risk than the market yet achieve a superior return comes from our

Superior Investment Selection Process, Dynamic Asset Allocation, and Strategic Rebalancing

Superior Investment Selection Process: Allgen puts thousands of hours a year into investment research. We seek to invest in securities (both stock and bond) that historically have the highest long-term net return with the lowest amount of risk or volatility. The investments we choose are typically the ones that have held up well during the worst of times (like 2008 or after the tech bubble in 2001-2002), yet still perform respectable during bull markets. The combination of decent returns when markets are going up and reduced losses when markets fall lead to superior long-term returns and a smoother ride along the way. For more detailed information on our investment selection process and criteria go to: https://www.allgenfinancial.com/wp-content/uploads/2014/10/Allgen_Investment_Management_v3.pdf

Dynamic Asset Allocation: Allgen has the ability to buy mutual funds, stocks, bonds, Exchange Traded Funds (ETF’s) and Close End Funds (CEF’s). We invest in both domestic and foreign securities. We can buy companies of any size market capitalization. We use a Core and Explore strategy to gain consistent long-term returns while managing risk. The “Core,” which is the bulk of the portfolio, is composed of well-diversified holdings. The percentage of stocks and bonds would depend on the client’s risk profile. The core piece tends to be more conservative in both up and down markets. The “Explore,” which is the smaller part of the portfolio, attempts to accelerate returns in a strong market and protect the account during a weak market. When markets are showing signs of strength we will invest the explore money in more cyclical investments, which performs better in bull markets. When we think markets are vulnerable to a decline we will use the explore side of the portfolio to go more defensive by investing in safe havens, which tends to appreciate when the market goes down.

Strategic Rebalancing: We strategically rebalance portfolios to take advantage of opportunities during weak markets and reduce risk after strong markets. When markets are strong, stocks usually go up greater than bonds. In this scenario we would sell off a portion of the stocks and use the proceeds to buy into bonds, therefore lowering the risk of the overall portfolio. During a weak market, stocks usually go down greater than bonds. In this scenario, we would sell off some of the bonds and use the proceeds to buy stocks. We also strategically rebalance between sectors, market caps, and types of bonds, which helps us buy low and sell high.

Increased Volatility in 2016

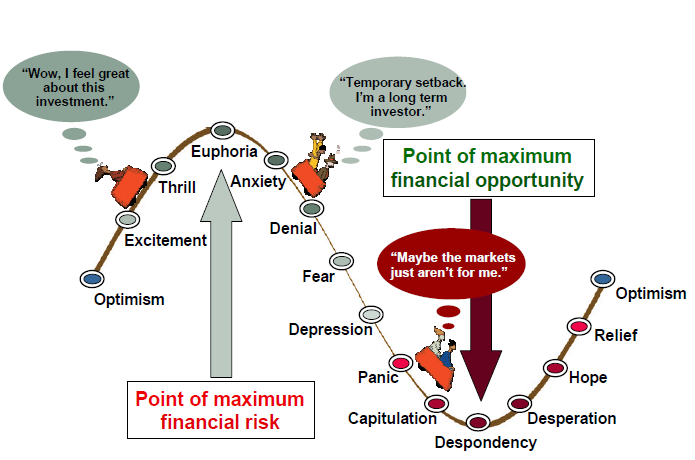

As the market dives (pun intended) into 2016, we expect this year to be a year where the market experiences larger swings (both up and down). Multiple factors lead us to this conclusion: 1) The FED started raising interest rates and are no longer trying to stimulate the economy through Quantitative Easing. 2) It’s an election year which usually causes uncertainty of the direction of the country (markets don’t like uncertainty). 3) Valuations are higher than average after a 6-year bull market. Market fluctuations can cause investor angst as the market goes on a “roller coaster ride”. To make matters worse, the media will surely amplify this message. Investors need to understand that the media is  incentivized to increase viewership and the best way to do that is by exaggerating the daily news. But, the reality is journalists are not money managers. Journalists try to provoke emotions (mainly fear) while money managers try to use facts and statistics along with a level head to make sound investment decisions. Hasty decisions made out of fear can dramatically reduce long-term returns. The good news is Allgen’s style of money management tends to outperform during times of volatility. Since we are active money managers we strive to find opportunities to buy when investors are scared and the market is low. Fear can cause markets to drop and create great buying opportunities for those who are able to think objectively. Plus, we have the ability to become defensive and protect capital when markets have gone up too much as we discussed in our investment philosophy.

incentivized to increase viewership and the best way to do that is by exaggerating the daily news. But, the reality is journalists are not money managers. Journalists try to provoke emotions (mainly fear) while money managers try to use facts and statistics along with a level head to make sound investment decisions. Hasty decisions made out of fear can dramatically reduce long-term returns. The good news is Allgen’s style of money management tends to outperform during times of volatility. Since we are active money managers we strive to find opportunities to buy when investors are scared and the market is low. Fear can cause markets to drop and create great buying opportunities for those who are able to think objectively. Plus, we have the ability to become defensive and protect capital when markets have gone up too much as we discussed in our investment philosophy.

Value vs. Growth Investing

DEFINITION of ‘Value Stock’

A stock that tends to trade at a lower price relative to its fundamentals (i.e. dividends, earnings, sales, etc.) and thus considered undervalued. Common characteristics of such stocks include a high dividend yield, low price-to-book ratio and/or low price-to-earnings ratio (i.e. Johnson & Johnson and Proctor & Gamble).

DEFINITION of ‘Growth Stock’

Shares in a company whose earnings are expected to grow at an above-average rate relative to the market. Growth stocks tend to grow their sales and earnings at a fast rate, but they usually don’t pay a dividend and tend to trade at higher multiples. These stocks also are usually the more popular stocks (i.e. Netflix, Facebook) which can cause them to be overvalued. (Source: www.Investopedia.com)

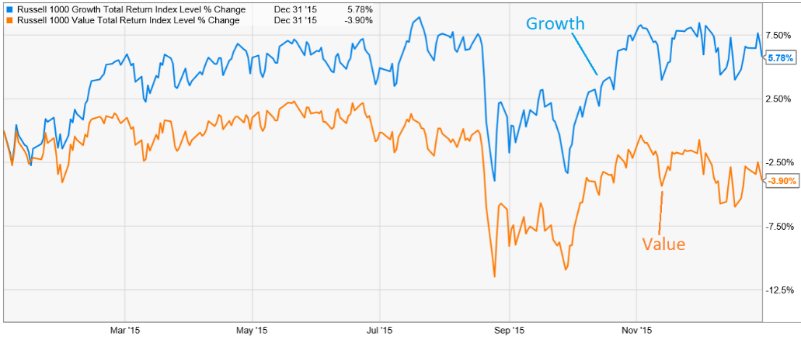

While Allgen builds diversified portfolios which contain both value and growth stocks we favor investing in value stocks because historically they have outperformed growth stocks and usually take less risk. The chart above shows that over the last 20 years value stocks have outperformed growth stocks by a significant amount (71% total or 1.1% compounded annually). Other studies that look at the 40 year period between 1970 to 2010 show that value stocks outperformed by approximately 3% annually. (Source: Ibbotson) However, over the last 5 years, Growth has done better than Value, which has caused some of our portfolios to underperform during that time frame. In 2015 growth stocks outperformed value stocks by 9% (chart on the bottom). Historically, after growth has outperformed value for an extended period of time, the value will outperform growth in the period following. We expect value stocks to fare better than growth stocks in 2016. While we prefer to invest in value stocks for long-term outperformance, they also tend to be less volatile (less risky) which plays into our investment philosophy.

Going Forward

2015 was a rather disappointing year in the market and 2016 has started off rough. But times like these usually lead to opportunities. Warren Buffet once stated: “The stock market is the only place where when things go on sale everyone runs for the exits.” Historically high levels of fear tend to be great times to invest. Our investment philosophy strives to protect our clients’ capital, but also looks for price drops for buying opportunities. If 2016 ends up being a volatile year, it would present opportunities to “buy low.” An area that has become attractive is value stocks which have underperformed over the last few years. We expect this trend to revert to the norm with value stocks outperforming this year. We constantly monitor market factors and adjust accordingly as our proactive money management style seeks to take advantage of pricing anomalies while managing risk and protecting our clients’ hard earned money.

Written by: Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Advisors, Inc.; Paul Roldan, Chief Executive Officer; Christina Shaffer, Operation Specialist

Advisory services are offered through Allgen Financial Advisors, Inc., a registered investment advisor.

Any information provided in the blog has been prepared from sources believed to be reliable, but is not guaranteed by Allgen Financial Advisors, Inc. and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Allgen Financial Advisors, Inc. and its employees may own options, rights, or warrants to purchase any of the securities mentioned in this e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.