Read through this post on how longevity impacts retirement planning and Financial Freedom or skip to the AllGen Academy longevity video below.

Longevity

Another major consideration when planning for Financial Freedom is longevity, the number of years you’re anticipating to live and fund in retirement. Longevity impacts your ability to maintain a desired lifestyle over time without running out of money.

Longevity is reflected on your Trail Map towards the top of the Formation column, labeled ‘Years needed to fund thru age 95’. The number shown here is the difference between your desired retirement age and age 95. If you plan to retire sooner, you will have more years that need to be funded with your accumulated savings. If you retire later, you will have fewer years to fund.

Life Expectancy

A metric often used to determine longevity in financial planning is life expectancy. Within the last century, life expectancy has increased dramatically across the world. As technological breakthroughs continue to advance health care and people live longer, it will become increasingly important to plan and save accordingly so that you don’t outlive your assets.

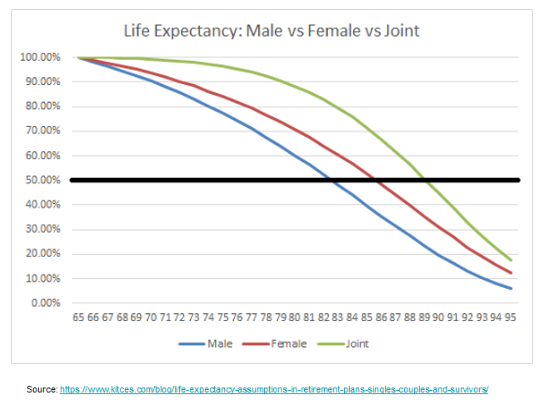

In the chart below, you can see that men live until age 81-82 on average and women live until 85-86 on average. For a married couple, there is a 50% likelihood that one of the spouses will live to age 90. This means that if you plan to reach Financial Freedom by age 60 or 65, you will have to plan for an additional 25 or 30 years of income from your accumulated assets or other sources.

Factors that could impact life expectancy include:

- Gender

- Health

- Lifestyle

- Family history

A key takeaway is that the longer someone expects to live, the more savings he or she will need to accumulate for Financial Freedom.

Longer life expectancy = more savings needed

Strategies to Sustain Lifestyle in Financial Freedom

- Save more. Plan on saving more for retirement.

- Spend conservatively. Don’t overspend when you’re in the Freedom stage so savings don’t deplete too quickly.

- Invest portfolio. This helps keep up with inflation.

- Increase reliable income streams. These may be things like Social Security benefits or pensions.

- Plan ahead for long-term care expenses. As you may recall from the Inflation lesson, healthcare costs are one of the fastest-increasing expense categories. Long-term care expenses in old age can be especially costly when you consider potential needs like in-home nursing services.

- Work a little longer. Stay in the workforce longer while doing something you LOVE. There is a growing trend of people scaling back from a demanding career, but still maintaining some level of earned income in a way that feels productive and enjoyable. Doing so will help you offset some of your living expenses during the first part of Financial Freedom.

Longevity may not be a fun topic to think about, but accounting for today’s longer life spans is critical to the sustainability of your assets and lifestyle in Financial Freedom. Planning accordingly will allow you to enjoy a fulfilling lifestyle without the fear of running out of money.

For more information on how taxes impact how much you’ll need to save for retirement, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.