Read through this post on how longevity impacts retirement planning and Financial Freedom or skip to the AllGen Academy income sources video below.

The four components of Financial Freedom we’ve covered so far—lifestyle, inflation, taxes, and longevity—have the potential to increase the amount needed in retirement and thus the amount you need to save. Income Sources, on the other hand, could reduce the amount of savings needed.

Reliable income streams in retirement add stability and sustainability to your Financial Freedom plan. Having one, two, or multiple streams of income in retirement reduces the amount of money you’ll need to withdraw from accumulated assets to live on. This allows more of your assets to stay invested, continue to grow, and potentially last longer. In general, reliable sources of income in retirement mean you’ll need to accumulate a lesser lump sum than if you weren’t expecting any sources of income.

One thing to keep in mind is that although sources of income may be reliable, they may not adjust for inflation over time. It’s not wise to solely rely on stable income streams as your costs of living may eventually outpace the monthly amounts you receive over the course of 20 or 30 years.

Another potential disadvantage to reliable sources of income is that while they may be ‘guaranteed’ for your lifetime or a certain period of time, you will likely not be able to withdraw a large lump sum of money from the income stream. Most lock you into a consistent schedule of payments without the flexibility of stopping those payments for a lump sum.

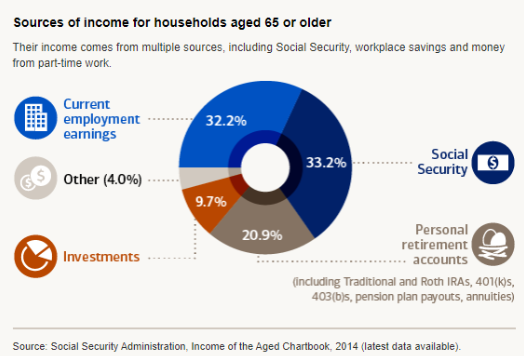

So, what income sources are we talking about? There are multiple types so we’ll cover each one at a time. Here is a chart of the different types of income received by the average 65+-year-old household.

Social Security

Social Security was historically one of the most common forms of reliable income for retirees. It continues to make up roughly one-third of household income on average in retirement. However, the original Social Security system is not set up to sustain the longer life spans of today so we may see some revamping in the future. For now, the qualification for Social Security benefits remains the same. You must work for at least 10 years and pay into the Social Security system as you go (called credits). The monthly benefit you receive in retirement is calculated from an average of your highest earning years. Income that is not reported and/or excluded from Social Security withholdings (such as tips earned in the hospitality industry) may reduce the Social Security benefits you receive in retirement.

Once you approach Financial Freedom, you have the choice of starting Social Security benefits as early as 62 years of age and as late as age 70. Starting earlier or later has its pros and cons. One of the determining factors is how much you’ll receive: the earlier you start, the lower the monthly benefit you will get, and vice versa. If you are still working, claiming Social Security early may also subject part of your benefits to taxes.

Pensions

Pensions are another type of reliable income stream although they are becoming less and less common. Large companies may offer pension programs to employees as deferred compensation. You pay a portion of your paycheck into a pool of funds to accrue a retirement benefit over time. Upon retiring or leaving your employer, you may choose to take your pension as a lump sum distribution to be invested in an individual retirement account (IRA) or choose an income stream for the rest of your life.

The income stream option is called annuitization which guarantees a monthly benefit to you based on your projected life expectancy. You could also opt for a lower monthly benefit in order to have it last until the death of your spouse in the event you pass away first. This is called the survivorship benefit. Lastly, pensions may offer a cost of living adjustment (COLA) that increases the monthly benefit by a certain percentage each year in an effort to keep pace with inflation.

Annuities

Annuities function similarly to pensions but instead of being offered by your employer, annuities are contracts purchased from insurance companies that guarantee a certain level of income either now or in the future. You pay into the contract periodically or with a lump sum. When you are ready to start the income stream, the amount you paid in will convert into a stable income stream for a set period of time or the rest of your life. Like a pension, this is called annuitization.

Since you are transferring the risk of investing to the insurance company, they will charge different types of fees to guarantee that income stream. It’s important to understand the fee structure and all the pros and cons before purchasing annuity contracts.

Earned Income

The last income stream is the income you earn in retirement such as through part-time work, self-employment, consulting, or freelancing. You may get paid to do something you love as opposed to working full-time to accumulate assets. Surprisingly, recent trends have shown more and more retirees choosing to continue earning some level of income as they enjoy Financial Freedom. Earning income in retirement could be a viable option for entering into that phase sooner or with less accumulated assets.

In summary, income sources are a key component of Financial Freedom. Having multiple sources of income provides greater stability in your Financial Freedom plan and less of a drain on your investments, making your plan more sustainable over time.

For more information on how taxes impact how much you’ll need to save for retirement, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.