Read through this post on cash, cash equivalents, & alternatives or skip to the AllGen Academy cash equivalents video below.

A third major asset class is Cash and Cash Equivalents, which consists of:

- Checking and savings accounts

- Money markets

- Bank reserves

- Super short-term fixed-income investments

This category of investments is considered to be the safest out of the three main asset classes as there is little to no fluctuation in value over time. They are also the lowest-yielding investments.

Cash Equivalents

Cash equivalents are useful for liquidity needs such as emergency reserves or a large purchase in the near future. However, they won’t offer the growth potential and compound interest necessary for most people to reach Financial Freedom.

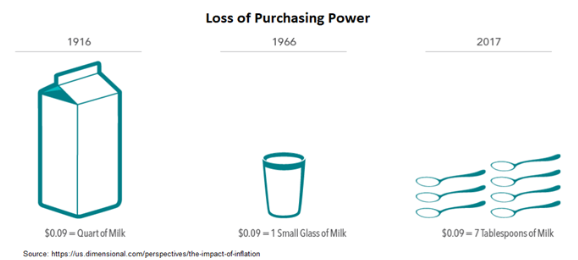

The main downside to keeping your savings in cash (or cash equivalent accounts) is the risk of inflation which is the loss of purchasing power over time. As we covered in the Inflation lesson, the prices of goods and services usually increase throughout the years. This means the same amount of money can buy a lesser amount of goods or services in the future.

If your money is kept in a cash equivalent account for a long period of time, it will likely result in a negative real rate of return. For example, if the inflation rate is 3% but your cash is only earning 1% interest, your real return is -2%.

Alternative Investments

In addition to the three main asset classes, alternative investments can play a role in further diversifying your portfolio. Historically, these alternative investments are held by professional traders but they are becoming more available to the average investor.

Here are the major types of alternative investments:

- Real Estate – the most common form of real estate investment is Real Estate Investment Trusts (REITs). These are investments that hold various types of real estate (commercial, industrial, residential, etc.) that can be publicly traded on stock exchanges. Investors benefit from price appreciation of the underlying real estate assets as well as rental income streams.

- Commodities – investments in raw materials or agricultural products.

- Currency – foreign currencies are traded on the Foreign Exchange Market (FOREX). The values of different currencies are influenced by:

- Interest rates

- Financial stability of the country

- Amount of that currency in circulation

A currency is weaker when that country’s interest rates are decreasing and its central bank is printing a lot of money (called quantitative easing). The reverse is also true: the currency is stronger when that country’s interest rates are going up and there is less money in circulation.

Conclusion

Cash and cash alternatives tend to be more stable than either stocks or bonds, which means that their prices don’t tend to change much over time. This also means that there isn’t necessarily a lot of opportunity for high rewards, but they can be a safe investment if your financial advisor believes they’re right for you and diversifying your portfolio. Contact us to get started with an investment manager today.

For more information on cash, cash equivalents, & alternatives, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.