Read through this post on bonds or skip to the AllGen Academy bonds video below.

Another common asset class in investing is called Bonds, fixed-income instruments where an investor lends money to a borrower in exchange for a stream of interest payments over a defined period of time. A bond is essentially an IOU issued by governments, corporations, and municipalities, among other entities.

As a bond investor, you are entitled to receive your original investment back as well as interest payments charged on that initial amount. The pre-determined date that you can expect to receive both principal and interest in full is called maturity.

Components of Bonds

There are two main components of bonds:

- Fixed Interest Rate – the rate that the borrower pays, usually on a semi-annual basis

- Price – the price that a bond is currently trading at on the open market (where bonds are bought and sold). The bond price is influenced by current interest rates and the creditworthiness of the borrower.

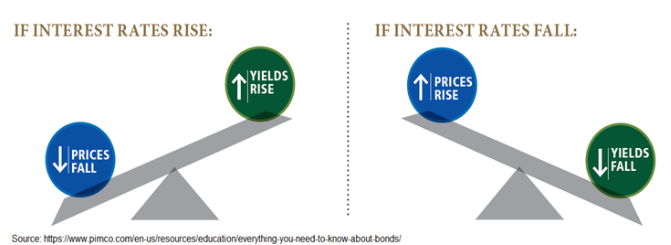

An important dynamic to understand is that bond prices are inversely related to interest rates. When interest rates go up, bond prices decrease and vice versa.

As bond prices fall, the yield (return) on that bond increases because now it can be purchased at a discount below the original face value (also called the par value). On the flip side, when bond prices rise, the yield or return on that bond is reduced because the bond is being sold at a premium (above par value).

Types of Bonds

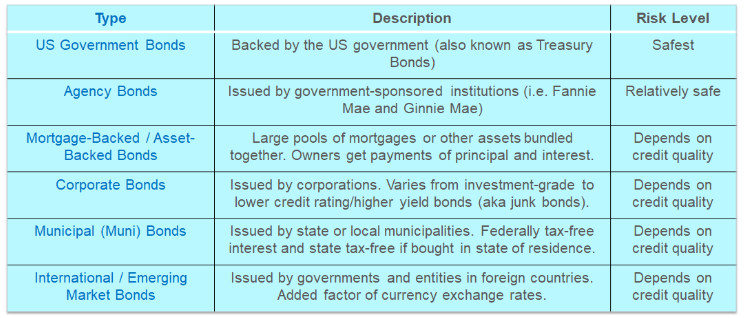

There are various types of bonds issued by different types of entities. Each comes with its own level of risk depending on how stable and/or creditworthy the borrower is.

Duration of Bonds

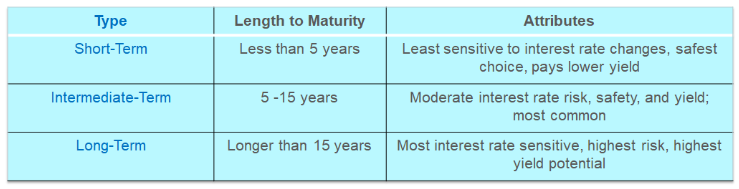

Another characteristic of bonds is the duration or length of time to maturity which influences how volatile the bond price is. In general, short-term bonds (less than 5 years to maturity) are less sensitive to changes in interest rates. They’re considered safer while typically paying lower yields. Long-term bonds (more than 15 years to maturity) are the most sensitive to interest rate changes. With the higher risk comes the potential for higher yield.

Conclusion

Bonds play a major role in investment diversification because the bond market is typically the inverse of the stock market. This means that when the stock market is down, the bond market is up. Bonds mature over time and the longer a bond takes to mature, the higher the risk (and the higher the potential reward!). Contact us today to get started with an investment manager.

For more information on bonds, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.