With the recent announcement of one of the most popular budgeting apps, Mint, closing and redirecting users to Credit Karma in March 2024, many are wondering which app to use instead. The short answer is that it depends on your specific needs and what you are looking for. We are fans of using apps to help budget and track your net worth, stay organized, learn how to be financially responsible, and even potentially improve your long-term financial health. Below we will walk through the pros and cons of some of the most popular alternatives to mint. That said, there are limitations to spending tracker apps. When you have a more complex financial picture (like complex tax and estate needs) and are looking for more customized guidance, consider working with a financial advisor.

What Is Happening With Intuit’s Mint Software?

If you used Mint, you will have to take action by the time Mint closes on March 23, 2024. While Intuit intends for the transition to be seamless, it isn’t automatic. The Mint app will let you know when it’s ready for you to start moving your account data over to Credit Karma if that’s the app you choose. Once you’ve transferred your data, however, you will no longer be able to access Mint except for downloading transactions.

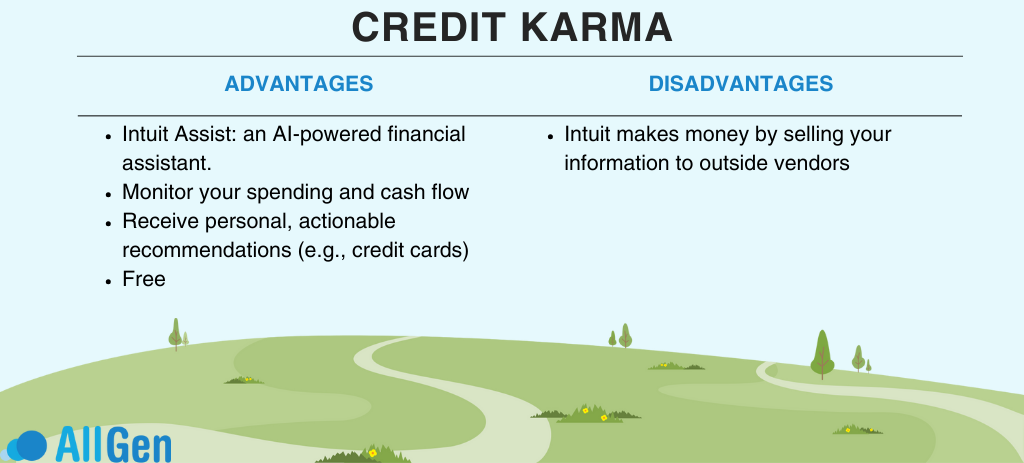

Advantages of Credit Karma

Credit Karma won’t be exactly the same as Mint, but will maintain some of the most popular features from Mint while offering new ones. You can still monitor your spending and cash flow with Credit Karma and the app will use your data to provide personal, actionable recommendations, such as which credit card to use based on the rewards or what to do if you have an account that is low on cash. Intuit has also launched Intuit Assist, which is an AI-powered financial assistant that can help Credit Karma users with financial questions and decisions.

How Does Credit Karma Make Money?

While the Credit Karma app is free and is also owned by Intuit (the same company as Mint), there are some drawbacks. Both Mint and Credit Karma are free apps, but they have to make money somehow. They do this by selling your information to outside vendors, which means that by signing up for either, you’ll most likely receive a lot of credit card offers as well as other marketing and promotions.

For this reason, you may want to consider other budgeting and net worth tracking apps.

Top 4 Budget Tracker Apps To Consider

If you don’t want your data sold to the highest bidder, there are other options available to you. The following apps are good options to consider that won’t result in unwanted ads and credit card offers. Each app has its own pros and cons, however, so it’s important to do thorough research before deciding which money management app is right for you.

Best Free Budgeting Apps

If an expense tracker and budget tracker app isn’t currently in your budget, here are some free options. Keep in mind that free versions or free apps may not have all of the features of a paid one, however.

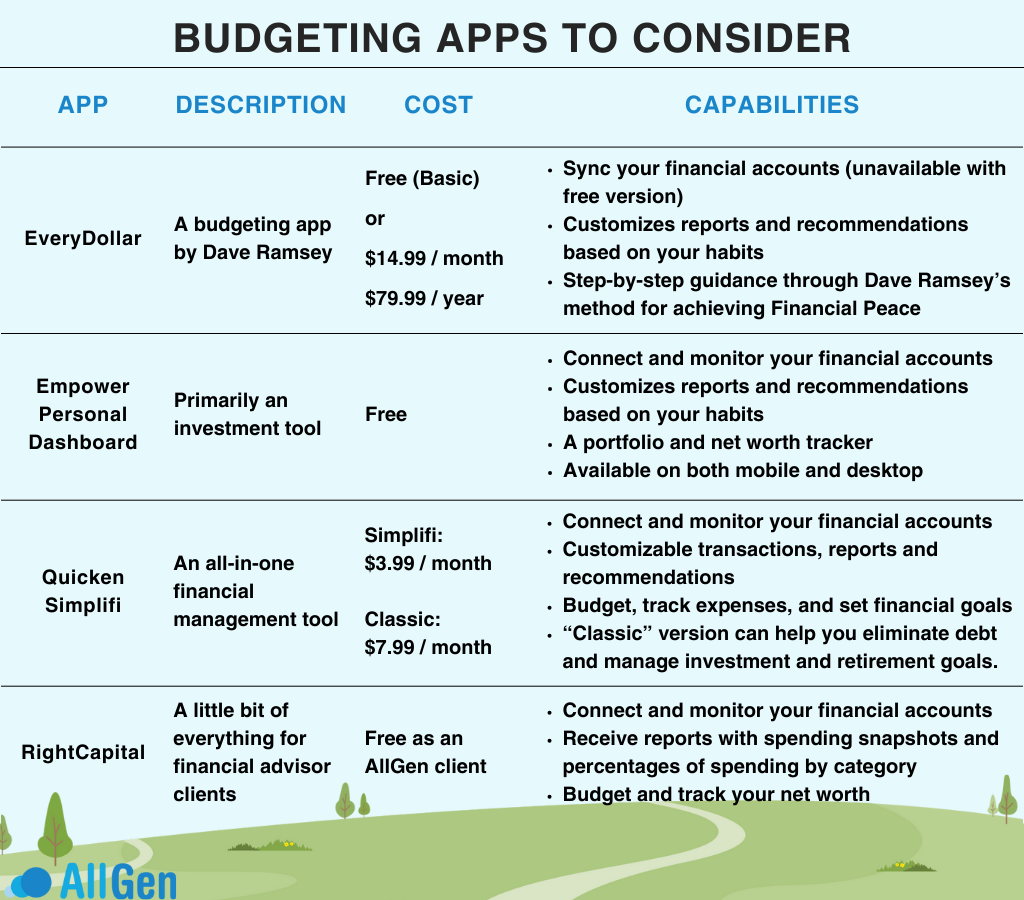

EveryDollar

EveryDollar is a budgeting app created by Dave Ramsey’s organization that offers a simple, zero-based budgeting framework.

Cost: Free Basic Version, $14.99/month or $79.99/year Premium Version (Free Trial: 14 days)

Free Version: With the free version, you have access to some limited features. Account syncing is unavailable with this version, meaning that you’ll have to manually enter incoming and outgoing money as well as manually categorize line items in your budget and set reminders for bill payments. The lack of syncing is a pretty large con of the free version of EveryDollar.

Premium Version: The Premium version guides you step by step through Dave Ramsey’s method for achieving Financial Peace. All features from the free version are included, but you can sync your savings and investing accounts so that these features are automated. The app can provide custom reports and recommendations based on your habits over time.

Our Takeaway: The free version is rather bare-bones (without any syncing capabilities) and the premium version costs more than other, similar apps. We do like that the paid version guides you through Dave Ramsey’s method, which generally aligns with our financial planning, but it lacks the personal touch and more tailored advice that you get with a real financial planner.

Empower Personal Dashboard

Empower Personal Dashboard, which used to be called Personal Capital, is primarily an investment tool but can also be helpful for those looking to budget and track their spending.

Cost: Free

You can use this free app to connect and monitor different financial accounts, including checking and savings, credit cards, retirement plans, mortgages, and loans. The app allows you to customize categories that it will then use to provide you with a spending snapshot of recent transactions as well as the percentage of your spending that each category makes up. On top of that, it’s a portfolio and net worth tracker that is available on both mobile and desktop.

Our Takeaway: We like that Empower allows you to sync and track your accounts for free. That said, Empower Personal Dashboard is owned and operated by Great-West LifeCo, which is an insurance company. While they’re not selling your data to third-party companies, they may start marketing their own financial products to you. Additionally, this is still primarily an investment tool, so if your goal is saving and planning out your spending, another app may be better suited to your needs.

Quicken Simplifi

Quicken Simplifi is an all-in-one financial management tool that helps you with everything from budgeting and meeting financial goals to saving for retirement.

Cost: $3.99 per month for Simplifi, $7.99 per month for Classic

The Quicken Simplifi app is an easy-to-use mobile app that offers features such as savings goals, automation, progress reports, customizable transactions, and more. You can also upgrade to Quicken Classic, the desktop version of the software that offers additional features that can help you eliminate debt and manage investment and retirement goals.

Our Takeaway: We like Quicken Simplifi because it offers many of the same features as other apps but for a much lower overall price. It’s easy to use and can help you to be more effective in your budgeting and financial planning. Plus, there are different versions to suit different needs, whether you’re looking to budget better, save for retirement, or manage your business.

RightCapital

RightCapital does a little bit of everything. You can budget, track your net worth, run Monte Carlo projections, store data and documents in an Online Vault, and much more. Plus, your information isn’t sold to other companies.

Cost: Varies – typically offered to clients of financial planners as a benefit for the fee you pay.

With RightCapital, you can connect a wide variety of different financial accounts, from checking and savings to credit card accounts, IRAs, 401(k) accounts, mortgages, and loans, as well as monitor those accounts from the app. You can also customize how the app presents its reports, which include a spending snapshot and percentages of spending by category. Plus, you can track your net worth and investment portfolios. The app is accessible both on desktop computers and mobile devices. Keep in mind that you can only get access to RightCapital through working with a financial planner, but it has become an industry standard for planners to offer this or other robust wealth apps to their clients for free.

Our Takeaway: RightCapital is available only through a professional Financial Planner like AllGen Financial Advisors, so you may have to pay for financial planning services. For example, if you sign up with AllGen, your financial planner provides you with the RightCapital software at no additional cost to you.

Why You Should Consider a Financial Planner Instead of an Expense Tracker App

Apps and software can be incredibly useful tools. They can help you stick to a financial plan and see the effects of that plan over the long term. However, working with a real financial planner to create the financial plan in the first place can lead you to reach new heights an app may not be able to tell you. Contact us today to set up an appointment with one of our financial advisors.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.