Read through the blog here, or skip to our Q2 2025 Market Update Video below

Key Takeaways:

- Volatility is back, but it’s not unusual. Markets saw a sharp pullback, but history shows that large drops are common and often followed by strong rebounds.

- High volatility and low consumer sentiment can present good buying opportunities. Measures like the VIX and consumer confidence suggest fear is high – often a sign the market may be near a turning point.

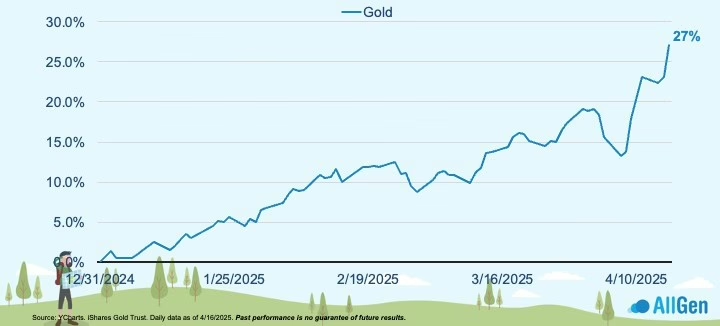

- International stocks and gold are leading in 2025. International equities are outperforming U.S. stocks, and gold is up over 25%, helped by a weaker dollar and strong demand.

- Planning matters more than predictions. The market will continue to shift, but having a risk-managed, diversified portfolio built around your goals is what really drives long-term success.

Returns for 2025

U.S. equities, such as the S&P 500 and small-cap stocks, are facing a challenging 2025 with declines of -9.3% and -17.4% respectively. Meanwhile, there are other assets showing more resilience – international stocks are up 4.6%, bonds are up 2.2%, and gold is up 27.1%, reinforcing the benefits of a diversified portfolio that is stronger in the face of volatility.

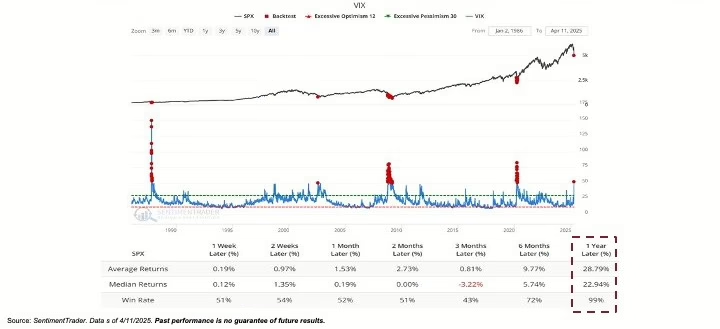

When the VIX spikes above 50, it usually translates to positive one-year returns.

It’s not all bad in the stock market though as pullbacks can improve valuations and present good buying opportunities. A commonly used volatility indicator is the VIX or “fear index” for the stock market. When we look at the VIX during extreme times, like these, we find that 99% of the time the S&P 500 is up an average of 29% one year later (data from 1986 to 2025). This may create good buying opportunities for investors that have excess cash and can stomach further near-term volatility.

Low consumer confidence often translates to buying opportunities for long-term investors.

While volatility is high in the stock market, consumer confidence is low – especially as many have likely seen their 401ks drop. When consumer sentiment is low, the market is often close to a bottom, setting the stage for a potential recovery. Using S&P 500 return data from 1952 to 2025, one year and three years later the S&P 500 is up 92% and 100% of the time respectively. As long-term investors, we see this as another reason to consider investing any excess cash.

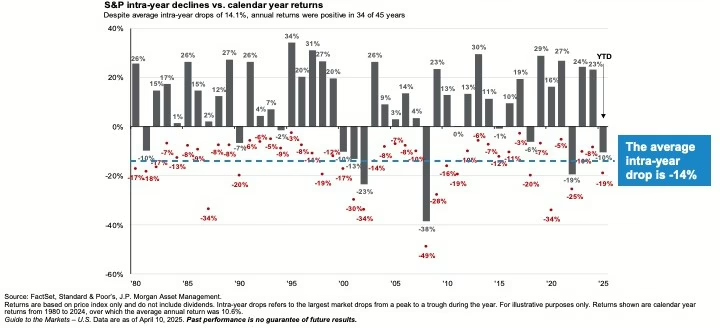

Intra-year declines are common.

Irrelevant of current volatility levels, weak consumer sentiment, and whether you have excess cash to invest while the market is down, it’s important to remember that drops in the stock market aren’t unusual. Historically, the market sees an average intra-year decline of around 14%, and some years have been much worse. In 1987, for example, the S&P 500 dropped 34% but still ended the year positive. In fact, in 34 out of the past 45 years, the market finished the year up despite a significant drop along the way. It’s important to note that just because we’ve had a big decline doesn’t mean the markets are going to decline forever.

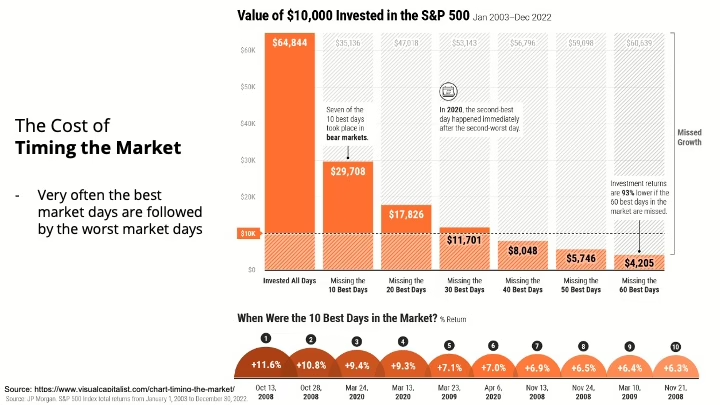

The Cost of Timing the Market

We’ve all heard the advice to “buy low and sell high,” but when fear takes over, people tend to do the opposite—selling low and waiting to re-enter when things feel “safe.” The problem? By the time it feels safe, the market has often already rebounded. Missing the market’s best days can seriously hurt long-term returns. A $10,000 investment in the S&P 500 from 2003–2022 grew to nearly $65,000 if you stayed fully invested, yet dropped to just $29,000 if you missed the 10 best days. And 7 of those best days happened during major downturns, not after them.

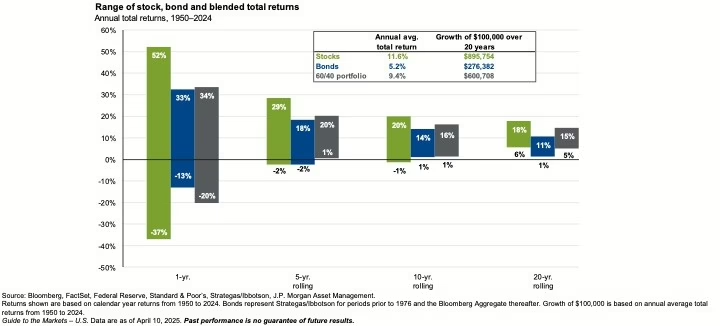

A balanced portfolio has never been down on a 5-year rolling basis.

Here’s something that might surprise you: going all the way back to 1950, there’s never been a five-year period where a balanced portfolio (one that mixes stocks and bonds) was negative. In fact, the worst 5-year rolling period for a 60/40 stock/bond portfolio was 1%. This serves, again, as a good reminder of why we hold both stocks and bonds in all our portfolios.

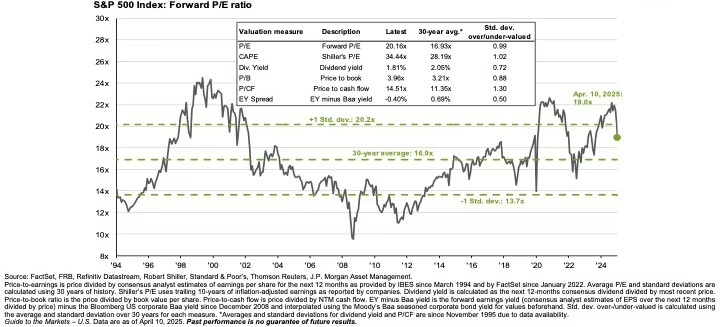

Valuations are becoming more attractive.

Valuations for U.S. stocks are becoming more attractive, especially in comparison to the highs of the past couple years. Although stocks are not yet “cheap,” the recent market pullback has led to more reasonable prices, creating potential opportunities for long-term investors. This is particularly true for value-oriented stocks, which offer attractive growth potential at lower multiples. As valuations normalize, we see this as an opportunity to position portfolios for future gains.

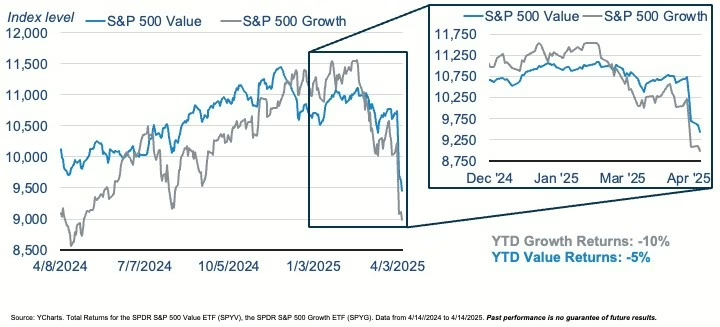

Value is outperforming growth year-to-date.

So far in 2025, value stocks have held up better than growth. Growth is down roughly 10%, while value is only down about 5%.That’s a big change from the last few years when growth stocks—especially big tech—were leading the way. But after such a strong run, growth stocks were priced pretty high. When markets pulled back, growth stocks had more room to drop from these stretched valuations. We’ve been talking about this for a while and positioning portfolios accordingly.

Defensive stocks are leading the pack year-to-date.

When you break it down by sector, it’s the defensive areas like consumer staples, healthcare, and utilities that are actually up this year. These are the kinds of companies people rely on no matter what’s happening in the economy. Think groceries, hygiene products, everyday stuff. Meanwhile, tech and consumer discretionary have taken the biggest hits. That’s where we’ve seen the most pain, especially in names like Amazon and Tesla. So it’s not always the flashy stocks that lead, which is why we like having those defensive pieces in the mix.

The Mag 7 have plummeted.

To elaborate further, the “Magnificent 7” tech giants (including Apple, Amazon, Google, etc.) have dropped significantly in 2025, dragging down the broader market. These companies have had an outsized impact on the S&P 500’s performance in recent years, and their underperformance has been a key factor in this year’s market decline. Their losses highlight the risks of concentrated exposure to a few stocks as well as the higher exposure to international trade within the tech sector in times when tariffs are increasing. We remain cautious about tech-heavy portfolios and encourage diversification to minimize such risks.

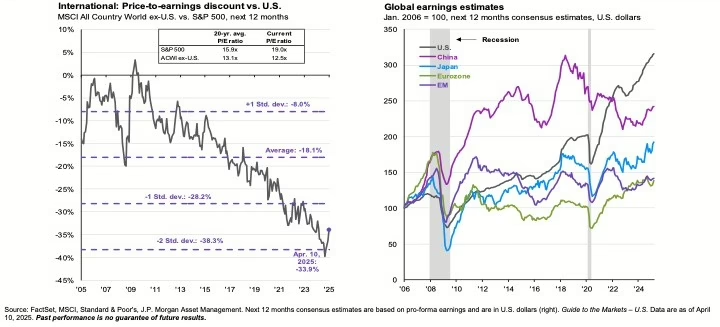

International is still cheap.

Even with the headwinds, international markets, especially emerging ones, are trading at some of the biggest discounts we’ve seen compared to U.S. stocks. Valuations are historically low, which creates potential for long-term upside. We’ve been saying this for a while now, and we still believe international exposure has a place in a well-balanced portfolio. The key is staying diversified while keeping an eye on where value is showing up.

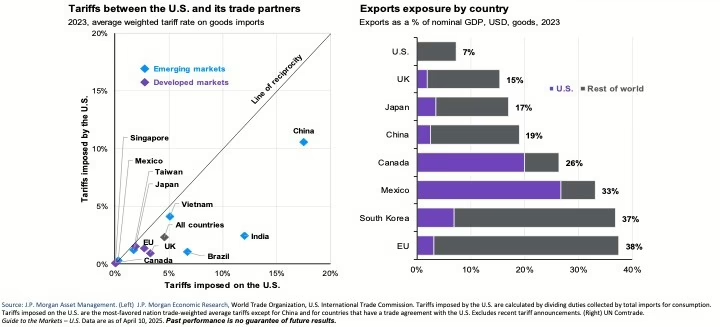

Tariffs

There’s been a lot of talk about tariffs lately, and for good reason. Tariffs do generally make the pie smaller for everyone, decreasing GDP. Tariffs were also the straw that broke the camel’s back for a stock market that was vulnerable to a pullback with all-time high valuations and prices. That said, many countries charge higher tariffs on US goods than the US does on foreign goods, meaning that there is some legitimacy to renegotiating trade agreements with other countries. The devil is in the details and this is a very nuanced topic though – before tariffs were put in place/increased, some countries were already close to what would be considered equilibrium tariffs represented by the line of reciprocity in the chart above, and yet, some much further from equilibrium. It’s important to realize the truth is often somewhere in the middle and no matter whether you agree or disagree with the new tariffs, do not sell out of the market if you are a long-term investor. Stay the course and focus on what you can control, which is staying invested and your financial plan (savings, spending, etc).

International stocks are performing better than domestic stocks.

Despite the headlines, international markets have actually been one of the bright spots this year. Developed international stocks are up over 6%, while the S&P 500 is down about 10%. That’s a big gap. Part of that is due to a weaker dollar, and part of it comes back to valuations; international stocks are still trading at a big discount compared to the U.S. We’ve had exposure to international stocks for some time now, and this year it’s really started to pay off. It’s a good example of how spreading your investments globally can create opportunities and help smooth out the bumps.

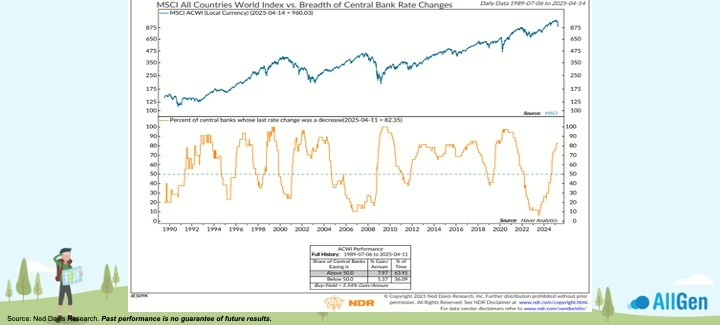

Most of the central banks are easing.

Adding to the positive backdrop for international markets, most global central banks are now easing. Over 80% of them are cutting rates to help stimulate growth. That kind of environment tends to be supportive for stocks and bonds alike. When central banks are in stimulus mode, markets generally have a tailwind behind them. We’re keeping an eye on where that support is strongest and looking for opportunities in those areas as part of our broader strategy.

The dollar has dropped as more rate cuts are priced in.

With markets now expecting multiple rate cuts from the Fed, the dollar has started to weaken. From a technical perspective, it even broke through some key support levels we’ve been watching. That’s not all bad. A weaker dollar can be a tailwind for U.S. exports and gives a boost to international investments when those gains are converted back into dollars. For clients with global exposure, this is something that could add value over time.

Gold is up 27% with the drop in the dollar.

Gold has been on a tear, up 27% this year after gaining 28% last year. That’s a big move, and a lot of it ties back to the drop in the dollar and ongoing concerns about inflation. We’ve had a solid position in gold for a while now, and it’s doing what we hoped it would, which is providing stability during uncertainty. If the dollar keeps trending lower or volatility picks up again, gold could keep playing an important role in the portfolio.

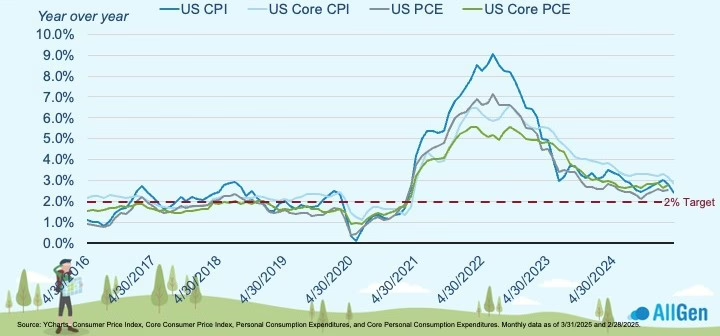

Inflation declining, remains above the 2% target.

Inflation has cooled off from the highs we saw in 2022, but it’s still sitting above the Fed’s 2% target. We’ve seen some encouraging signs in the latest readings, with both headline and core inflation starting to tick down again. That’s something we’re watching closely. If inflation keeps dropping, it could give the Fed more room to cut rates. But until we’re solidly below that 2% line, they’re likely to remain cautious. For now, it’s a good reminder of why having assets that protect against inflation in your portfolio can help.

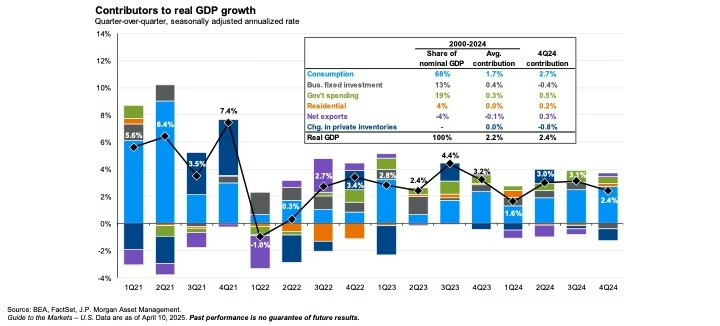

Consumer spending makes up 68% of GDP.

One thing that hasn’t changed? The U.S. economy still runs on consumer spending. It makes up about 68% of GDP, so keeping an eye on the consumer is a big part of understanding what’s next. Even with inflation and higher rates, spending has stayed relatively steady. There are some signs of strain, like rising delinquencies and dwindling savings, but for now, the consumer is holding up. As that picture shifts, we’ll continue watching how it affects broader growth.

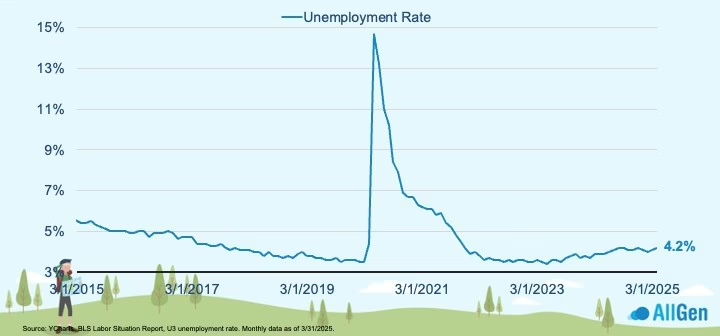

Unemployment is still low.

Despite all the market noise, the job market has stayed relatively strong. Unemployment is sitting around 4.2%, which most economists still consider full employment. It’s leveled off in recent months, but we’re not seeing big spikes. As long as people are working, that tends to support consumer spending, even if the spending isn’t as large as it was a few years back. We’re keeping an eye on it because a weaker job market is a sign of a weaker economy.

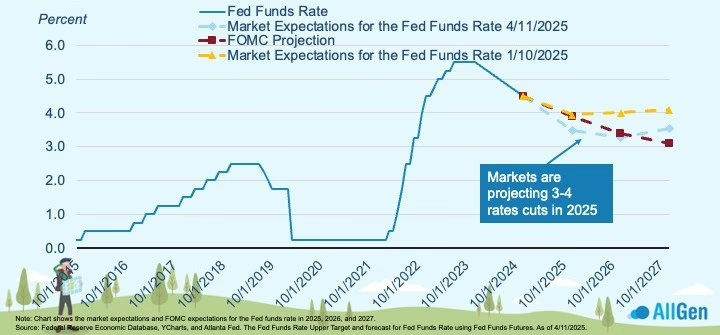

Markets are pricing in 3-4 rate cuts this year.

The market is currently expecting about three to four rate cuts this year. That’s a shift from earlier in the year when expectations were lower, but after recent volatility and signs of slowing, the outlook changed. Lower rates tend to be good for both stocks and bonds, which is why we’re watching this closely. We’ve already adjusted some of our fixed-income positioning to take advantage of this environment.

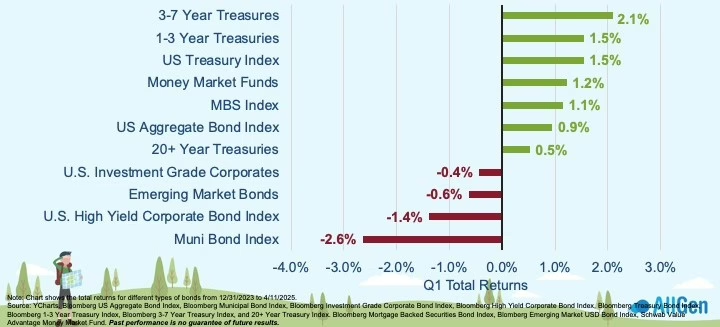

Most bonds are up year-to-date.

Most bonds are off to a good start this year, especially the higher-quality ones like U.S. Treasuries and mortgage-backed securities. That’s a direct result of shifting rate expectations and more investors looking for stability. We’ve leaned into that by increasing our exposure to longer-term and safer bonds. It’s been a good move so far and has helped smooth out some of the recent market noise.

Expect continued volatility and stay invested.

We’ve seen a sharp drop recently, but that’s part of investing. The average year sees a pullback around 14%, but 76% of the time the market still ends the year positive.

It’s easy to get caught up in the headlines, but history shows that staying invested through volatility matters more than trying to time the ups and downs. We’ve built portfolios to handle those swings and will keep adjusting as needed to stay on track.

Staying Focused Through the Noise

We’ve had a lot thrown at us this year: market drops, interest rate swings, and plenty of headlines. But underneath it all, there are still solid opportunities across global markets, especially in areas like high-quality bonds, gold, and international stocks.

Yes, volatility is likely to stick around. But that’s part of the journey. The key is having a plan built to weather the ups and downs, not one that reacts to every bump in the road.

Contact Your Financial Advisor

A well-diversified, disciplined strategy that manages risk first is what we strive to build for our clients. Contact your advisor to learn more about how AllGen can help manage risk in your portfolio!

For more information, watch the full April 2025 Market Update video below.