By The AllGen Team

As you get ready to cast your vote, it’s important to remember that inflation and economic trends have a more direct impact on market returns than election results. Most people don’t realize how the presidential election impacts the economy—and more specifically, how the presidential election impacts investments.

For investors, this means that while it’s true that election results often affect policies and regulations, your smartest move is often sticking with a solid plan built by a professional financial advisor.

We wrote this article to share our insight into the specifics of the impact of presidential results on the economy. We want you to have an informed understanding of how to strategize your investments during this election cycle.

How Much Control Does the President Actually Have Over the Economy?

To start, let’s review the President’s authority and limitations when it comes to the economy. Depending on the state of the economy during a president’s tenure in office, presidents are typically praised or criticized as failures. However, the economy is a multifaceted, intricate system, and the President has more influence over certain areas than others.

Although the economy and the stock market are not the same thing, there are some aspects of the economy that the markets can represent. The President doesn’t actually have as much power over the stock market as many people believe, despite the fact that presidential decisions can have an immediate impact on investor confidence and market performance (especially when it comes to specific stocks and industries).

For example, history tells us that stock market trends at the beginning or end of a president’s tenure aren’t necessarily reflective of their decisions. Typically, the trends are more related to the cyclical nature of market volatility that occurs naturally, or changes in socio-political situations, interest rate adjustments, or to any number of other variables that affect market performance.

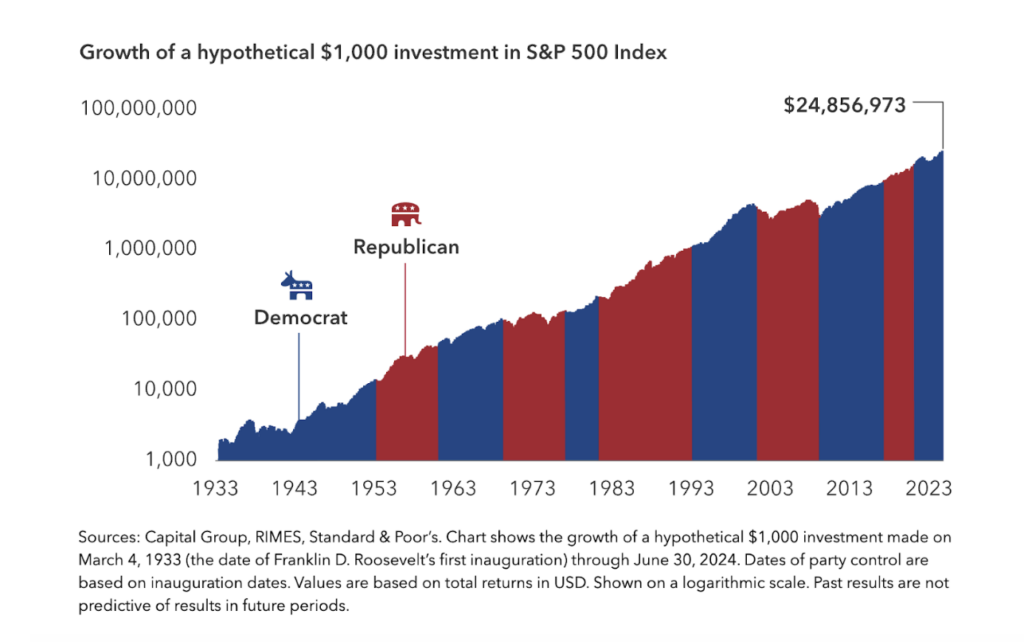

For example, take this hypothetical growth of $1,000 invested in the S&P 500 since March 1933 until June 30, 2023:

Put simply, political parties don’t directly drive stock market trends, and the President most likely shouldn’t get much credit or blame for stock market performance during their term.

However, the President does influence proposing fiscal policy (i.e., tax law) and regulatory policy, choosing Federal Reserve governors, and responding to shocks and crises. These are all decisions you don’t have any control over.

But you do have control over some very important aspects of your financial situation—things that are more significant than election results.

Focus on What You Can Control

All elections are significant, but in terms of your finances, they’re actually a “non-event” if you have a sound financial plan in place. With everything going on in the world, these are the things you can (and should) focus on:

Your outlook: The markets are dynamic and ever-evolving. If you check the performance of your portfolio every time there is a change in the markets, your stress level can take control of your common sense. Instead, focus on your long-term perspective and stay disciplined.

Your goals: You set your goals for a reason. Remind yourself of your priorities and the “why” behind each one. If you haven’t experienced moments like this before, don’t let the election noise stop you from pursuing your goals.

Your decisions: One of the most important rules in investing is to avoid making financial decisions based on emotions. Rather than panicking, follow the guidance of your financial advisor. You may encounter many financial bumps along the way as you pursue your life goals, and your advisor has the knowledge and experience to walk you through each one.

Watch our full take on the election’s impact on the market below.

Partner With a Professional

How are things going for you during this election cycle? Are you feeling unsure about how the presidential election impacts your investments? Or are you feeling confident because you’ve taken the time to create a solid financial plan?

If you don’t yet have a personalized financial strategy or are unsure if your current plan can weather the election, we’re here to help. Our team at AllGen Financial Advisors takes a client-centric approach to offering its services. We believe that outsourced investment management doesn’t align with our clients’ interests.

To schedule a complimentary meeting, call (407) 210-3888 or email roldan@allgenfinancial.com.

About AllGen

Based in Orlando, Florida, AllGen Financial Advisors, Inc. is an independent, fee-based Registered Investment Advisor (RIA) firm dedicated to helping individuals and businesses maximize their financial resources. The AllGen team comprises trusted advisors, each with specialized skills, providing comprehensive guidance and tools to clients at any stage of life or socio-economic position to experience and maintain financial freedom. AllGen offers highly tailored financial planning and investment management, helping clients understand their current financial situation and define their future goals. The team develops and executes customized plans to pursue these goals, managing and tracking investments and financial progress along the way. Known for being relatable and approachable, AllGen’s advisors leverage their vast experiences, education, and interests to make complex financial concepts understandable and personal. At AllGen, clients are treated as individuals, not just numbers.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.