Read through our market commentary here, or skip to Jason’s March 2023 Market Update video below.

The History that Led to Bank Failures in 2023

To properly understand the recent events in the banking sector, specifically the failure of Silicon Valley Bank (SVB), a quick history lesson is in order.

The COVID-19 Stimulus Reduced Interest Rates in 2020

During the fallout of the Covid-19 shutdowns and economic recession back in 2020, world banks responded by enacting numerous credit facilities, governments passed multiple rounds of stimulus, and central banks around the world dropped interest rates to near zero. Lasting through 2021, bank deposits grew at an unprecedented rate with the influx of liquidity (Cash) into the market, causing investment in venture capital to reach record highs. SVB, predominantly known as Silicon Valley’s tech start-up lender, saw their deposits nearly double.

The Federal Reserve Increased Interest Rates to Combat Inflation in 2022

In 2022, the Federal Reserve began hiking interest rates at a record pace to desperately combat inflation. We’ve mentioned in our January 2023 Market Update that growth companies typically get hurt the most when interest rates go up. The increase in borrowing costs caused the riskiest assets, like venture capital, to experience massive outflows and repricing over 2022 given the decline in liquidity. It also led to a significant decline in cryptocurrencies, brought to light corruption within the cryptocurrency industry, and resulted in solvency issues for FTX. In November of 2022, FTX filed for bankruptcy.

Silvergate and Silicon Valley Bank Shut Down in 2023

On March 8, 2023, Silvergate, a cryptocurrency services firm, voluntarily shut down amid solvency concerns and an investigation by the Justice Department. Two days later, Silicon Valley Bank was seized and shut down by the FDIC. Several stablecoins, which are cryptocurrencies that peg their value to the US dollar, broke their pegs. This means that they went below their typical constant value of $1.

Bank Failures Caused by Lack of Diversification and Poor Risk Management

The common theme among these recent banking failures is that their client deposits (checking/savings accounts) were not diversified, leaving clients with potentially uninsured deposits. Likewise, the banks had poor risk management. Facing higher-than-average withdrawals from clients, these banks were forced to sell securities, like long-term Treasuries and mortgage-backed bonds, at substantial losses to attempt to cover the requests for funds. As more customers demanded withdrawals, it became clear that Silvergate, SVB, and Signature Bank weren’t going to be able to cover client demands, prompting shutdowns and the involvement of the FDIC.

The FDIC, Fed, and Treasury Agree to Back Bank Deposits

The FDIC, Federal Reserve, and Treasury issued a joint statement that they would back bank deposits in efforts to curb systemic risks. The FDIC protects $250,000 per depositor, per insured bank, for each account ownership category. Since the start of the FDIC on January 1, 1934, no depositor has lost a penny of insured funds as a result of a bank failure. The SIPC is the equivalent of the FDIC for member broker-dealers. It protects against the loss of cash and securities – such as stocks and bonds – held by a customer at a financially-troubled SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash. Most customers of failed brokerage firms are protected when assets are missing from customer accounts.

Charles Schwab Not at Risk from Bank Failures

The Founder and CEO of Charles Schwab released a joint statement below assuring clients they have no direct business relationship with Silicon Valley Bank or Signature Bank, reducing their credit risk from either. They also mentioned that over 80% of client-held cash at Schwab Bank is insured dollar-for-dollar, with the remaining amount covered by their credit line from the Federal Home Loan Bank. More information on that can be read here: Perspective on recent industry events | About Schwab.

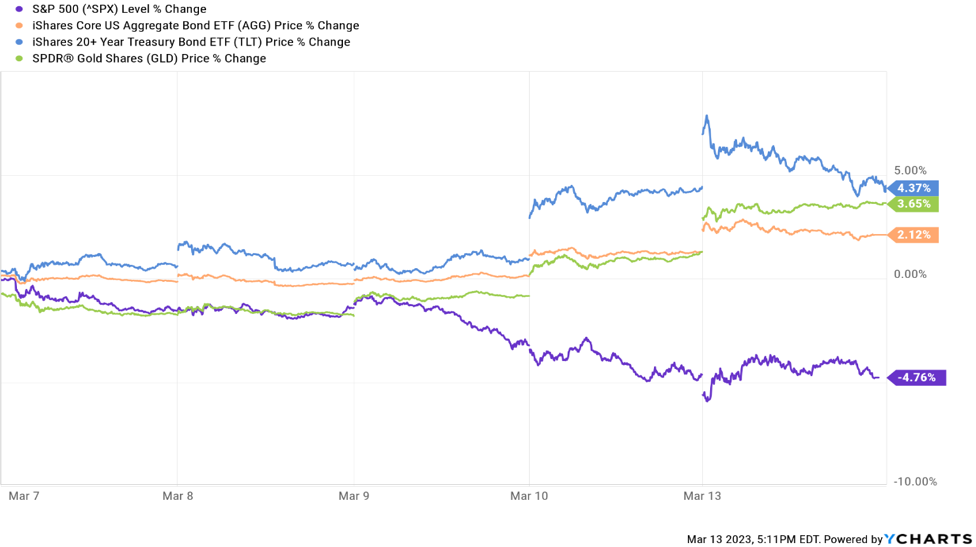

Diversification Helps Protect Portfolios from Stock Market Declines

Although stocks have taken significant hits with financials leading the downward charge, the song of diversification rings loud! While the S&P 500 declined -4.76% between March 7 and March 13, Bonds have seen gains over the same time period, with long-term Treasuries up 4.37%. Maintaining diversification by spreading investment risk across many different asset classes has its advantages during uncertainty.

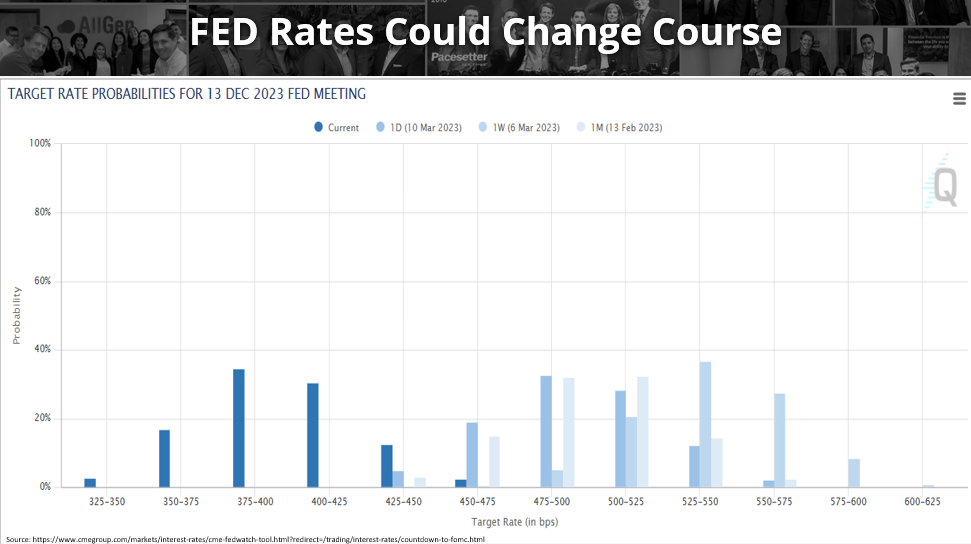

The Federal Reserve May Not Increase Interest Rates

We are closely watching the Federal Reserve’s reaction as probabilities of future rate increases are dropping, meaning the Fed could be more likely to loosen up its grip on interest rate hikes more than expected. Just in the last few days, the probabilities of future rate increases have dropped when studying the chart below.

It’s important to keep your long-term investment goals in mind when making investment decisions. Remaining diversified during times of uncertainty can help cushion the blows. To talk to a financial advisor about your financial plan, please click here!

For more information, watch the full March 2023 Market Update video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.