Gains, Losses, and Income

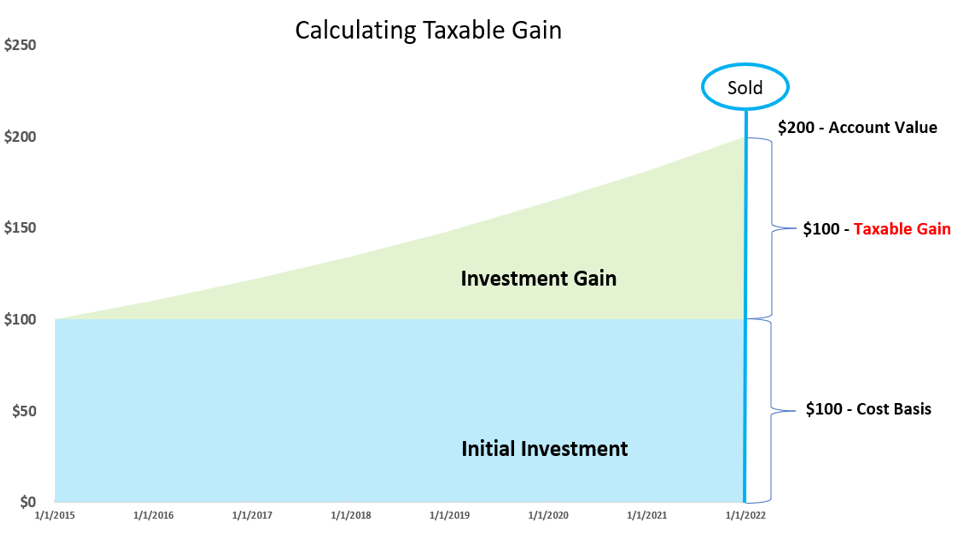

Investments tend to fluctuate in price over time, with the ultimate objective to grow in value or pay income, both of which involve taxes. If an investment is bought at a certain price and sold at a higher price (i.e. stocks), this is considered a capital gain and taxed at the investor’s capital gain tax rate (from 0 – 20% currently) or, if sold at a loss, considered a capital loss. A gain is only taxable when it is realized, meaning the investor has sold the position and received the profit (see chart below).

A diversified portfolio will hold several non-correlated investments where some might be trading at higher prices than originally purchased and others at lower prices than originally purchased. These holdings will need to be rebalanced periodically to bring the portfolio back to target allocations, which could cause the investor to recognize gains and losses throughout the tax year (this does not apply to investments in tax-deferred accounts such as IRAs and 401ks).

What Is Tax Loss Harvesting?

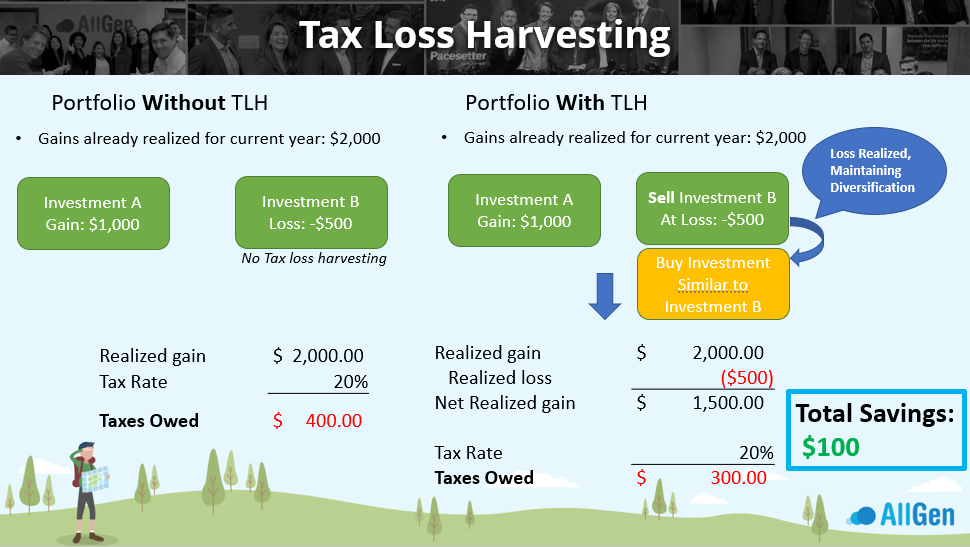

Tax loss harvesting is a trading technique used to reduce the tax liability owed by the investor for the tax year. The process involves selling an asset currently trading at a loss and, at the same time, buying a similar asset to replace the investment’s role in the portfolio. This maintains diversification in the portfolio and allows the investor to benefit from a potential recovery, while also allowing the investor to realize the loss to offset realized gains and taxable income. For example, suppose it is close to year-end and your portfolio already has a realized gain of $2,000 for the current year. Of the different assets in your diversified portfolio, investment “A” has unrealized gains of $1,000 and investment B has unrealized losses of $500. To reduce taxes owed and maintain diversification, the investor can sell Investment B (the losing investment) to recognize the loss of $500, then replace it by purchasing a similar investment. Selling the losing investment realizes the loss of $500 that can be used to offset the current realized gain of $2,000, leaving the account with a net realized gain of only $1,500. Now, suppose the tax rate is 20%, meaning you are required to pay taxes of 20% on any realized capital gain. Before tax loss harvesting, you would owe $400 in taxes for the current year (20% of $2,000) however, after tax loss harvesting, you would now owe $300 in taxes (20% of $1,500): a savings of $100! Depending on the size of the account and the size of the loss, tax loss harvesting can significantly reduce your tax liability (see the illustration below).

Can I Carry Over Realized Losses to the Following Tax Year?

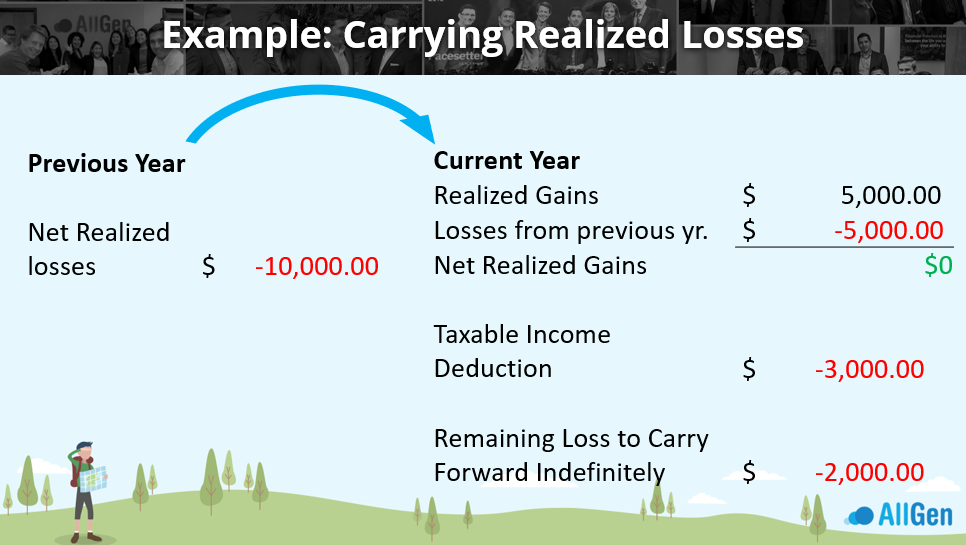

If the portfolio has net realized investment losses instead of realized investment gains, the investor will not owe any capital gains tax for the current tax year. These losses can then be carried forward to the following tax year to continue to reduce potential future realized gains. For example, suppose last year your portfolio realized net losses of $10,000, and this year your portfolio realized gains of $5,000. For tax purposes, you may carry over the losses from last year to offset the gains of this year. After offsetting the gains of $5,000 to zero using the $10,000 in available losses from the previous year, you are left with $5,000 in losses that can be used to deduct your current year’s taxable income for a maximum of $3,000. The remaining losses of $2,000 can be carried forward to future years indefinitely! It’s important to consult a tax professional when reporting your carried forward losses.

How Does Replacing an Investment Work?

Selling an investment and realizing the loss is only half the process when effecting tax-loss-harvesting. The other half involves replacing the investment with one similar in nature to keep the account invested so that if markets recover, the account won’t miss out by sitting in cash. Below is an example of selling an asset at a loss and replacing it with a similar asset. Suppose your diversified portfolio includes an international stock component and uses the Vanguard Total International Stock ETF (VXUS). In 2020, the Covid-19 pandemic was unfolding and investments declined very quickly. VXUS declined nearly -32% in just a couple of weeks. The Schwab International Equity ETF (SCHF) is a similarly invested fund, as the name implies, and would serve as a good candidate to replace the fund. To fully participate in tax loss harvesting and to keep your portfolio invested, you would sell all the VXUS and at the same time, purchase SCHF. See how in the below chart, VXUS and SCHF move very similarly in nature. This keeps your international stock holding intact while allowing you to realize the loss of VXUS to reduce your end-of-year realized capital gains, ultimately reducing taxes owed. However, if you were to have sold all your VXUS and continued to hold cash, your portfolio would now hold cash instead of an international ETF and would miss out on a potential market recovery!

Tax-loss-harvesting is an effective strategy that investors can use to reduce taxes. However, there are years when tax loss harvesting is difficult. In steadily rising bull markets, it’s possible that all holdings in a portfolio are trading at gains, not allowing the opportunity to harvest losses and leaving investors with potentially large tax bills. Conversely, while volatile or bear markets can cause concern among investors, they also provide some of the best opportunities for tax loss harvesting, which can be beneficial in the current and future tax years. The strategy requires special attention, as there are certain rules like the Wash Sale Rule, as well as short-term vs. long-term gains/losses offsets, that could derail an attempt to minimize taxes. If you’d like to learn more about how tax loss harvesting can benefit your specific situation, contact an advisor here!

For more information about tax loss harvesting, watch our videos below and check out our blog explaining tax loss harvesting in general.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.