Read through this post on how to pay off your mortgage or skip to the AllGen Academy paying off your mortgage video below.

The final step in the Formation stage on the Path to Financial Freedom is paying off your mortgage. Homeownership can represent one of the most significant assets in your net worth but it could also be one of your largest liabilities. We tackled paying off all consumer debt in the Foundation stage but now it’s time to also eliminate your mortgage to be completely debt free.

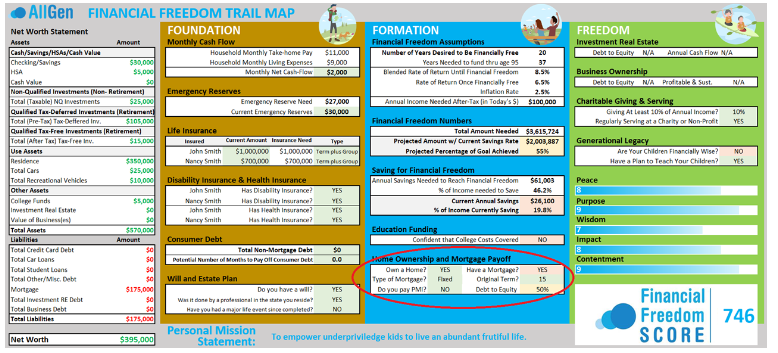

You can find information about your current mortgage on your Trail Map at the bottom of the Formation column:

Beyond being completely debt-free, paying off your mortgage offers many other advantages:

- You will have peace of mind from not having any debt and owning your home outright

- You will save money on interest payments

- You will need less money to live on in Financial Freedom. Having a paid-off house means you’ll require fewer savings to fund your desired lifestyle. You could potentially reach Financial Freedom and retire sooner.

- You can take more risks in your portfolio if desired and better withstand market volatility.

Paying off your entire mortgage may seem like a bold undertaking but all these benefits and the flexibility that comes with being completely debt-free are worth it.

Helpful Tips

There are many ways to approach early mortgage payoff. Here are some helpful strategies to start.

1. Make Sure You’re in the Right Type of Mortgage

Most homeowners default to a 30-year mortgage, but that type of mortgage will cost you significantly more money in interest and take you much longer to pay off your mortgage if you just stick to the minimum monthly payments.

Opting for a 15-year mortgage instead of a 30-year will allow you to pay off your mortgage faster with less interest.

Example: The total cost of a $275,000 mortgage can vary widely depending on the type of mortgage. This screenshot from the Mortgage Comparison Calculator (available in the next lesson) shows that you’ll save a whopping $102,716 if you choose a 15-year mortgage instead of a 30-year mortgage.

Contrary to popular belief, monthly payments on 15-year mortgages are not double those of equivalent 30-year mortgages. In this particular example, the monthly payment for the 15-year mortgage is only 54% more than for the 30-year mortgage.

2. Consider Whether it Makes Sense to Refinance

Refinancing your mortgage might be a good option if one or more of the following are true:

- You’re within the first 10 years of a 30-year mortgage (refinance the 30-year mortgage to a 10 or 15-year mortgage)

- Current interest rates are at least 1.5% lower than your mortgage interest rate

- You’re paying private mortgage insurance (PMI) on your current mortgage. Try to reach an 80% loan-to-value ratio as quickly as possible and then refinance to eliminate PMI from your monthly payments.

3. Focus on Making Extra Principal Payments

Making extra principal payments can have a big impact on the overall cost of your mortgage. If you have a monthly surplus after completing the previous steps in Foundation and Formation, use your surplus to make extra mortgage payments on a monthly basis.

If you receive larger lump sums such as a bonus or tax refund, send the extra cash to your mortgage but make sure you instruct your mortgage lender to apply it towards the principal. As you’ll see in the next tip, making extra payments can significantly reduce the amount of interest you’ll end up paying over the life of your loan.

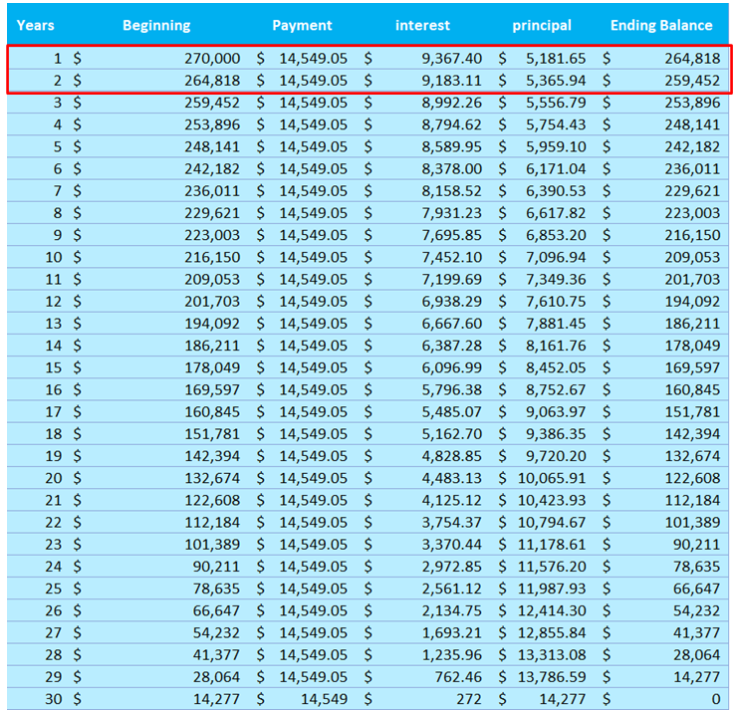

4. Learn How to Read an Amortization Schedule

An amortization schedule is a table that breaks down each monthly payment by the amount that goes toward interest and principal. Your monthly payments are fixed but the exact proportion of interest and principal changes each month according to the schedule.

The majority of your monthly payment is applied to interest at the beginning of the amortization schedule. As you continue making payments, the monthly interest amount will decrease while the amount left over being applied to the principal will increase. Toward the end of the loan term, most of the monthly payments are applied toward the principal with very little interest due until the very end when you finish paying off the loan.

It’s important to understand how amortization works because you can see how your extra payments will impact the interest paid and outstanding balance. Extra lump sum payments are particularly advantageous toward the beginning of your mortgage because you’re able to knock out a lot more interest with each additional payment on the principal.

For example, if you make a lump sum payment of $10,548 to the principal at the beginning of this mortgage (Year 1), you would shave off two years of payments which is equivalent to $29,098 ($14,549 x 2 years).

More significantly, you would save $18,550 in interest (the total of the first two years of interest payments). Your $10,548 lump sum payment would effectively save you $18,550 in interest. This is a powerful strategy and especially useful in the early years of your mortgage.

Conclusion

Eliminating your mortgage requires diligence and commitment, but being completely debt-free is a major milestone that will benefit you throughout Financial Freedom.

For more information on how to pay off your mortgage, watch our AllGen Academy video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.