1st Thing to Know – Parts vs. Plans

You are standing behind someone in line at the pharmacy. The pharmacist is asking for his Medicare prescription card and the customer provides it. The pharmacist says the prescription will be $150. The patient is shocked and says he usually only pays $5 for it.

What just happened?

Answer: The patient provided the Plan D (Supplemental insurance) card, not Part D (prescription drug coverage) card!

Explanation

There are PARTS and there are PLANS. When you hear PART A or PART D, this refers to the type of Medicare coverage that one has. Examples:

- Part A Hospital coverage – paid by taxes and no cost to those over 65

- Part B Doctor visits – covers 80% of costs; paid by everyone 65 or over (who is not on an employer plan); Premium in 2018 = $134*

- Part D Prescriptions – paid out of pocket – average cost is $40 per month

When you hear PLANS, this is referring to different Supplemental Plans. These (ex: Plan A, Plan F) refer to supplemental plans that can be purchased to offset the 20% that Part B does not cover.

Cost: premiums range from $140 – $200 per month.

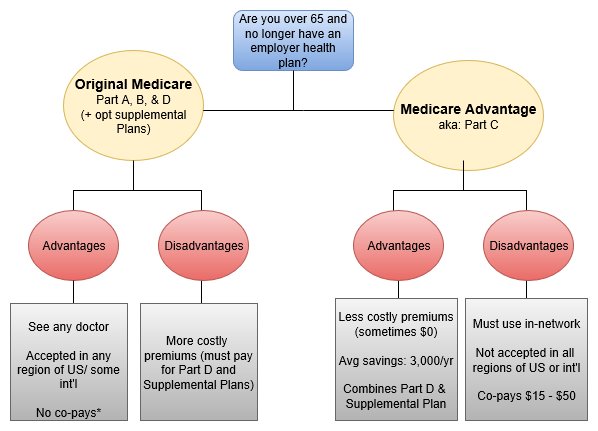

2nd Thing to Know – There are 2 kinds of Medicare: Original & Advantage

*Part B premiums are tiered and based on income from 2 years prior

So, which one is right for you?

Do you travel much? How is your health?

- If you are a snowbird or travel a lot, you may want to consider the Original Medicare to ensure that you have coverage regardless of the region you are in when a medical event occurs.

- If you are generally healthy and don’t travel much (or have a 2nd home in another state), then perhaps the Medicare Advantage is right for you.

3rd Thing to Know –Penalties for not signing up

- Part B – Mandatory regardless of which type of Medicare chosen

- Must sign up once you turn 65 or when you leave your employer’s healthcare plan, whichever is later.

- Penalty: 10% of current premium for each full 12-month period that you were eligible

- Example: waited 12 months (based on $134 premium); penalty = $13.40

- New premium = $147.40

- Part D – Optional

- Penalty: 1% per month for every month after eligible

- Example: waited 12 months (average Part D cost $40/mo); penalty = $4.80

- New premium $44.80

- Penalty: 1% per month for every month after eligible

Can I switch from Original Medicare to Medicare Advantage (and vice versa)?

Generally, yes barring any major medical conditions

(cancer, heart disease, surgery pending, kidney failure, etc.).

*Something to consider* – you may not qualify for supplemental plans later

If switching to Original down the road, you may no longer be insurable for the Supplemental Plans. Remember these pay the 20% that Part B of Original Medicare does not pay. This can add up to quite a sum if you are hospitalized for any length of time.

Other things to know

- Supplemental Plan F is the plan with the most coverage (some call it the ‘Cadillac plan’). This will no longer be offered after Jan 1, 2020. If you already have this plan, you will be grandfathered in.

- 7-month birthday wrap around – You are eligible to apply for Medicare plans typically only during open enrollment (Oct 15-Dec 7th), except for the first time you are eligible (age 65). You can apply for the 3 months prior and 3 months after your birthday in that first year.

- No medical questions are required the first time you sign up for Medicare nor during your first open enrollment. Every open enrollment thereafter requires you to answer medical questions.

At Allgen we have helped many clients with these plans. We welcome the opportunity to assist. Contact us at advisors@allgenfinancial.com.

Written by Teresa Talton, CFP® Professional with Allgen Financial Advisors, Inc.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.