The Long and Short of It:

* While elections can cause uncertainty, statistics show that the most likely outcomes have historically resulted in decent market returns

* European banks, namely Deutsche Bank, have been under serious pressure, but we do not believe they are the next Lehman Brothers

* Odds favor an interest rate increase by the Federal Reserve prior to year end

3rd Quarter Review

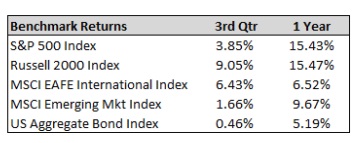

The quarter started with a sharp rebound following the drop from the “Brexit” in late June. The US market hit all-time highs in July, edged up in August, and then slipped a bit lower in September as markets became more volatile. The quarter was particularly strong for small company stocks that have been lagging their large counterparts for the last 2 years. International stocks also had a nice rebound following the Brexit drop in the second quarter. Bonds were mostly flat. In this quarter’s market commentary, we will discuss the potential ramifications of the upcoming election, the European banking issues, and the interest rate / bond outlook.

Elections

I think the most telling visual I’ve seen that best describes the public sentiment in this year’s presidential election is a yard sign that I pass everyday on the way to work that says “Everybody Sucks 2016.” While that may not be the most scholarly way to discuss the election, it gets the point across that these are the most un-liked presidential candidates of this generation. In determining market direction an important factor is public sentiment. If sentiment is overly optimistic, then people are easily disappointed when expectations are not met. However, if sentiment is extremely negative, then people are often relieved when things turn out to be not so bad. In today’s environment public sentiment is so negative regarding who becomes president that when the next president is elected they will have extremely low expectations to overcome. If the next president does an average job, it would be considered a huge win from a sentiment point-of-view (better than expectations). Therefore, a bullish scenario is being formed by such low expectations.

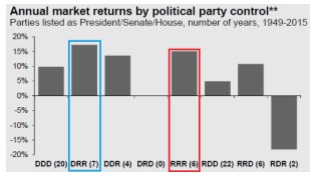

Another potential positive is the historical market returns of the most likely political party control scenarios. The chart on the right shows market returns since 1949 based on who controls the President/Senate/House. The most likely scenario (highlighted in blue) based off of current polls would be a Democrat President, Republican Senate, and Republican House. There have been 7 years which that has been the case since 1949 with markets averaging over 15% annually. The second most likely scenario (highlighted in red) is a Republican President, Republican Senate, and Republican House. There have been 6 years which that has been the case since 1949 with markets averaging about 15%. While ultimately we do not believe the markets are at the mercy of elections, it may be comforting to know that either candidate will most likely exceed the current rock bottom expectations. Also, the two most likely scenarios of political power according to current polls have historically produced solid market returns.

There have been 6 years which that has been the case since 1949 with markets averaging about 15%. While ultimately we do not believe the markets are at the mercy of elections, it may be comforting to know that either candidate will most likely exceed the current rock bottom expectations. Also, the two most likely scenarios of political power according to current polls have historically produced solid market returns.

Source: U.S. House of Representatives, U.S. Senate, Gallup Inc., FactSet, Standard and Poor’s, BEA, J.P. Morgan Asset Management. **Stock market returns are price returns and do not include dividends. Average annual returns are calculated using year-end to year-end numbers for the S&P 500. During the calendar year of 2001 the Senate changed party control 3 times. It is counted as being under Democratic Party control for the entire year because the Democrats held the chamber for most of the year. Guide to the Markets – U.S. Data are as of June 30, 2016.

Europe’s Banking Issues

Deutsche Bank has garnered a lot of media attention recently as have banks in Italy. Many of Europe’s largest bank stocks have dropped by around 40% on average. One of the worst has been Italy’s third largest bank and the world’s oldest, Banca Monte dei Paschi, whose share price is down nearly 90%. Yet, the bank that has received the largest amount of attention is Deutsche Bank. Some conspiracy theorists are calling it the next potential Lehman Brothers (Lehman was the largest bank to file bankruptcy in the US during the credit crisis in 2008). The problems with Deutsche Bank and other European banks, however, are different than the problems that Lehman Brothers faced during the credit crisis. Back then, US banks were overly leveraged as was the US population. Add declining real estate prices and the result was the economic disaster of 2008. Conversely, the challenge European banks face is that the economies have had slow growth for nearly a decade. This has caused the European Central Bank to lower interest rates to negative levels putting pressure on bank profit margins. Capital ratios, which were very low for the US banks (and some European banks) during the credit crisis of 2008 are much healthier these days for the European banks. For example, a recent article in the Economist stated: “Had today’s definitions been used in 2007, reckons Mr. Graham, Deutsche Bank’s ratio of common equity to risk-weighted assets (an important gauge of resilience) would have been just 1.8%. Now it is 10.8%; regulators want 12.25% by 2019; Deutsche’s own target is 12.5% by 2018.” While these regulations have helped to strengthen banks’ balance sheets, it has caused profitability to weaken, causing share prices to fall over the last year. While we will continue to monitor the European economy and banks, we believe the current situation is stable. Source

Interest Rate and Bond Outlook

After holding off the entire year from raising rates, it seems the FED will finally raise interest rates prior to year-end. There are 2 more FOMC meeting dates in 2016 (Nov. 2nd and Dec. 14th). It’s very unlikely that the FED will raise rates in November as the FOMC meeting is 6 days prior to the election. However, the Fed Fund Futures Prices, which have long been used to view the likelihood of interest rate changes, is currently predicting a 65% chance of an interest rate hike when the FOMC meets on December 14th. Some people are concerned that raising interest rates will hurt the stock market. Historically, interest rate increases when rates are below 5% have been positively correlated to a rising stock market. In addition, the Fed has continuously stated that they plan to raise rates slow and gradually. Historically the stock market has performed well in a slow rate rising environment. However, if rates rise, bond prices could be negatively affected. Some experts believe we are in a bond bubble, and it is true that US Treasury bond prices have recently achieved all-time highs. Long-term US Treasury bonds appear to be vulnerable to a major correction at some point. In preparation for another rate increase we have reduced bonds as a percentage of our clients’ portfolios, and we hold bonds with a shorter duration to the index, which should protect us if the bond bubble pops. Source

Going Forward

While elections can cause uncertainty, we pointed out that the most likely scenarios of political power after this election have historically resulted in solid market returns. And while European banks have recently garnered a lot of negative attention, they are much better capitalized now compared to 2008 and are better positioned to survive even if they continue to struggle generating profits from a low interest rate environment. Finally, odds favor an interest rate increase by the Federal Reserve prior to year-end. Considering all this, know that our investment philosophy is to manage risk first in order to avoid a major loss, and we seek to outperform markets over a full cycle. We are constantly monitoring the markets, economies, interest rates, currencies, sentiment, and many other indicators to try to stay ahead of the markets in order to preserve and grow our client’s wealth. We appreciate your trust and confidence in us!

Written by: Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Advisors, Inc.; Paul Roldan, Chief Executive Officer; Christina Shaffer, Operation Specialist

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Advisors, Inc. (Allgen) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of Allgen, is available upon request.