The Markets Take a Breather – Remember to Stay the Course

Market returns were disappointing in 2015 with most benchmarks being slightly negative. This was due to a weak December. To make matters worse, 2016 started off alarmingly negative. The S&P 500 dropped over 5% in the first week.

Yet, despite this drop, one needs to keep a proper perspective on market returns and stay the course. The stock market as a whole has had positive returns for the last 5 consecutive years. At some point, the market was bound to have a negative year. It’s normal for the market to have a down year every once in a while.

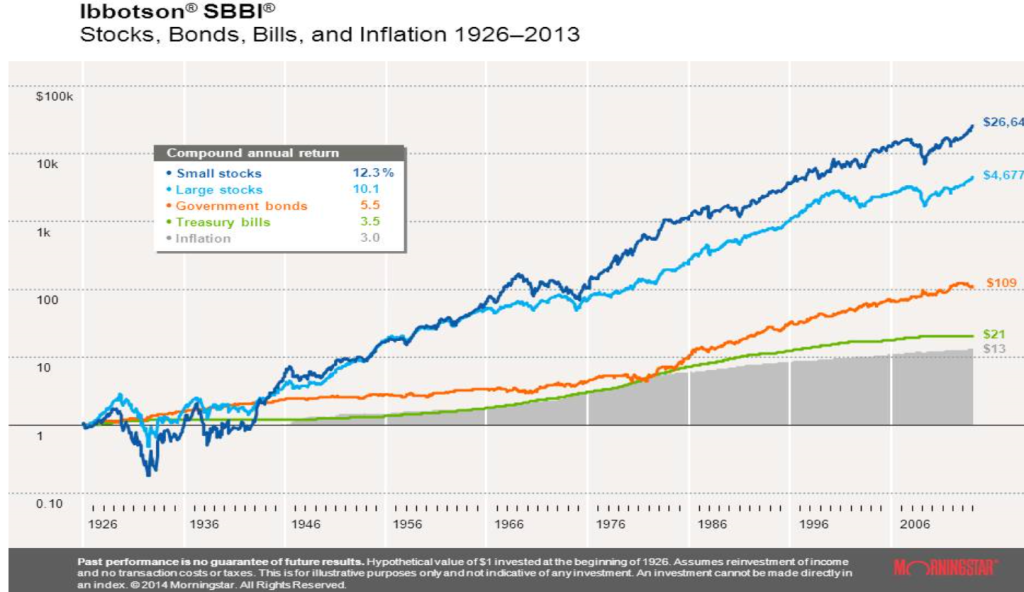

In the investment world, this is referred to as consolidation. Consolidation happens because stock valuations become expensive as markets go up. When markets consolidate and go sideways or down for an extended period of time, their valuations become cheaper or more “reasonable” in price. The long-term chart below points to the fact that even with consolidation, stocks tend to trend higher over the long-run.

In fact, an investment of $1,000 in small cap stocks in 1926 could be worth around $26,641,000 today! $1,000 invested in a savings account, represented by Treasury Bills (green line), almost 90 years later would have only grown to approximately $20,000. This explosion of profit from stocks came despite World War I and II, the Korean War, Vietnam, The Cold War, the Terrorist Attacks of 2001, and many other crisis. Even after the Great Depression, the initial investment of $1,000 in my example would have dropped to about $300 but then rebounded back to $1,000 after 4 years.

More recently, an investment in an all-stock portfolio in 2007 (at the peak of the market) would have dropped, but then recovered fully by 2013 (as per the performance of the S&P500) with a nice profit by 2016, even after the worst stock market drop since the Great Depression. A moderate portfolio with a mix of 60% stock and 40% bonds would have recouped its losses much quicker than the all-stock portfolio.

However, there is a difference between theory and practice. The temptation (and typical behavior) is to get out of the stock market and go cash with the hopes of getting back in when the market looks “better.” However, history has proven that 1) no one can time the market to that level of precision and 2) being out of the market typically leads to missing the rebound which has a huge negative effect on a portfolio. This emotional reaction leads to behavior that is anti-profit making: selling low and buying high.

Bottom line: don’t let the short-term volatility direct your long-term decisions. We will reinforce that portfolio returns should be viewed in the context of a greater financial plan. We hope the education the Allgen Team has provided you along the way will alleviate any concerns. We’ll be happy to answer all questions and address any other concerns.

Advisory services are offered through Allgen Financial Advisors, Inc., a registered investment advisor.

Any information provided in the blog has been prepared from sources believed to be reliable, but is not guaranteed by Allgen Financial Advisors, Inc. and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Allgen Financial Advisors, Inc. and its employees may own options, rights, or warrants to purchase any of the securities mentioned in this e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.