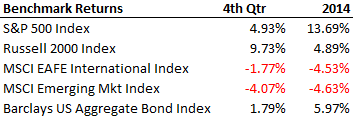

4th Qtr Review

Recent Drop in Oil Prices

Oil recently dropping below $50 a barrel (see chart below) has prompted many people to ask how did that happen and what does it mean going forward. How it happened is simple: oil production has gone up at a faster rate than oil demand. Because of recent technology enhancements and shale discoveries in the U.S. oil industry, production as increased about 60% in the last 5 years from 5.5 million barrels per day to almost 9 million barrels per day. The increase in production in the U.S. has meant that we import far less oil from other countries. In fact, the U.S. no

Potential for Increased Volatility in 2015

Since 2013 U.S. stock markets have seen little volatility. In fact, for the 2 years prior to October 2014 the stock market had not seen a pullback in stocks greater than 6%. Since October that trend started to

2015 Outlook on Interest Rates and Bond Update

Most economists believe that the Fed rate hike is inevitable this year. One indicator for future rate hikes is seen by monitoring the interest rate futures. According to CME Group FedWatch there is a 70% probability that interest rates will go up in 2015 and have the highest probability to end the year between 0.5% and 0.75%. Currently the Fed Funds Rate is at 0% – 0.25%. Consensus points to the Fed starting to gradually increase rates in July of 2015, but if global economic growth decreases the Fed may take a longer time before they raise rates. Long-term, Allgen maintains that we are coming out of a balance sheet recession (too much debt followed by deleveraging) which is historically associated with gradually increasing rates. At this point we don’t see a major threat of rates increasing rapidly.

Bonds have 3 main uses in a portfolio: increasing stability (lowering volatility), providing a stream of income, and increasing liquidity. Of those three, the most important thing they have done since 2007 for our clients was provide security when markets pulled back; they’ve allowed us to rebalance portfolios and sell some bonds as they have gone up and buy some stocks as they have come down (and vice versa).

Going Forward

While the recent, sharp drop in oil prices has caused some alarm in the market, we believe cheaper oil is a net positive. Markets have also shown an increase in volatility which is likely to continue in 2015. While increases in volatility usually goes along with increased fear among investors, history has shown that times of heightened fear have been good times to buy. Moreover, periods when markets take wild swings up and down have favored our management style as we take a more proactive approach to strategically rebalancing portfolios, while attempting to take advantage of pricing anomalies. We encourage our clients to keep a long-term investment perspective in mind and try to avoid the temptation to allow short-term market movements to drive you to make emotionally based decisions regarding your investments. While stocks provide long-term growth potential, bonds have served their role in protecting capital, reducing volatility and providing income. Probability does favor an increase in rates this year but we think that the increases, once they begin, will be gradual. We continue to manage risk first in all of our investments, while seeking to outpace our clients’ appropriate benchmark over the long-term net of our fees.

Written by:

Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Services, Inc.;

Paul Roldan, Chief Executive Officer; Chris Damiano, Operation Specialist