Read through the blog here, or skip to Jason’s January 2025 Market Update Video below.

Key Takeaways

We are cautiously optimistic going into 2025:

- Although we expect another positive year for stocks, temper your expectations as another 20%+ year is unlikely.

- We aren’t as fond of international stocks given the stronger dollar, weaker economic growth, potential tariffs, and rising geopolitical tensions.

- There are a lot of opportunities in fixed income as yields are significantly above their long-term averages and the uncertainty around the Fed funds rate creates potential for gains if correctly positioned.

- The economy has some cracks, but we still expect average to above average GDP growth and are closely monitoring inflation.

Returns for 2024

2024 proved to be a strong year for equity markets, with the S&P 500 delivering a stellar 23% total return. This performance reflects the resilience of large-cap U.S. stocks, driven by robust earnings growth and optimism in the tech sector as we will touch on later on. Small-cap stocks, represented by the S&P 600, grew by 10%, showing healthy but less pronounced gains. International equities rose by 7%, lagging behind U.S. equities largely due to geopolitical tensions and slower earnings growth. Bonds, however, performed the worst out of the four major areas with a modest 1% return, highlighting the impact of a rising rate environment and inflation concerns. This diversified performance underscores the importance of maintaining a diversified portfolio.

Q4 2024 Returns

To drill down further into Q4 2024 returns, which were mixed, large-cap equities saw modest gains of 3%, while small caps stagnated, ending the quarter flat. Meanwhile bonds dropped 3% and international stocks pulled back a more significant 8%. These results were shaped by the rise in yields, concerns about an inflation resurgence, and geopolitical uncertainties. The quarter’s performance serves as a reminder of the volatility inherent in markets and the need for careful navigation of global and sectoral dynamics.

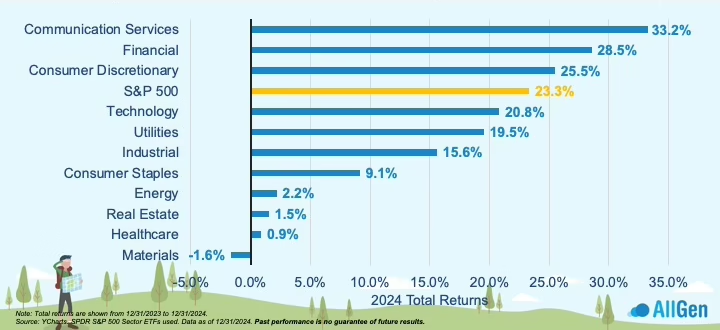

Stock Sector Performance in 2024

Drilling further into the sectors within the S&P 500, communication services outperformed all sectors with a remarkable 33% return, driven by gains in major players like Meta and Alphabet. Financials and consumer discretionary followed closely at 29% and 26% respectively, reflecting strong interest margins and consumer spending. Conversely, the materials sector not only underperformed the broader S&P 500 Index but posted negative returns for the year – dragged down by lower commodity prices and slower global demand.

Growth Outperformed Value

It shouldn’t come as a surprise that growth stocks (driven primarily by the Communications sector) outperformed value stocks in 2024. Growth stocks surged 36%, overshadowing the 12% gains of value stocks. This trend reflects investor confidence in the future profitability of innovative sectors despite elevated valuations. The tech sector, including companies like NVIDIA and Apple, continued to dominate, raising questions about concentration risks and sustainability of growth premiums.

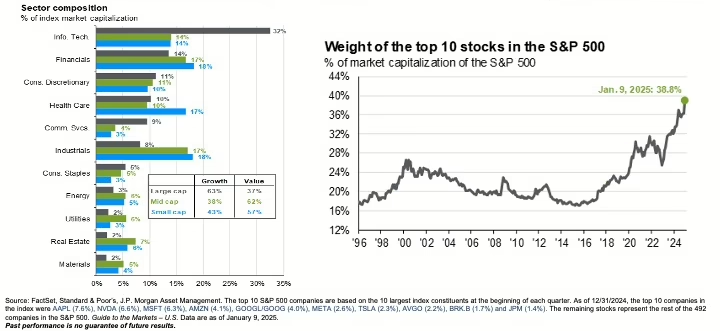

Sector Weights in the S&P 500

The top 10 stock weightings in the S&P 500 hit a historic high in 2024, accounting for nearly 40% of the index’s market cap. Dominated by tech giants such as Apple, NVIDIA, and Microsoft, underscores the leadership of a few key players. While this concentration has fueled market returns, it also introduces risks to the overall index should these individual companies face valuation corrections or regulatory challenges. This weighting will likely change one day in the future and diversification will be your best friend to protect against a potential pullback and manage volatility.

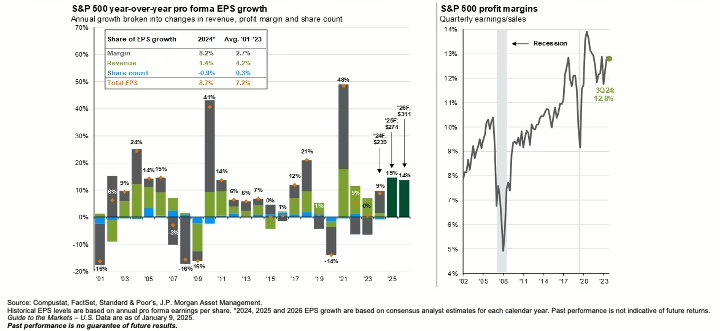

S&P 500 Earnings & Profit Margins

Earnings growth continues to drive equity valuations, with the S&P 500 achieving strong profit margins. In 2024, earnings grew by approximately 9%, supported by operational efficiencies and share buybacks. Analyst consensus projects earnings to grow at 14-15% annually over the next two years. However, such lofty projections coming off already high year over year EPS gains makes for more headwinds for stocks going into 2025 relative to 2024.

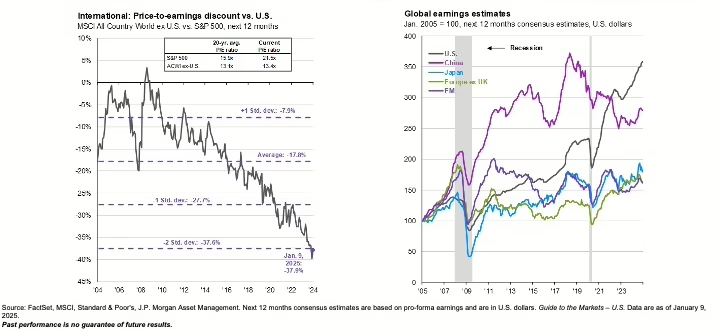

International Stocks: Attractive Valuations but Slower Earnings

International equities are trading at historically low valuations relative to U.S. stocks. The discount reflects weaker earnings growth and geopolitical uncertainties, particularly in Europe and emerging markets. While European stocks are near all-time valuation lows, their muted profit growth tempers enthusiasm. The U.S. continues to dominate in earnings growth, contributing to its valuation premium. For investors, the opportunity lies in balancing exposure to undervalued international assets while accounting for the risks tied to geopolitical and economic headwinds.

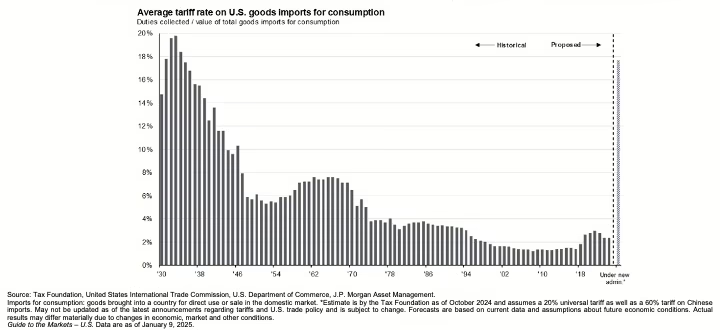

Tariff Projections and Economic Impacts

Rising tariff threats remain a key concern for global markets. Proposed tariffs, including a 60% rate on Chinese imports, could reignite inflation and disrupt supply chains. While these projections often serve as negotiation tactics, they still create uncertainty. Higher tariffs could dampen international trade and equity returns, particularly in multinational companies that rely heavily on international trade. We are closely following how the proposed tariffs evolve into what is actually implemented and positioning portfolios accordingly.

The Dollar Rallied As the Fed Is Expected to Cut Less in 2025

The U.S. dollar strengthened significantly during Q4 2024, reflecting expectations of fewer interest rate cuts by the Federal Reserve in 2025. The dollar’s performance is closely tied to the interest-rate differential between the U.S. and other economies. A stronger dollar benefits importers but creates challenges for exporters and emerging markets with dollar-denominated debt.

Gold Continues to Rise Despite a Strong Dollar

As you can see in this chart, gold posted an impressive 27% gain in 2024, an unusual occurrence alongside a strengthening dollar. This divergence suggests that gold’s rally was driven by its role as a hedge against geopolitical risks and inflationary concerns. The dual strength of gold and the dollar signals mixed market expectations about future economic conditions. AllGen remains slightly overweight on gold, serving as a portfolio diversifier, inflation hedge, and recession hedge.

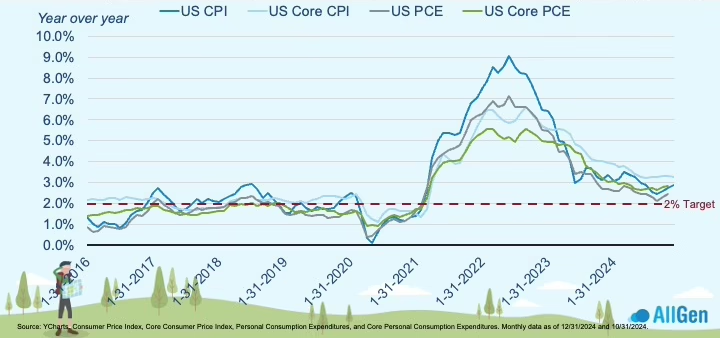

Inflation Remains Sticky

Inflation metrics, including CPI and PCE, have retreated from their 2022 peaks but remain above the Federal Reserve’s 2% target. The December 2024 core CPI stood at 3.2%, showing signs of persistence, particularly in housing and wage-related components. Although the Fed has already reduced rates by 1% in 2024, further cuts depend on inflation trends. Investors should be prepared for inflation’s potential impact on purchasing power and asset prices.

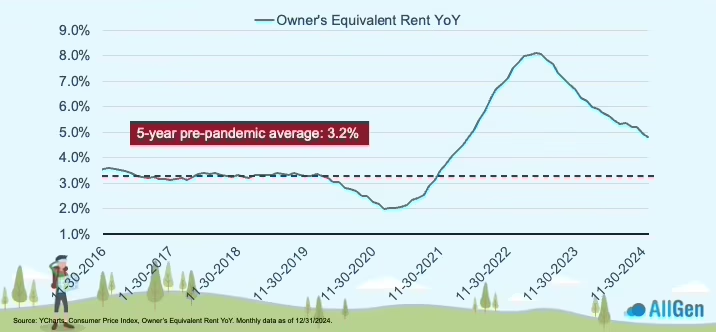

Owner’s Equivalent Rent Declines Slowly

Housing costs, as measured by owner’s equivalent rent (OER), have been a major driver of inflation. After peaking at 8% in 2022, OER declined to 4.7% at the end of 2024 but remains above the 5-year pre-pandemic average of 3.2%. This gradual decline is encouraging but highlights that housing costs still contribute to elevated inflation levels. Continued moderation in this metric is necessary for broader price stability.

Worker Shortages and Labor Trends

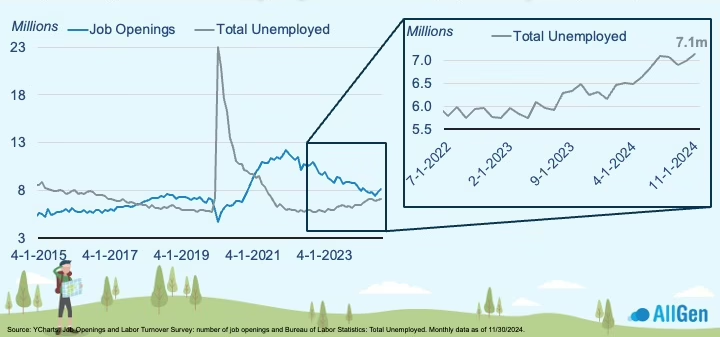

The labor market continues to normalize, with job openings and unemployment rates moving toward parity. By late 2024, there were 7.1 million unemployed individuals and less than 1 million unfilled positions, signaling a significant reduction in worker shortages. Wage pressures have eased, but the labor market remains tight compared to pre-pandemic levels. These trends are essential for understanding inflationary pressures and consumer spending capacity.

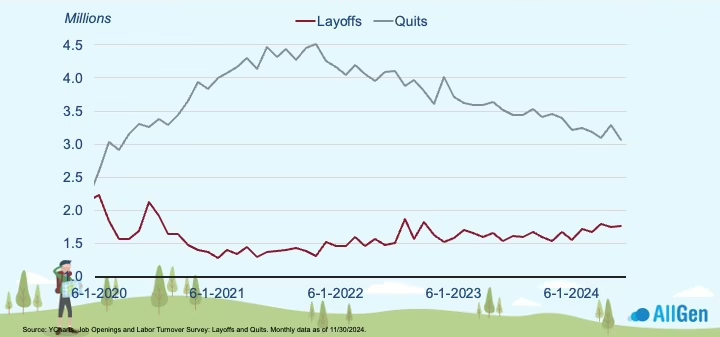

JOLTS Quits and Layoffs: A Changing Labor Landscape

The Job Openings and Labor Turnover Survey (JOLTS) highlights shifts in labor confidence. quit rates, once elevated during the “Great Resignation,” have significantly declined as workers are less confident in finding higher-paying opportunities (see the gray line in the chart above). Meanwhile, layoffs remain below pre-pandemic levels but have slightly increased. If these trends continue, it may help moderate wage inflation.

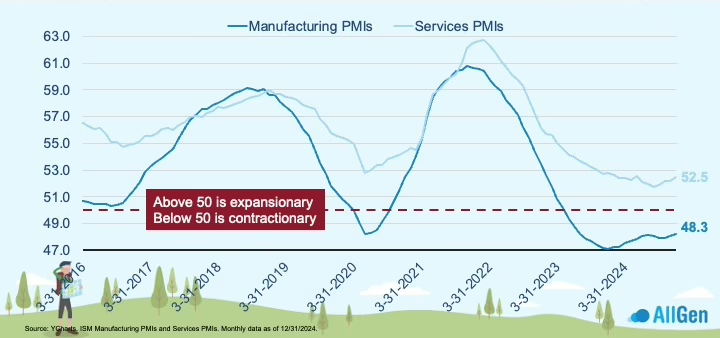

Manufacturing and Services PMIs

To better gage the path of future economic growth, we can look at the ISM manufacturing and services purchasing managers indices (in dark blue and light blue respectively). The manufacturing sector remained in contractionary territory with a PMI of 48.3, while services expanded with a PMI of 52.5. Both sectors showed improving trends by year-end, driven by resilient demand and stabilization in supply chains. While this economic strength is encouraging, it has tempered expectations for further rate cuts, as stronger growth could rekindle inflation concerns. Monitoring these metrics is vital for gauging the broader economic health.

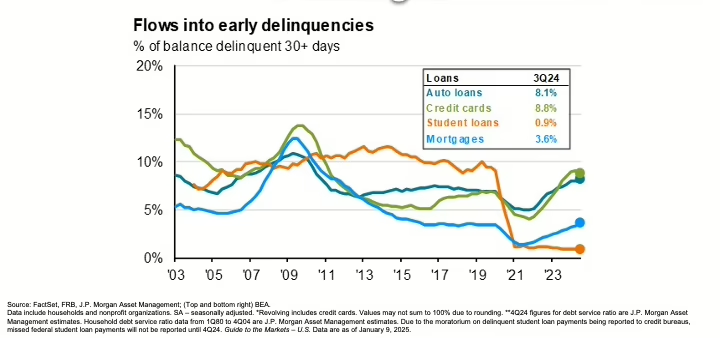

Consumers 30+ Days Late on Payments

Although consumer spending remains strong at 2-3% year over year, consumer delinquency rates ticked up slightly in 2024. particularly for credit cards and auto loans, as higher borrowing costs strained household budgets. Mortgage delinquencies, however, remained historically low, reflecting strong home equity and conservative underwriting practices post-2008 (see the blue line in the chart above). This trend suggests some cracks in consumer finances, requiring careful monitoring for potential ripple effects on broader credit markets.

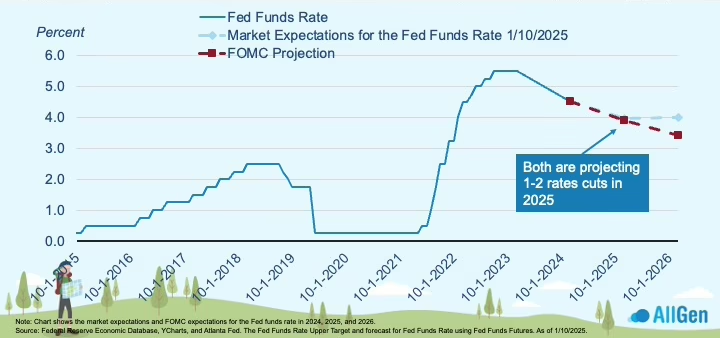

Fed Funds Rate Projections for 2025

Now that we have looked at the growth and inflation picture for the economy, let’s turn to the Federal Reserve’s policy in 2025. Both market participants and the Federal Reserve anticipate 1 or 2 rate cuts in 2025. However, divergence appears in longer-term projections, with markets expecting fewer cuts than the Fed. This discrepancy reflects lingering uncertainty about inflation persistence and economic resilience. A clearer picture will depend on how inflation and growth unfold in early 2025 and will impact the performance of the bond market.

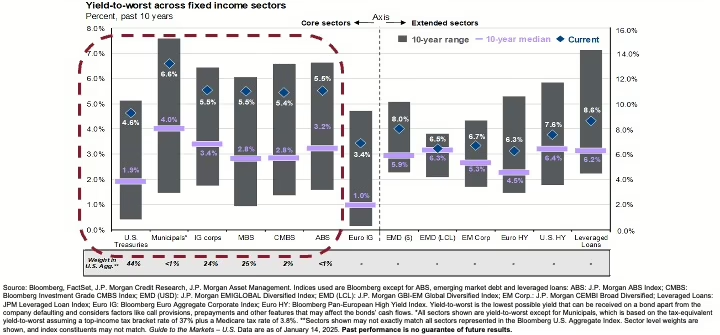

Bond Yields Are Way Above the 10-Year Average

Bonds are offering historically attractive yields, with U.S. Treasuries yielding 4.6%, significantly higher than the 10-year average of 1.9%. Municipal bonds and corporate bonds are similarly attractive, providing tax-equivalent yields of 6.6% and 5.5%, respectively. Despite recent challenges, bonds present compelling opportunities for income-focused investors and those seeking to diversify equity-heavy portfolios.

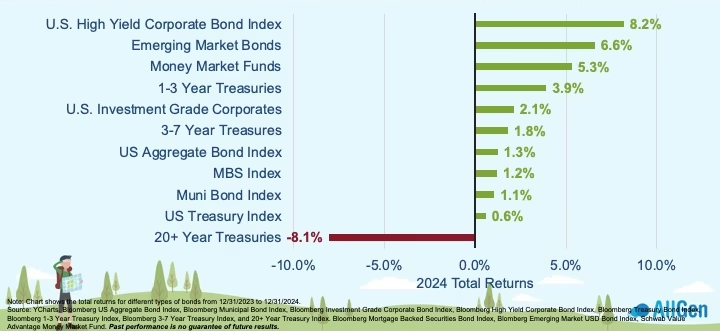

Most Bonds Were Up in 2024

Although the broad bond market only returned 1% for 2024, high-yield corporate bonds (+8%) and emerging market bonds (+6%) posted impressive returns. Meanwhile, longer-duration Treasuries faced challenges, declining by 8.1%. These results reflect the strong credit quality backdrop for corporate bonds and the importance of managing the portfolio’s sensitivity to interest rates. AllGen remains slightly underweight on bonds, favoring shorter durations to navigate ongoing market volatility and interest-rate uncertainty.

Cautiously Optimistic Going into 2025

While consumer finances show signs of softening, the strong labor market and steady economic growth (expecting 2–2.25% GDP growth for 2025) provide a supportive backdrop. U.S. stock valuations remain expensive but are supported by robust profit margins. International equities present value opportunities, though geopolitical tensions, rising trade tensions, weaker growth, and a strong dollar may weigh on returns. Fixed-income investments offer attractive yields, providing diversification and income potential, but do expect some volatility along the way. Inflation remains the primary risk we are watching for 2025. The bottom line: maintaining a well-diversified, risk-managed strategy will be key in navigating the complexities of the year ahead.

Contact Your Financial Advisor

A well-diversified, disciplined strategy that manages risk first is what we strive to build for our clients. Contact your advisor to learn more about how AllGen can help manage risk in your portfolio!

For more information, watch the full January 2025 Market Update video below.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.