The Long and Short of It:

– The Federal Reserve plans to reduce bonds potentially having a negative effect on the market and bonds

2nd Quarter Review

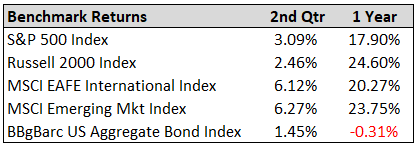

Stocks continued to plug away in the second quarter. As was the case in the first quarter, international and emerging markets continued to lead the way, while domestic markets posted a modest gain. Surprisingly, bonds had a decent quarter even though the Federal Reserve (FED) raised rates. In this quarter’s market commentary, we look at the potential for continued outperformance in international and emerging markets, and the ramifications of the FED’s change in policy.

Strength in International and Emerging Markets

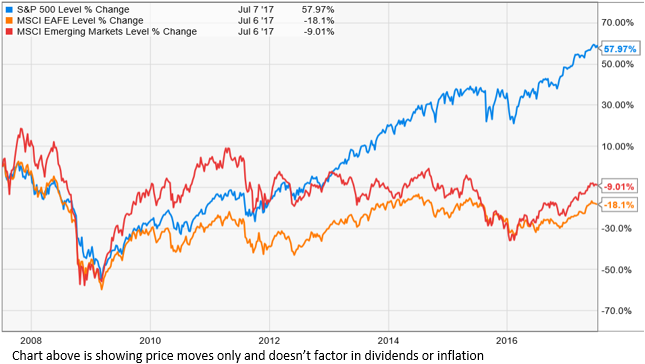

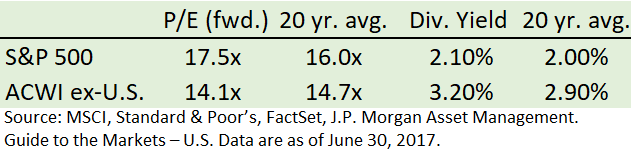

We mentioned in our previous market commentary that we believed international and emerging markets were in a position to outperform compared to domestic markets. We based our hypothesis on 3 factors that we observed. First, international and emerging markets were undervalued compared to domestic markets. Second, foreign currencies were historically below their average prices, and lastly, their economies were starting to strengthen. Our hypothesis became reality in the 2nd quarter as both the MSCI EAFE International Index and the MSCI Emerging Market Index returned over 6% for the quarter versus the S&P 500’s return of about 3%. We believe this trend will continue based on the same 3

FED’s Change in Policy

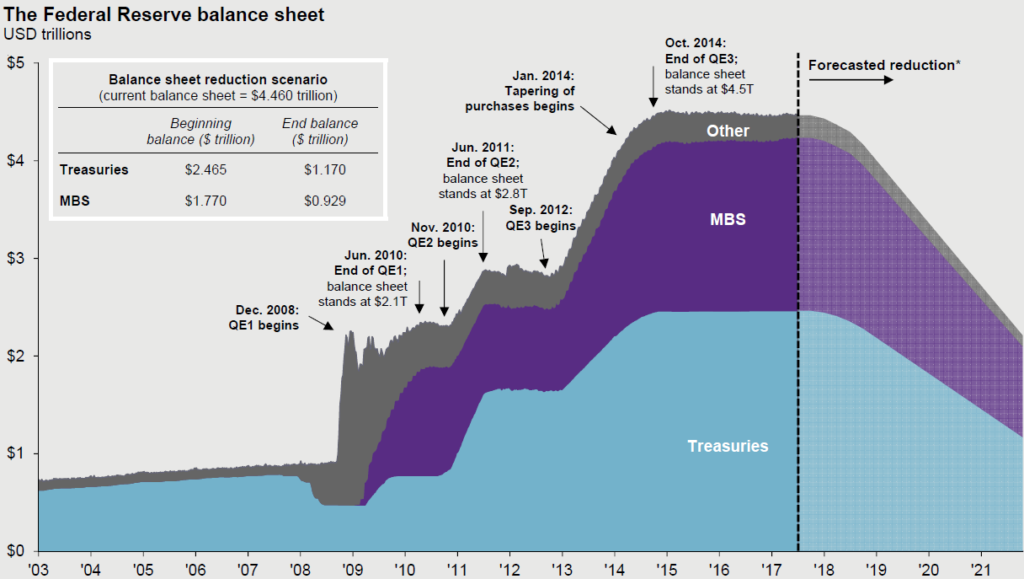

The last FED meeting in June brought a change in policy. While they raised rates a quarter of a point (0.5% YTD), as expected, they indicated they would start quantitative tightening (QT) in the near future. While the market was anticipating this to happen eventually, many economists believed it was sooner than expected. Quantitative tightening is the opposite of quantitative easing (QE). As you can see in the chart below in December of 2008 the FED started QE1 in which the FED created money (some call it “printing money”) then subsequently bought Treasuries and Mortgage Backed Securities (MBS) bonds. The intention was to keep interest rates low by buying bonds (keeping borrowing costs low), in the hopes of spurring economic growth. The FED continued to do Quantitative Easing over the next 6 years until it

QT Effects on Stocks

While it is encouraging that the FED believes the economy is strong enough to take away the monetary stimulus, the ramifications of quantitative tightening on the stock market could be negative. Just as quantitative easing is meant to boost markets the opposite could occur through quantitative tightening. If interest rates were to go up because of the reduction in bonds, then borrowing or holding debt could become more expensive thereby taking money out of the economy. The FED needs to be careful not to cause the economy to slow down too much, driving us back into a recession.

QT Effects on Bonds

The ramifications of quantitative tightening for bonds could also be negative. As the FED reduces bonds this could cause bond prices to go down which would cause yields to go up. As such we have maintained our defensive posture in bonds.

Going Forward

There are multiple indicators that suggest the recent outperformance of international and emerging markets over domestic markets could continue. We have been adding to our investments in international and emerging markets, and we will continue to do so this quarter as opportunities arise. The recent policy change by the FED to reduce their balance sheet through quantitative tightening may cause a slowdown in the stock market if applied too quickly. It could also cause bond prices to drop and as such we will stay defensively postured in our bond portfolios. We are constantly monitoring the markets, economies, interest rates, currencies, sentiment, and many other indicators to try to stay ahead of the markets as we look to preserve and grow our client’s wealth. Our investment philosophy is to manage risk first in efforts to avoid a major loss, as we seek to outperform markets over a full cycle net of our management fee. We appreciate your trust and confidence in us!

Written By: Jason Martin, CFP®, CMT, Chief Investment Officer Allgen Financial Advisors, Inc.; Paul Roldan, Chief Executive Officer; Christina Shaffer, Junior Analyst

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. Allgen Financial Advisors, Inc. (Allgen) is an investment advisor registered with the SEC. Allgen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by Allgen. It is not intended to be a solicitation or offer to sell investment advisory services to residents of any state in which Allgen is not currently authorized to do so. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of Allgen, is available upon request.