The Long and Short of It (Summary):

- The yield curve has inverted which has historically preceded a recession

- Current sentiment shows extreme optimism which could be a negative for the market

- Fed futures pointing to potential rate cuts could be good for bonds

1st Quarter Review

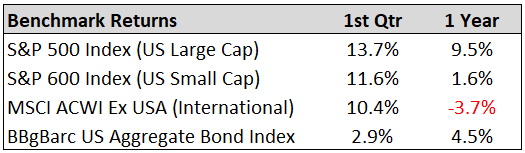

U.S. stocks had one of their strongest quarters since 2009. US large caps were up 13.7% and small caps were up 11.6%. International stocks rose 10.4% for the quarter. Bonds were up a solid 2.9% for the quarter as the FED announced they will hold rates steady. In this quarter’s market commentary we look at the ramifications of an inverted yield curve, extreme levels of optimism in market sentiment, and how the Federal Reserve could potentially lower rates this year.

Inverted Yield Curve

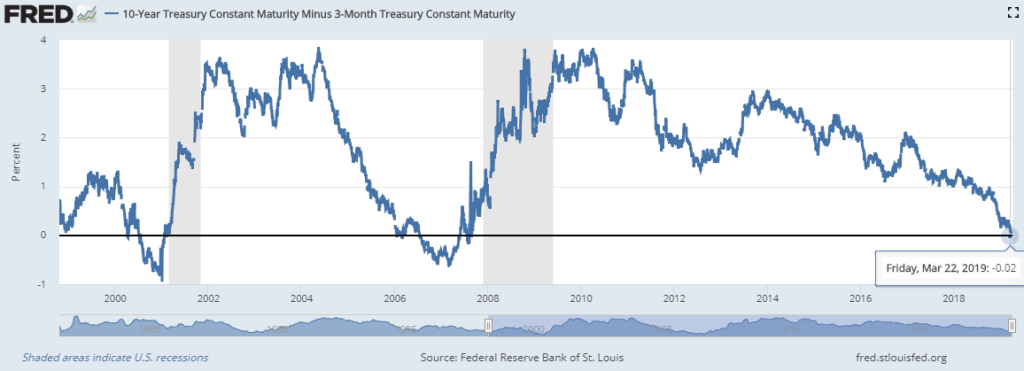

On March 22nd, 2019 the yield curve officially inverted for the first time since mid-2007 (see chart below). The rate of the 10-Year Treasury yield minus the 3-Month Treasury yield was negative, meaning longer-term rates were lower than

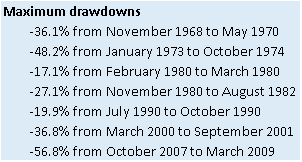

shorter term rates. Typically in a strong economy, long-term rates are much higher than short-term rates. When short-term rates move higher than longer-term rates (aka – inversion), it’s a sign of a weak economy to come. Identifying an inverted yield curve is important because it has preceded every recession since the mid-1960’s. We follow the Yield Curve closely because it has historically been a reliable leading indicator of recessions and difficult markets. Of the last 7 recessions, the average time range between the inversion of the yield curve and the start of a recession has been 11 months. The average return for the S&P 500 during the time span from inversion to the start of each recession has been a positive 2.8%. However, the maximum drawdown (the amount the S&P 500 dropped from top to bottom) after inversion is listed in the chart to the right.1

While the yield curve inversion has been a reliable signal, there is no perfect indicator meaning markets could continue to rise for longer than expected. Allgen is taking precautions with our client’s portfolios as we continue to posture our portfolios defensively by reducing our overall stocks, holding more defensive stocks, and reducing cyclical stocks. We are also increasing safe-haven assets like U.S. government bonds and money markets. The recent strong market bounce over the last few months has provided a great opportunity to sell a portion of stocks.

Sentiment Is Overly Optimistic

The powerful bounce in the stock market over the last few months has caused many contrarian indicators to flash bearish signals. When bullish sentiment among investors enters extreme territory, it’s time to pay attention. A few notable sentiment indicators are currently pointing to extreme bullishness. Ned Davis’ Crowd Sentiment Poll and Sentiment Trader’s Smart Money/Dumb Money Index are both pointing to extreme optimism and the volatility index (VIX) is showing a high level of complacency. Markets have historically pulled back after such overly optimistic occurrences.

The Federal Reserve Could Lower Interest Rates – Good for Bonds?

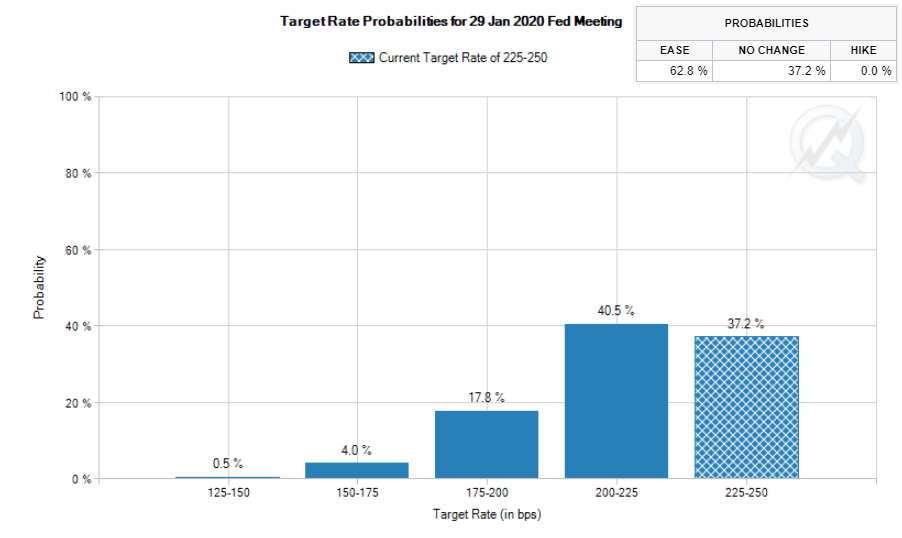

The Federal Reserve (FED) went into 2019 suggesting they could raise rates 2 times for another 0.50% increase in rates. However, in January the FED announced that they are halting rate rises and will hold rates at current levels. Rising rates, and quantitative tightening from 2015 through 2018 led to a 7-year high in interest rates. Both forces tend to slow down the economy. People and companies that are in debt have seen their borrowing costs rise which means reduced cashflow (bad for economy). The economy starts to slowdown and markets tend to drop near the end of a rate rising cycle. With some economic indicators starting to cool off, the FED has now taken the position of holding rates steady. However, as of April 10th, 2019, Federal Fund futures rates (see chart below) show that the market is predicting a 63% probability rates will decrease and a 37% probability interest rates will stay the same by January of next year. So, what does this mean for bonds? Historically falling interest rates have been positive for bonds. Bond prices tend to go up as interest rates go down. In our client’s portfolios we have been increasing bond holdings and extending the duration of our bonds (increasing longer-term bond holdings).

Bottom Line:

The stock market experienced a strong bounce off its December lows to start 2019. However, the Yield Curve has inverted which has preceded the last 7 recessions, potentially indicating more difficult times to come. At the same time reliable sentiment indicators are flashing warning signs as extreme optimism has reentered the market, which is a bearish signal. The Fed Funds future rates are predicting that rates will decline over the next 9 months. These two factors show potentially difficult times for stocks while potentially better opportunities for bonds in the foreseeable future. As such, we have become more defensive on the stock side of our portfolios while increasing exposure and duration to the bond side. We will continue to monitor the markets, economies, interest rates, currencies, sentiment, and many other indicators to try to stay ahead of the markets as we look to preserve and grow our client’s wealth. Our investment philosophy is to manage risk first in an effort to avoid a major loss, as we seek to outperform markets over a full market cycle net of our management fee. We appreciate your trust and confidence in us!

1Source: https://www.schwab.com/resource-center/insights/content/new-liz-ann-article

Written by: Jason Martin, CFP®, CMT, Chief Investment Officer, Paul Roldan, Chief Executive Officer; Christina Shaffer, Analyst Allgen Financial Advisors, Inc.;

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.