Key Takeaways:

- We expect the debt ceiling to be raised in time to avoid a default – keep in mind that the media typically plays into the drama of it all to gain viewership.

- Our investment philosophy is to manage risk first, which we typically do through proper diversification.

- Events like the debt ceiling crisis may present buying opportunities within the market that we strive to capitalize on for our clients.

- It’s important to have adequate emergency reserves to make sure you can weather the small chance of a government shutdown as government employees may be briefly furloughed.

Mark Twain once said, “History doesn’t repeat itself, but it often rhymes.” What’s happening within Congress and the White House looks eerily similar to the debt ceiling crisis in 2011 and 2013. Politicians are once again horsetrading with the federal government’s ability to meet its financial obligations in order to pass legislation or spending cuts that are otherwise difficult to pass. Yet, it’s not quite the same – the events are unfolding against a different economic backdrop and talks seem to be progressing at a better rate than last time. We expect the debt ceiling to be raised in time to avoid default, as has happened almost 80 times in recent history. It’s still important to understand what is happening, how this impacts the management of your portfolio, and how to manage your personal finances to be prepared in case the government does default and shut down.

What Is the Debt Ceiling?

Most have heard over the last month: the deadline for the debt ceiling is June 1st. But what is the debt ceiling and how did we get here? The debt ceiling is a limit on the amount of money the U.S. federal government can spend, put into place by Congress in 1917. The debt ceiling was enacted by the Second Liberty Bond Act of 1917 to allow the U.S. Treasury to issue bonds to finance World War I without seeking Congressional approval so long as the amount issued remained under a set dollar amount (the debt limit or ceiling). Getting back to the present day: the federal government often spends more than it earns, therefore the debt ceiling has been raised many times over the last few decades. There are typically negotiations within Congress that are part of the process, but Congress doesn’t always cut it so close to the deadline. The last time Congress cut it close was in 2011 and 2013 (the government temporarily shut down in 2013). The debt ceiling was last raised in December of 2021 to $31.381 trillion.

Is This the 2011 Debt Ceiling Crisis All Over Again?

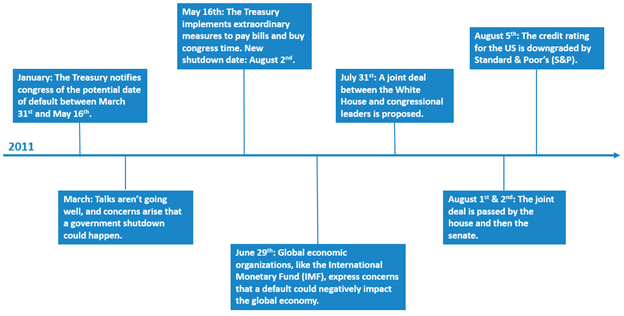

To parse through the noise and determine if history is, in fact, repeating itself, we pulled together a timeline of events from the 2011 debt ceiling crisis. What we show below is the abridged version. After months of debating and extraordinary measures enacted by the Treasury, Congress and the White House finally pulled together a proposal both parties could agree on just two days before the new shutdown date. Of course, there were consequences for cutting it so close to the deadline: the U.S. credit rating was downgraded from one of the highest ratings of AAA to a not-as-high, but still high, rating of AA+. This time around, talks are in a better place than they were one to two weeks out from the deadline in 2011 and there haven’t been any warnings of a downgrade to the U.S. credit rating. It turns out that history isn’t repeating itself, it’s just rhyming.

Source: CNN.com. “Debt Ceiling: Timeline of deal’s development.” August 2, 2011.

What the Debt Ceiling Means for Your Portfolio

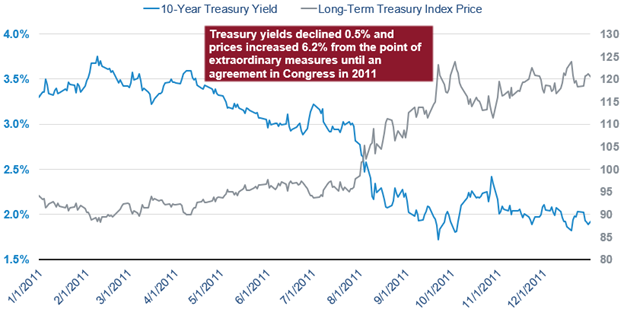

Getting back to our roots, the core of our investment philosophy is to manage risk. A key component of our risk management strategy is proper diversification, using assets where prices do not move lockstep in the same direction. In 2011, we saw longer-term bond yields fall during the debt ceiling crisis. Keep in mind that when bond yields fall, prices tend to rise since they generally move inversely to one another. This increase in bond prices supported portfolio performance during a time when many were concerned about the U.S. government defaulting. Today, we are positioning your portfolios to benefit from falling rates.

Longer-term Treasury bonds performed well during the 2011 debt ceiling crisis.

Source: YCharts. 10-Year Treasury Yield and iShares 20+ Treasury Bond ETF. Daily data from 1/1/2011 to 12/31/2011.

Past performance is no guarantee of future results.

Look for Buying Opportunities in the Stock Market

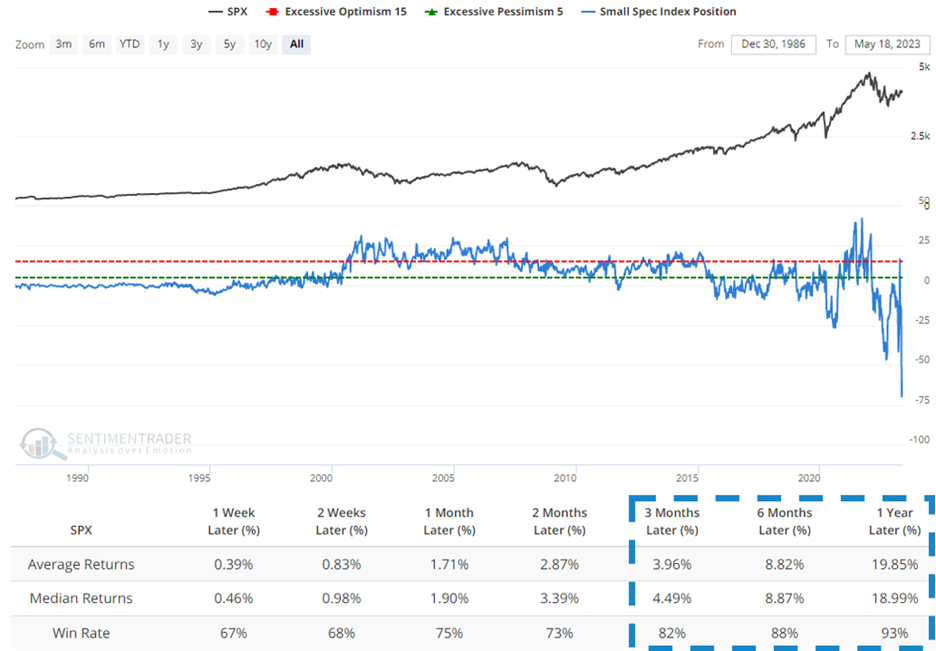

Switching gears to stocks, we are seeing a higher level of pessimism among small or non-institutional futures traders for the S&P 500, Nasdaq 100, and DJIA index. History has shown that it is usually good to do the opposite of nonprofessional traders because they frequently buy at the top and sell at the bottom of markets. The chart below shows the S&P 500 index in black and the Sentiment Trader’s Small Speculative Index Position in blue – the last reading on May 9th was a -60.58 index level. This extremely negative value means small futures traders on the major stock indices expect the market to decline. Backtesting the index against the S&P 500 since 1986 shows that the S&P 500 rose a median of 4.5% 3 months later, 8.9% 6 months later, and 19% 12 months later 82%, 88%, and 93% of the time respectively. This illustrates the importance of staying invested in the markets – even during times when the U.S. may default. Likewise, times during excessive pessimism in the markets can create opportunities to buy quality stocks at a discount (something we look for when managing your portfolio).

A contrarian indicator: small traders are betting that the stock market will decline.

Source: SentimentTrader. Sentiment Trader’s Small Speculative Index Position and the S&P 500 Index. Weekly data as of 5/18/2023.

Past performance is no guarantee of future results.

Always Be Prepared: Build Emergency Reserves Into Your Financial Plan

It is important to always be prepared for whatever life may throw your way. That is why one of the first steps we take when preparing a financial plan is to make sure our clients have enough liquidity or cash on hand as emergency reserves – we typically recommend 3-6 months’ worth of expenses for pre-retirement and 12 months for those in retirement. This is particularly important for any government employees that may be temporarily furloughed if the government briefly shuts down. In that scenario, the government will likely either a.) prioritize their payments, meaning pick and choose what gets paid, or b.) invoke the 14th amendment to pass an executive order for the Treasury to continue to issue debt to meet any payments coming due. Either way, having reserves should provide more than enough cash to get through a government default. If you do not have a financial plan yet, then please reach out to your financial advisor at AllGen.

Important Disclosures: The information provided here is of a general nature and is not intended to answer any individual’s financial questions. Do not rely on information presented herein to address your individual financial concerns. Your receipt of information from this material does not create a client relationship and the financial privileges inherent therein. If you have a financial question, you should consult an experienced financial advisor. Moreover, the hiring of a financial advisor is an important decision that should not be based solely upon blogs, articles, or advertisements. Before you hire a financial advisor, you should request information about the financial advisor’s qualifications and experiences. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative (or “informational”) purposes only and not intended to be reflective of results you can expect to achieve. AllGen Financial Advisors, Inc. (AllGen) is an investment advisor registered with the SEC. AllGen does not provide personal financial advice via this material. The purpose of this material is limited to the dissemination of general information regarding the services offered by AllGen. The Disclosure Brochure, Form ADV Part II, which details business practices, services offered, and related fees of AllGen, is available upon request.