Mining your taxes for financial planning opportunities

Who was this article written for?![]() Foundation

Foundation![]() Formation

Formation ![]() Freedom

Freedom

Many emotions come flooding in around tax season; some dread filing taxes, others fear making a mistake, others are smooth sailing while their CPA works hand-in-hand with them, and others may be excited about the possibility of more cha-ching in their pocket.

Whatever you’re feeling, or wherever you’re at, we wanted to talk to you for a minute about shifting the tax mindset from “just another chore” to “opportunities for my future”.

First, let’s discuss – Why does Tax Day fall on the 18th this year?

This year taxpayers have until April 18th to file their 2016 returns because when the 15th falls on a weekend, it is postponed until Monday. But since Emancipation Day in Washington DC is being observed on Monday, the filing deadline is Tuesday, April 18th 2017.

Next, let’s talk about opportunities that are still available for the 2016 Tax Year.

While we have a little over a month left, take a look at the remaining 2016 tax year opportunities. (These will depend on your specific financial circumstances.)

- If your Flexible Savings Account offers you a grace period option you have until March 15, 2017 for plan year ending Dec. 31 2016.

- You have until April 15th to make contributions to an IRA/Roth IRA for you and your spouse (even if your spouse did not earn income).

- If you have self-employment income, you can make contributions to a SEP-IRA with 20% of the net profit.

“How are taxes related to my financial plan?”

College education, health insurance, and Medicare are just a few financial goals that rely on your filed tax returns.

- your FAFSA for federal student financial aid;

- your application for health insurance under the Affordable Care Act;

- your application for Medicare Part B. Your 2016 tax return will be used to determine your 2018 Medicare Part B premiums.

A little planning collaboration among you, your tax preparer and your financial advisory team can make a significant difference in savings and achieving your financial goals.

To Hire, or Not To Hire a Tax Professional…that is the question!

Whether you use software and self-prepare or use a tax professional, now is a great time to plan ahead and anticipate what is most time effective for your household. Depending on how much you value your time or the more complex your tax preparation, the hiring of a tax professional may return value that extends beyond their fee.

An experienced tax professional can make valuable tax savings suggestions that a software program just cannot anticipate.

According to the IRS, tax filers spend an average of 13-hours preparing and filing their taxes. For a $60,000 household that equates to $375 in time plus the cost of your software.

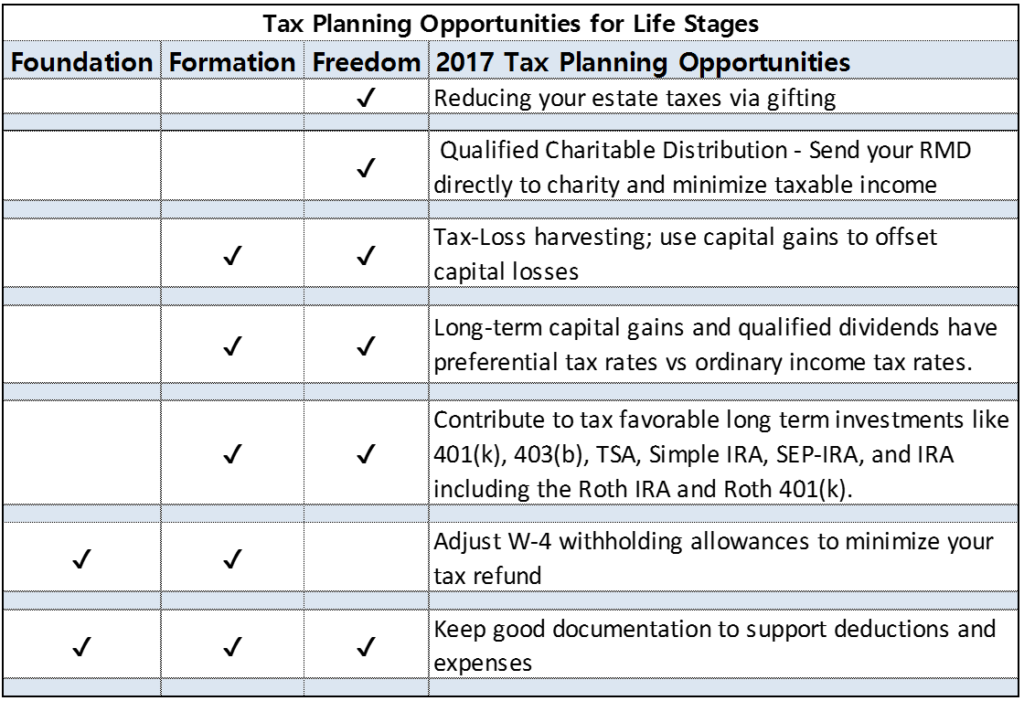

This table offers general planning opportunities within the suggested life stage per Allgen’s Path to Financial Freedom.

So, to conclude:

Shifting your mindset about taxes can actually yield great success in reaching your financial goals. When collaborating with a financial advisory team and a tax professional, they can look for opportunities for you to reach those goals. Finally, if you need help looking into the opportunities that still apply before filing your taxes for the 2016 Tax Year, give us a call!

Written by Ana N. Fernández, CFP® AWMA™

Disclaimer: This material has been prepared for informational purposes only. Allgen Financial Advisors encourages you to engage your tax and legal advisors to collaborate with us, on your behalf, on any financial suggestions before taking action. Advisory services are offered through Allgen Financial Advisors, Inc., a registered investment advisor. Any information provided in the blog has been prepared from sources believed to be reliable, but is not guaranteed by Allgen Financial Advisors, Inc. and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Allgen Financial Advisors, Inc. and its employees may own options, rights, or warrants to purchase any of the securities mentioned in this e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.